NPLG 9.14.23: How AI-Apps Should Price

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 8,160, +67 since last week, +0.7%

Share the PLG love: please forward to colleagues and friends! 🙏

How AI-Apps Should Price

The new crop of high-growth, AI-powered applications are assisting users with work. For example, GitHub’s Copilot has 1.5M+ developers using the service to augment code generation. Copy.ai has 10M+ users who are generating marketing copy like blog posts and product descriptions. Tome has 10M+ users generating AI-powered slide decks. The default pricing model for these categories of AI-applications is per user pricing. This pricing model intuitively works because users are adopting the products as productivity tools that help assist and augment their work. Thus, AI-powered apps grow revenue by signing up more users.

These applications are evolving from co-pilot experiences to operating on autopilot mode. Mundane workflows will soon be handled end-to-end by AI-apps. As an illustrative example, instead of a product leader spending an hour every Sunday evening updating a product deck for a Monday standup, Tome will be able to auto-generate slides based on the latest usage data and feedback from the last meeting. AI-apps will handle mundane work and humans will be freed up to work on more stimulating and challenging problems.

Introducing: Work-Based Pricing

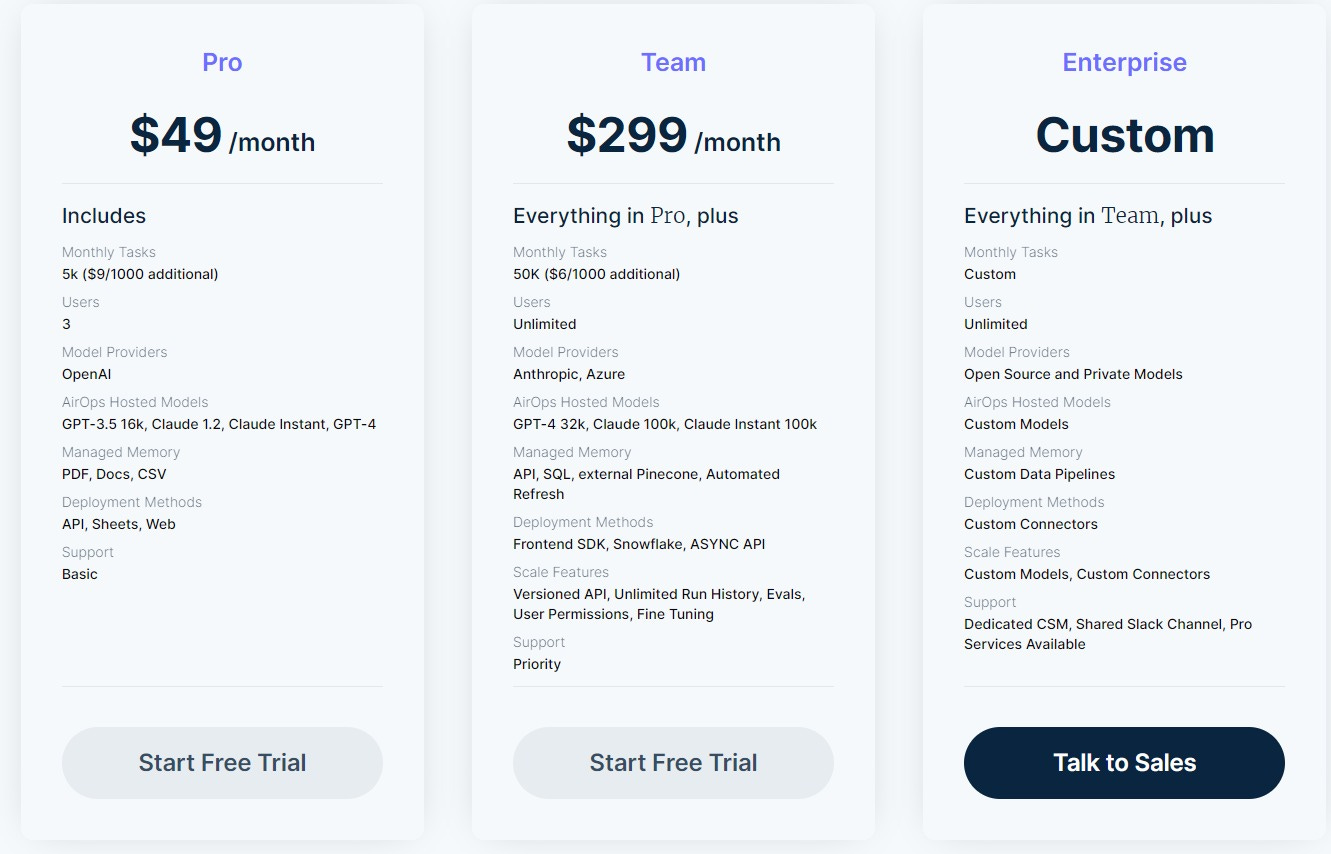

AI apps will need to evolve their pricing models from per user to per usage, or what I am calling per work. I am starting to see AI-apps layer in usage-based pricing on top of user-based pricing (see above example from AirOps pricing page). AI-apps will increasingly feel more like employees that you hire. Thus, you will pay them for the work that they do - some will be part-time, some will be full-time and some will work over-time all the time. Usage-based pricing also aligns optimally with cost structure as AI-apps can better predict what each unit of work costs.

