NPLG 7.20.23: Hypergrowth to 10K+ Daily Signups (Pinecone)

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 7,661, +72 since last week, +1.0%

Share the PLG love: please forward to colleagues and friends! 🙏

NPLG Startup of the Week: Pinecone

Generative AI is suddenly everywhere and is changing how we work, powering new creative use cases for slide creation (Tome, 10M+ users), marketing copy generation (Copy.ai, 10M+ users), image generation (Midjourney, 15M+ users), video creation (RunwayML), companion chatbots (Character.ai, 200M visits per month) and coding assistance (GitHub Copilot, 1.5M+ developers), to name a few breakout applications.

One of the challenges in deploying Generative AI at scale is providing additional context to the Large Language Models (LLMs) from up-to-date and private data, which typically involves storing data as embeddings and retrieving the right vectors depending on the query. Traditional databases are not optimized for the high-dimensional, complex vector representations that power modern AI models.

Enter Pinecone. Pinecone is a purpose-built vector data platform offering developers long-term memory for AI. Pinecone allows companies to leverage the capabilities of LLMs augmented with private data sources to produce more accurate and personalized generations.

Pinecone has raised ~$138M from top VCs including Wing, A16Z and Menlo. This year, Pinecone was voted to the top of the Enterprise Tech 30 list as one of the most promising technology companies by a panel of 100+ VCs.

For this edition of Notorious PLG, Pinecone VP of Marketing Greg Kogan shares his PLG strategy with the Notorious PLG community:

Our quick and (later) thoughtful approach to the free plan

“The free plan on Pinecone makes it easy for developers to explore and start building with vector databases, which are core pieces of infrastructure for Generative AI applications. Our free plan is also a core component of our PLG strategy, and one of the main reasons Pinecone has come to lead the (increasingly competitive) vector database market.

Here's a brief history of our free plan and how it evolved as we went from zero to 10,000 free signups per day.

To Free or Not to Free?

We spent months debating whether we should have a free plan at all, or whether we should open-source, offer a limited trial, or do none of the above. In the end, we decided the free plan is the best fit with our marketing strategy to "help engineers discover, explore, and build with vector databases," and with our product principle that Pinecone should be easy to use.

We ruled out limited trials because our product is in a cutting-edge space, and our would-be customers need ample time to learn not only the product but the surrounding concepts and workflows. And we ruled out open-sourcing primarily because it wouldn't allow us to deliver on our vision to provide easy-to-use vector search (the basic capability of vector databases) accessible to all developers.

Free it'll be.

Free what, exactly?

The next question was: What exactly will users get for free? Of course it'll be something less than the paid version, but in even a relatively streamlined product like Pinecone there are thousands of configuration or functionality changes that could be made to make it "less than" the paid version. The answer has serious implications: Give away too much and you'll cannibalize your business (check out my case study about Netlify); give away too little or the wrong things and people won't want to use the product.

Being the scrappy startup that we were back in 2021, we came up with some feature and capacity limitations for the free plan and launched the thing. Easy peasy.

Maybe we need a strategy

Our free plan worked, too well. Our userbase was already growing fast throughout 2022, but when the Generative AI boom took hold in early 2023 our userbase exploded, especially free users. Throughout much of Q2 we saw upwards of 10,000 free signups per day.

At this scale, those early decisions about the free plan had massive implications on our engineering overhead, infrastructure costs, support burden, and ability to provide a great experience for free users.

After realizing the growth wouldn't slow down any time soon ("good problem" blah blah) we first implemented emergency measures including a waitlist, and then went back to the drawing board.

This time with meaning

By this time we had a lot more clarity about our business, strategy, customers, and the market. We also had usage data.

Even with data in hand and clarity in mind, this time we were careful not to jump into technical decisions. We instead created a strategy for the free plan, which answered questions like:

What business goal does the free plan serve?

Is a free plan the right strategy to serve than goal?

How will we measure progress towards that goal?

Who is the target audience for the free plan?

