NPLG 6.2.23: Non-Obvious Things I Look For When Investing

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 7,193, +150 since last week, +2.1%

Share the PLG love: please forward to colleagues and friends! 🙏

Non-Obvious Things I Look For When Investing

As an investor in PLG software startups, I wanted to share some of the non-obvious things I look for in potential investments. By non-obvious, I am referring to some of the more subtle characteristics of a startup beyond a strong team, a market with customer pull and a differentiated product.

My non-obvious investing checklist:

High product velocity: I look to see how quickly a startup is shipping new product updates. I have found product velocity correlates highly with growth. I like to look at a company’s changelog to see the cadence and size of their releases.

Building in public: Sometimes it makes sense to stay in stealth until an MVP of the product is ready to be shared publicly. This is usually the case if a startup is entering a highly competitive market. However, I love it when founders are building in public by sharing product updates and demo videos on Twitter and LinkedIn. Founders that do this from the earliest stages tend to build strong brand awareness and loyalty and stay top of mind in customer, talent and investor communities.

Customer centric: A lot of founders claim to be customer centric, but there is a wide spectrum. For seed investments, some founders have spoken to 50+ potential customers already and have detailed notes on all the conversations that they are willing to share. This demonstrable commitment to spend time with customers correlates with building products that find a deep product market fit.

Built for teams: I meet 10+ new PLG companies every week and too many of them are focused on single player mode. Sure, you need a viable single player mode to help with customer acquisition, but the best PLG companies design, price and build their product for teams. Teams have better engagement and net dollar retention than individuals do and it’s hard to make a PLG business work that isn’t focused on winning over teams.

Video game mindset: I grew up playing video games with my siblings and roommates. Video games hook us because they are competitive, collaborative, highly visual, stimulating and most importantly fun. Founders who have a unique perspective on how to imbue their product with learning, leveling up and fun often have experience playing and appreciating video games.

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

This is a new section! I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track.

Conversion rate (website → free user):

Best: 10%

Good: 5%

Activation rate (free user → activated user):

Best: 60%

Good: 30%

Paid conversion rate (free user → paid user):

Best: 8%

Good: 4%

Enterprise conversion rate (free user → enterprise plan):

Best: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Best: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

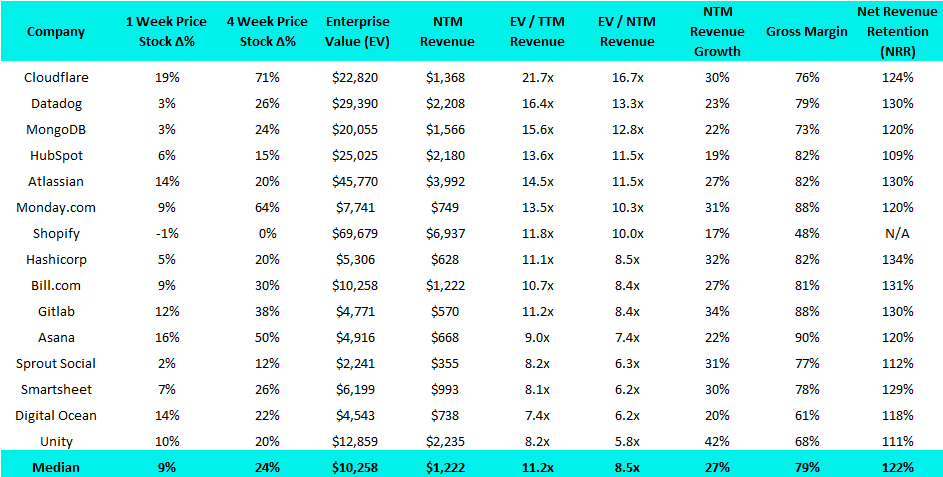

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

Cognosys, a developer of an artificial intelligence-based agent development platform intended to revolutionize productivity and simplify various complex tasks, has raised $2M. The round was led by GV, with participation from Untapped Capital.

Gan.ai, a startup that helps brands create tailored videos for their customers with an AI-powered video creation platform, has raised $5.25M. Surge, Sequoia Capital’s rapid scale-up program, led the round, with participation from Emergent Ventures.

Thena, a developer of a Slack management platform intended to redefine customer communication and intelligence, has raised $5M. The round was led by LightSpeed and First Round Capital, with participation from Pear VC.

Twirl, a developer of a platform for data teams looking to ship value, not tooling, has raised $2.52M. The round was led by Creandum, with participation from Cocoa Ventures.

Series B:

Elementl, the developer of Dagster, a SF-based data orchestration platform, has raised $33M. Georgian Partners led the round, and was joined by 8VC, Human Capital, Hanover, Sequoia Capital, Index Ventures, Amplify Partners and Slow Ventures.

Series C:

Anthropic, a startup developing an AI rival to ChatGPT, has raised $450M at a $5B valuation. The round was led by Spark Capital, Microsoft, Salesforce Ventures, Zoom Venture, with participation from Pioneer Fund, Wikus Ventures, Sound Ventures, GG 1978, SV Angel, Menlo Ventures, and Alphabet.

Tools for Humanity, the company co-founded by Sam Altman and behind the cryptocurrency project Worldcoin, has raised $115M. Blockchain Capital led the round, which also included Andreessen Horowitz’s crypto team, as well as Bain Capital Crypto and Distributed Global.