If you are building an AI-powered app, it’s time to start rethinking your pricing model by layering in usage-based pricing (my preferred term is “work-based pricing”) as I predict this will be the optimal pricing model for AI-apps. In the near future, AI-powered apps will grow revenue by taking on more work.

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track (zach@wing.vc).

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

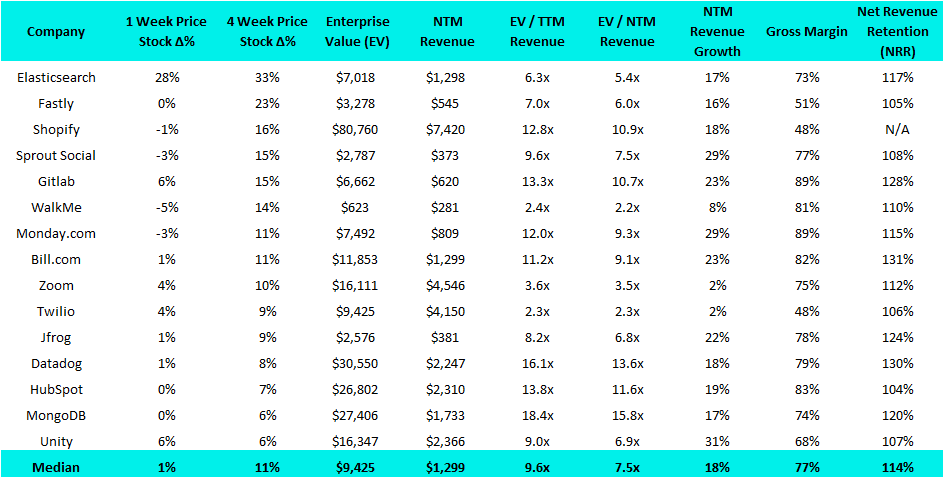

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

Seed:

Correcto., a developer of SaaS-based communication enhancement software designed to communicate with impact in the Spanish Language, has raised $7M. The round was led by Octopus Ventures, with participation from Carya Venture Partners and RiverPark Funds.

Gleen, a developer of a generative AI/ML system that works in conjunction with GPT-4 to maximize the accuracy and relevance of all generative AI responses, has raised $4.9M. The round was led by Slow Ventures, with participation from South Park Commons, CoinShares Capital Markets, 6th Man Ventures, Krust Group and ISM Angels.

SaaSGrid, a developer of data platform designed to scale SaaS start-ups, has raised $3.3M. The round was led by Craft Ventures, with participation from Riverside Ventures.

Series B:

d-Matrix, a developer of a computing platform designed to target artificial intelligence inferencing workloads in the data center, has raised $110M. The round was led by Temasek Holdings, with participation from Ericsson Ventures, McCarthy Marland, Lam Capital, Samsung Venture Investment, Microsoft, Industry Ventures, Archerman Capital, Cortes Capital, TGC Square, Playground Global and Mirae Asset Capital.

Prophecy, a low-code data transformation platform designed to make enterprises productive on their cloud data platforms, has raised an undisclosed amount from SquareOne Capital.