NPLG 10.12.23: "Freemium Really Hurt Our Business" - A Must Read from Equals CEO

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 8,331, +41 since last week

Share the PLG love: please forward to colleagues and friends! 🙏

"Freemium Really Hurt Our Business”

We featured next-generation spreadsheet Equals in NPLG earlier this year. After raising a $16M Series A from A16Z, CEO & Co-founder Bobby Pinero was guiding the company out of human onboarding and into PLG. Bobby bravely shared a post on LinkedIn this week that went viral and received an outpouring of feedback from other startup founders. I commend Bobby for building in public and for pushing the startup community’s thinking around PLG forward.

Today, Bobby shares with the NPLG community an updated post that openly reflects on the challenges of Freemium/PLG. He includes feedback from other founders in the updated post. This is a must read! Please share your thoughts by commenting on this NPLG post or on today’s LinkedIn post / tweet.

From Bobby:

“This week we shared our experience transitioning Equals to a freemium model (and why we went back again). Free didn’t work for us. In fact, it really hurt our business. Since publishing, I’ve been surprised at how many folks have come out to share similar experiences. We clearly struck a nerve. Here are just a few of the responses:

Freemium ≠ one-size-fits-all

Despite the constant pressure for founders to achieve mass adoption, it’s clearer to me, now more than ever, that freemium isn’t for every business. In fact, I think part of the problem is that many conflate PLG with needing to have a freemium model.

I think there's an interesting question, and a future post here – does PLG require a freemium motion? I'd argue Equals is still a PLG company in its current incarnation. Even though there’s no free path to using the product, we (still) lead with Product. We (still) have a self-serve funnel. And our growth is (still) fueled primarily by word-of-mouth. So maybe it's not the end of PLG as we know it, but rather an evolution of PLG that’s just a bit different to how we’ve been taught to think of it thanks largely to the successes of Notion, Figma, Airtable, and Canva (to name a few).

Let’s all continue to #BuildInPublic

Since opening up about our (costly) mistake, I’ve learnt so much from the incredible community of founders out there. I think this post resonated because we were honest, transparent, and vulnerable about what didn’t work for us - and I was a bit scared to do that!

I’m always in search of the truth, and I really enjoyed sharing our stories. So expect to see a lot more of the lessons and hard truths we’ve learned. Whether that’s based on what we’re doing at Equals, or the experiences from building some other companies you may have heard of, including Intercom, Loom, and Atlassian.

Building is hard, but remember that we’re all in this together. Anyways, on to the post and our experience with freemium. The original post can be found here.

The fallacy of freemium in SaaS

The following is a true story. It is the story of when we made Equals free. A decision that broke our business (for a minute).

Not all friction is bad

Deciding to make Equals free was one of the riskiest decisions I’ve made as CEO of Equals. I went into it with a ton of conviction. And I turned out to be wrong.

It all started when we launched Equals in April 2022. We made a big splash.

Because Equals is a complex product to build and expectations for how a spreadsheet should look and feel are insanely high, we gated access to the product. We wanted to onboard every single customer manually. We wanted to understand their use case. We wanted to establish a close relationship so they’d give us the benefit of the doubt when they inevitably ran into issues.

This strategy worked really well. In fact, it worked so well that revenue took off.

In just five months, we were able to raise a $16M Series A from one of the best investors in the world – a16z. And then I broke everything.

Freemium looked great (on paper)

Our pricing at the time was obscure – so obscure we were getting comments like these (there were more, but they've since been deleted).

Coming from Intercom – where we constantly struggled with a reputation of being unfairly and obscurely priced – we were particularly sensitive to this critique. The last thing we wanted was to have this be the perception of Equals, too. Pricing is hard, after all.

At the same time, we were watching the darlings of SaaS – companies like Notion, Figma, and Airtable – envying their massive adoption. Naturally, we thought it must be because they have a free tier and consumer-like pricing. It was obvious. We should do the same. At least, that’s what we thought.

