NPLG 7.27.23: PLG Product Benchmarks

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 7,755, +85 since last week, +1.1%

Share the PLG love: please forward to colleagues and friends! 🙏

2023 Product Benchmarks Report (OpenView)

My friends at OpenView just published their annual report on PLG Product Benchmarks. Kyle Poyar and team do an amazing job surverying ~1,000 top PLG private companies and analyzing GTM and product trends. For this edition of Notorious PLG, I wanted to highlight some of my favorite charts, graphics and takeaways from their report (full report here).

Private Company SaaS Growth Rates Have Slowed

Only one-fifth of companies in this year’s survey were growing at least 75% year-on-year, down from 49% in 2021.

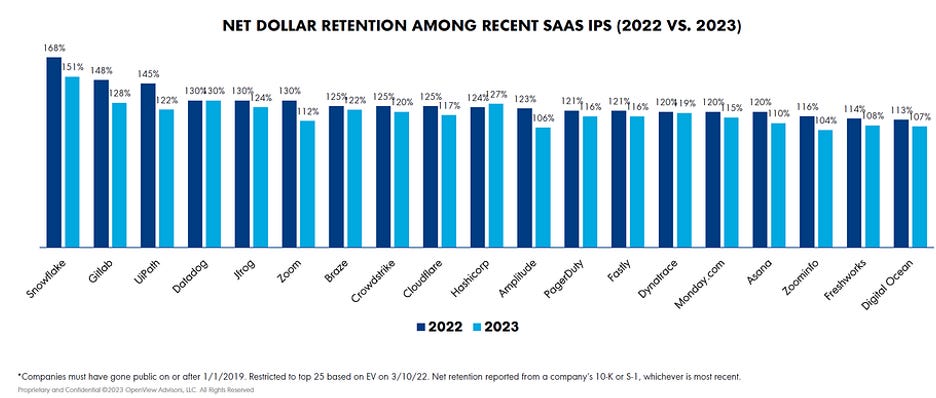

Net Dollar Retention Is Decreasing Across the Board

Growth Levers

The most influential lever took us somewhat by surprise: product-led sales maturity. Tracking product-qualified leads (PQLs) or product-qualified accounts (PQAs) increased the likelihood of fast growth by 61%

Hiring Strategy

Fewer than half of PLG companies have a sales team (47%) prior to hitting $1 million in ARR. In the early days, they’re more likely to invest in customer success (57%).

Conversion Rates Are Lower When Selling to Developers and Larger Companies

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track (zach@wing.vc).

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

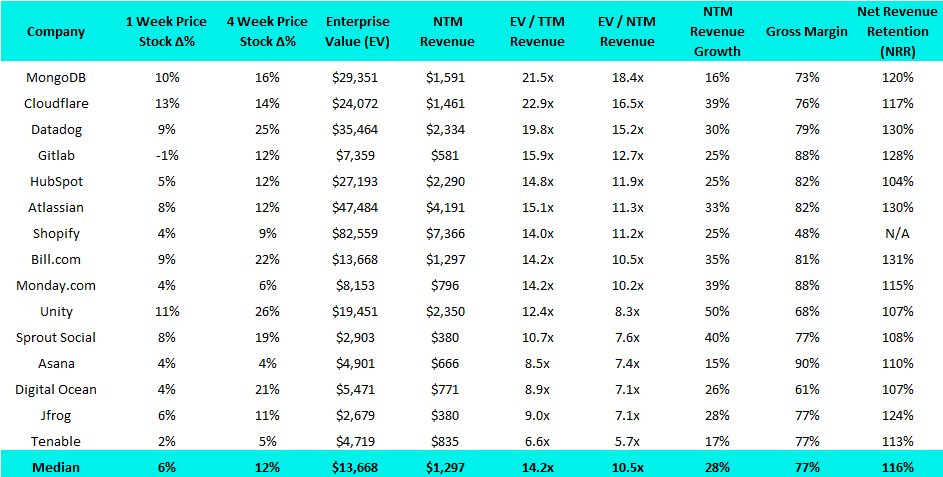

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

Cleanlab, a developer of data-centric artificial intelligence (DCAI) designed to help companies improve the quality of their datasets and diagnose/fix various issues in them, has raised $5M. Bain Capital Ventures led the round.

FedML, a developer of a learning and analytics library enabling secure and collaborative machine learning on decentralized data anywhere at any scale, has raised $11.5M. The round was led by DHVC, with participation from AimTop Ventures, LDV Partners, Road Capital, Finality Capital Partners, Sparkle Ventures, Robot Ventures, Wisemont Capital, Modular Capital, Prime Set and University of Southern California.

Gushwork.ai, a New York-based tech-enabled administrative services company, has raised $2.1M. The round was led by Lightspeed, with B Capital, Sparrow Capital, Seaborne Capital and Beenext also participating.

SPIRITT, a developer of a human-assisted AI platform intended to build complex applications without any tech skills, has raised $13.5M. The round was led by Izhar Shay, with participation from SVB Financial Group, Square Peg Capital and Disruptive AI.

Wing Cloud, a company that’s building an abstraction layer that lets programmers write once and use the same code across all three cloud services, has raised $20M. The round was led by Battery Ventures, Grove Ventures and StageOne Ventures, with participation from Secret Chord Ventures, Cerca Partners and Operator Partners.

Zelt, a developer of unified workforce platform intended to help employers run operations smoothly, has raised $3.7M at a $23.1M valuation. The round was co-led by Village Global and Episode 1 Ventures.

Series A:

Unstructured, which offers tools to prep enterprise data for LLMs, has raised $25M in Seed and Series A funding at a $80M valuation. Madrona led the Series A, with participation from Bain Capital Ventures, which led the Seed, and M12 Ventures, Mango Capital, MongoDB Ventures and Shield Capital.

Later Stage:

Hightouch, a startup that helps companies sync customer data across systems, has raised $38M at a $615M valuation. The round was led by Bain Capital Ventures, with participation from Iconiq, Y Combinator and Amplify Partners.