What do we want those audiences to achieve in the free plan? (Engineers building side projects have different outcomes in mind than engineers building work projects.)

What do those audiences need from the free plan in order to achieve that, and what do they not need? (For instance, our data showed that 99.1% of our free users needed less than 20% of the storage capacity we were giving them.)

What performance and support can we reasonably commit to delivering as the numbers continue to skyrocket? (For instance, we simply can't deliver one-to-one technical support to hundreds of thousands of users — at least not for long.)

What ongoing efforts do we need to start in order to deliver on this strategy? (For example, engineering work to improve the cost-efficiency of our infrastructure, and growth-marketing work to increase conversions from free to paid users)

The strategy was thoughtful but simple. The whole thing fit on two pages. Once we agreed on the strategy, the product and engineering teams went fast to work on delivering the new free plan.

Two weeks and many sleepless nights later, we launched an updated free plan. There was some concern the reduced capacity would cause an uproar. Yet the response from our users and community was overwhelmingly positive. We now have a free plan that is right-sized for our users, engineered to support those users for a long time to come, and most importantly makes sense for our business.”

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track (zach@wing.vc).

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

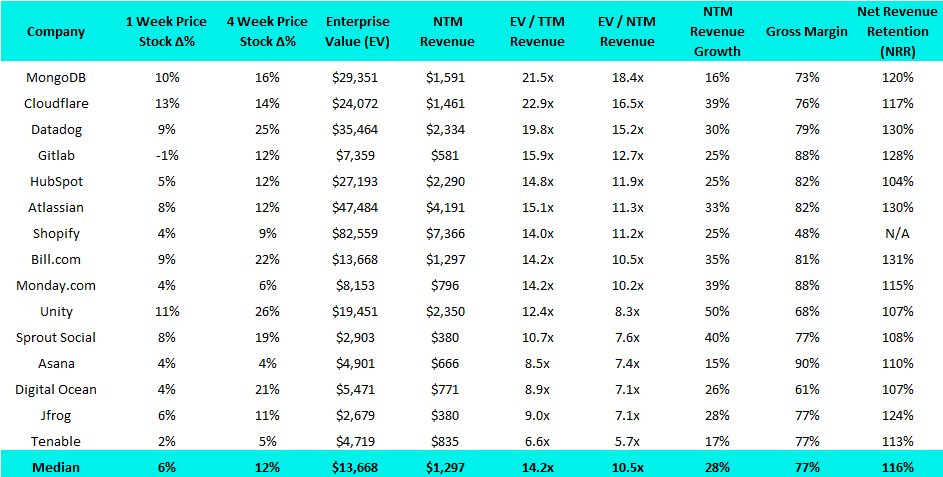

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

Lantern, a developer of a customer engagement automation platform intended to optimize upsell opportunities, has raised $6.8M. The round was led by Moxxie Ventures and Primary Ventures, with participation from Coalition, 8VC and 8-Bit Capital.

Olympix, a developer of a web3 security tool designed to find and automatically fix vulnerabilities in clients' code in real-time, has raised $4.3M. The round was led by Boldstart Ventures, with participation from Gauntlet, Blockdaemon, Robot Ventures, and Shrug Capital.

Spline, a developer of a design tool created to help build 3D website experiences without coding, has raised $15M. The round was led by Gradient Ventures, with participation from Chapter One, Leonis Capital, First Round Capital, NXTP Ventures, Backend Capital and Y Combinator.

Series A:

Resemble AI, a developer of voice cloning technology designed to produce realistic synthetic voices that capture human emotion, has raised $8M. The round was led by Javelin Venture Partners, with participation from Comcast Ventures, Craft Ventures and Ubiquity Ventures.

Series C:

Descript, a collaborative audio and video editor platform intended to transcribe audio to a text document for editing, has raised $53.7M. The round was led by OpenAI Startup Fund, with participation from Andreessen Horowitz, Spark Capital and Redpoint Ventures.