Opening the floodgates

Here’s the memo I sent to investors and employees spelling out the rationale behind the decision to introduce a free plan and open the floodgates, so to speak.

Make special note of my conviction. It didn’t help that almost everyone agreed with me – "I must be right!" I thought. 😬

So, when we announced our Series A, we opened up Equals to the world:

✅ No more onboarding call required

✅ Prices slashed for current and future customers

✅ A generous new free plan

We sat back, ready to watch the masses sign up.

And sign up, they did. For a little while.

The needle moved until it didn’t

Almost immediately, we 4x'd the number of companies using Equals on a daily and weekly basis. But then, over the course of the next six months, the business really stalled:

⛔ We struggled to retain customers

⛔ We struggled to turn free workspaces into paid subscriptions

Why? Our funnel was long. To hit a paywall, you had to:

🚧 Create a workspace

🚧🚧🚧 Connect to a datasource (a big hurdle)

🚧Invite teammates

🚧Run a query before seeing a paywall

All the while, we continued shipping innovative products, making big splashes with each release.

But we were unable to move the needle back in the right direction meaningfully. So, after six months, we decided the risk was too significant. We had plenty of runway, but we knew we had to get back to building a growing business. And perhaps there was something unintentionally incorrect about free – for us.

From free to free* trial

In June this year, we launched 25+ new datasources. And we killed our free plan at the same time. In order to use Equals, you could start a free trial, but you had to put a credit card down.

Now, I know what you’re thinking: why on earth would we introduce even more friction? Well, as it turns out, not all friction is bad. Within a couple of months, we were back on an exciting growth trajectory with the most engaged user base we’d ever seen.

This leads me to one of the most interesting learnings I’ve had while working on Equals – introducing more friction in order to use the product has proven to work better for our business. This was something Ben and I had seen first-hand during our respective tenures at Intercom as well.

Counterintuitive ≠ wrong

We all hear it. All the time. “Make onboarding simpler! Get people into your product as fast as possible! Make it free! You'll figure out how to monetize later!”. It makes sense. And it obviously works for some. It just didn’t work for us.

We believe that making people invest time, commit to a trial, and put skin in the game will help you build a more engaged user base. This friction weeds out the people who aren’t serious and creates a sense of urgency. It also forces you to focus on the customers and users that really matter.

A work in progress

Will Equals ever be free again? Maybe. It’s very possible that down the line, we’ll revisit a freemium path to using Equals. Perhaps we’ll just always be in pursuit of that elusively perfect pricing model.

Time will tell. For now, we’re 100% focused on continuing to create the spreadsheet for modern data analysis.”

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track (zach@wing.vc).

