NPLG 10.6.22: B2B Cold Email Is Dying

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 3,601, +153 since last week (+4.4%)

Share the PLG love: please forward to colleagues and friends! 🙏

B2B Cold Email Is Dying

My partner at Wing, Tanay, shared with me a powerful post by the team at ChartMogul, a subscription analytics platform. If you have 5 minutes, I recommend you read it.

ChartMogul relies on product-led growth. The company writes: “We spend most of our waking hours thinking about how to build a reliable, beautiful product that helps subscription businesses grow faster using their customer and billing data. This mentality extends, of course, to our marketing strategy, which is why folks still print out our cheat sheets and read our weekly roundup. It also extends to our customer acquisition and sales strategy. More than 90% of our leads come through our 14-day trial. Then, it’s our job to help those businesses get set up, evaluate our product, and ultimately, make a purchase decision. We’ve grown sustainably for six years in this way.”

ChartMogul experimented with outbound sales aka cold emails. The company hired two SDRs (sales development reps) to led this intiaitve. The company trained them on its value proposition, outreach style, and strategy. ChartMogel even consumed the latest and greatest prospecting content from sales leaders like Becc Holland and Josh Braun and took Winning by Design’s 4-week course on prospecting. ChartMogel was thoughtful and intentional about its outbound program.

Now, for the data.

In just under six months:

Set 39 total meetings set from an average of 1,650 emails sent/month (~10K emails sent total)

Create 13 deals (which is less than 1 deals created/month/SDR)

Convert 7 new customers (which is less than 1 sales/month/SDR) at a win rate of 54% and ASP = 1.5x

Ouch! 39 total meetings set from 10K emails (0.4% conversion). 7 new customers from 10K emails (0.07% conversion).

Outbound email, especially to B2B companies who are inundated with outreach, is becoming less and less effective. Sure, ChartMogul could have invested more to improve their outbound stratgey (tooling, messaging, cadence etc), but decided instead to abandon it all together. The team summarized: “We hear a lot about the importance of focus for product teams, but rarely for commercial teams. Sales and marketing teams are all too often pursuing a quick win or growth hack instead of sustainable growth via select channels. It’s essential to keep an eye on your limited resources and use them in the best way possible.”

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing:

PLG Tweet(s) of the Week:

Recent PLG Financings (Private Companies):

Seed:

Arcade, a startup that has made a Chrome extension to build demos, has raised $7.5M. The round was led by Foundation Ventures with participation from Upfront Ventures and Sequoia. Check out former NPLG edition featuring Arcade.

Ox Security, a company focused on security for software supply chains, has raised $34M. Investors in the round include Evolution Equity Partners, Team8, Rain Capital and M12, and Microsoft’s venture fund.

WorkPatterns, a people management application platform designed to guide working relationships and improve team performance, has raised $4.2M. The round was led by Javelin Venture Partners, with participation from Founders Fund, Zoom, Merus Capital, GTMfund, 10xFounders, Shorewind Capital, Moving Capital, Leblon Ventures, Mana Ventures, and Gaingels.

Series A:

Regie.ai, an AI content platform designed to offer an all-in-one content creation and management system, has raised $10M. The round was led by Scale Venture Partners, with participation form South Park Commons, Foundation Capital and Day One Ventures.

Series B:

Airplane, a SaaS platform for developers, has raised $32M at a $250M valuation. The round was led by Thrive Capital, with participation from Benchmark.

GlossGenius, a tech platform to help spa, studio and salon industry owners manage their operations, has raised $25M. The round was led by Imaginary Ventures and Bessemer Venture Partners, with participation from Left Lane Capital.

Series D:

Unravel Data, a platform designed to give developer teams visibility across data stacks, troubleshoot and optimize data workloads and define guardrails to govern costs, has raised $50M. The round was led by Third Point Ventures, with participation from Bridge Bank, Menlo Ventures, Point 72, GGV Capital and Harmony Capital.

Wasabi, a cloud startup offering services competitive with Amazon’s Simple Storage Service, has raised $250M at a $1.1B valuation. L2 Point Management led the round, with participation from Cedar Pine, Fidelity Management & Research Company and Forestay Capital.