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

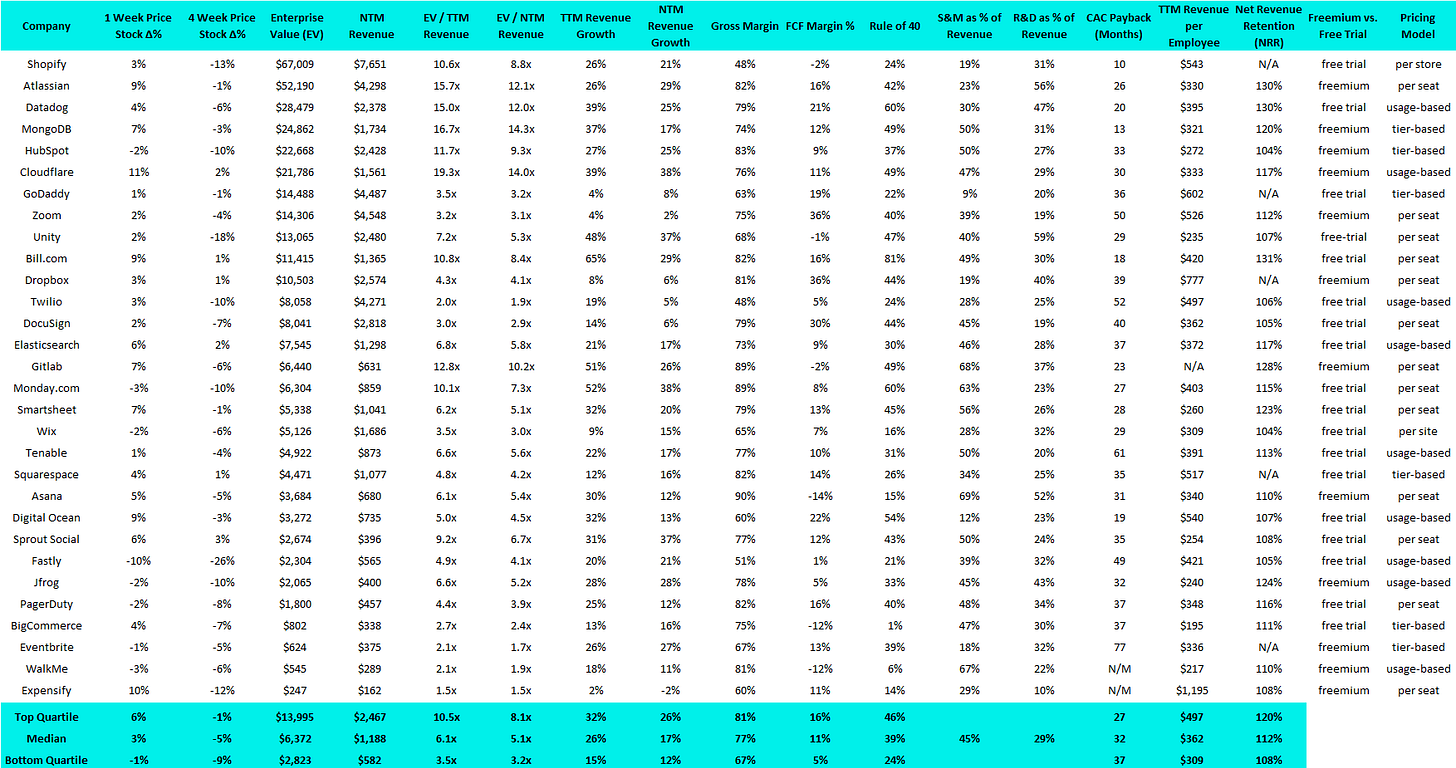

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

ClearFeed, a collaboration platform intended to provide seamless connectivity to backend ticketing tools, has raised $2.7M. The round was led by Peak XV Partners.

Kestra, an open source data orchestrator and scheduling platform intended to make data workflows accessible, has raised $3M. The round was led by ISAI and Axeleo Capital.

Sparx, a cost-containment platform designed to optimize spending at no cost by targeting places where businesses overspend, has raised $3.1M. The round was funded by Drive Capital, Thrive Capital, Human Capital and Wicklow Capital.

Series A:

Creatopy, an artificial intelligence-powered advertisement design automation platform designed to help businesses customize, automate and scale up their ad production and delivery, has raised $10M. The round was led by 3VC and Point Nine Capital.

Observe, an enterprise SaaS platform intended to turn business data into information, has raised $50M. The round was led by Sutter Hill Ventures.

Series B:

Prophecy, a low-code data transformation platform designed to make enterprises productive on their cloud data platforms, has raised $35M at a $135M valuation. The round was funded by Dallas Venture Capital and SquareOne Capital.

Series C:

Pulumi, an open source infrastructure-as-a-code platform designed to streamline cloud engineering, has raised $41M at a $391M valuation. The round was led by Madrona Venture Group, with participation from Tola Capital, New Enterprise Associates and Strike Capital Venture.

Thanks for sharing this breakdown, the "not all friction is bad" really stood out to me. Getting users to put some skin in the game clearly worked for equals

With free users , most drop off after x weeks if they fail to be activated. Putting a time based trial in place to drive urgency of activation (focus on urgency, user buy in) seems to be the big lesson regardless of freemium or free trial ?