Recent PLG Performance (Public Companies):

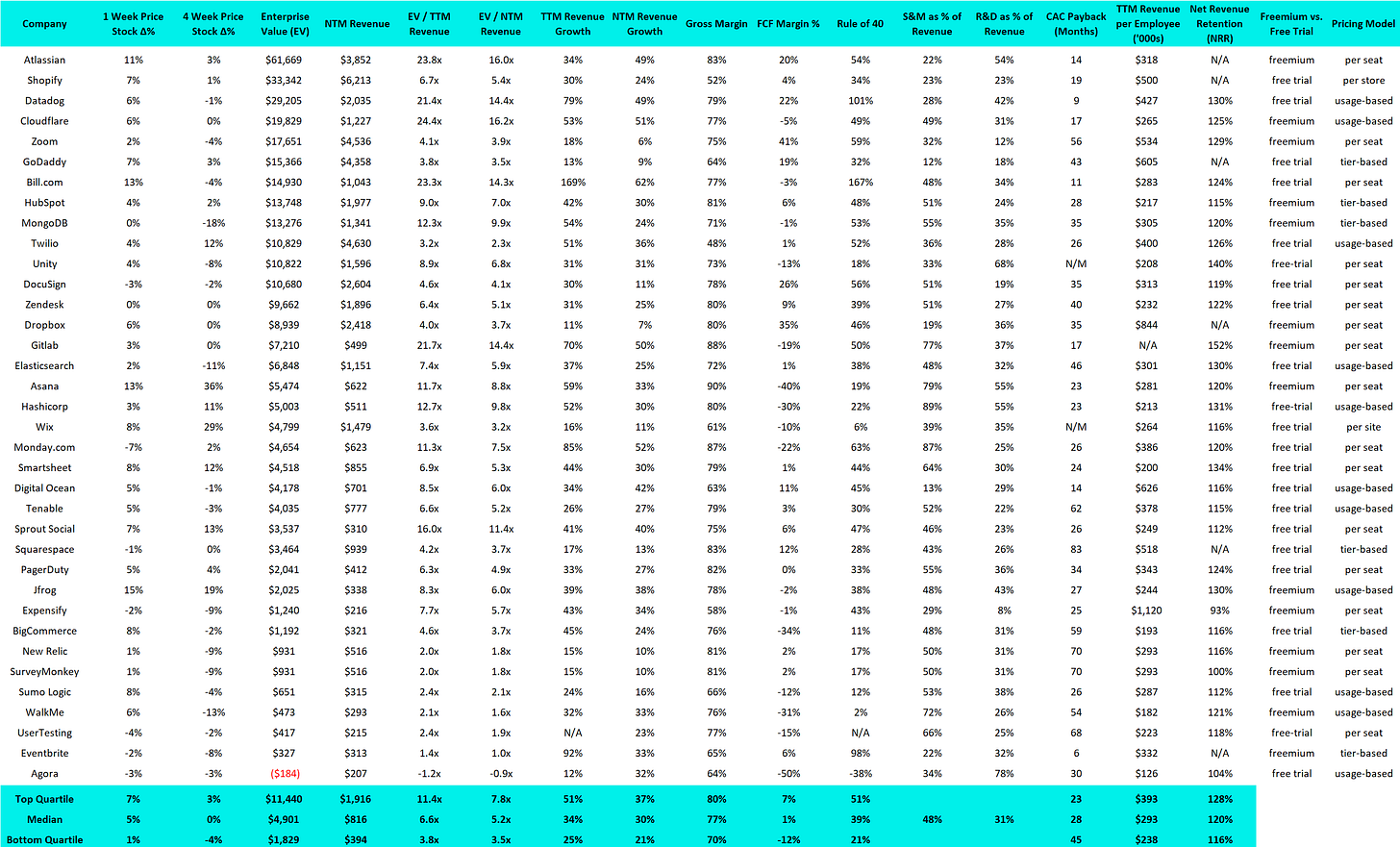

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest EV / NTM Multiples:

15 Biggest Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Kinda, I mean like.

Bad email is dying, but this has always been the case, I rarely find people going beyond 6+ follow ups and more than 6+ customizations.

The biggest issue is conversion though, I still prefer outbound due to conversion. I rarely would have people sign via cold email, it would payback the money but it was way too much work and no assets at the end of the day were produced