NPLG 6.22.23: Sam Altman's Conflicting Startup Advice

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 7,411, +73 since last week, +1.0%

Share the PLG love: please forward to colleagues and friends! 🙏

Sam Altman's Conflicting Startup Advice

When Sam Altman was president of Y Combinator, he frequently blogged and provided advice on Twitter to early-stage startups. Much of the advice centered around shipping a product quickly and raising as little capital as possible. In a recent interview (clip here), Sam said:

“I feel so bad about the advice that I gave while running YC that I’m thinking about deleting my entire blog. There were a lot of things that we really held dear — you have to launch right away, you’ve got to launch a first version you’re embarrassed about, raise very little capital upfront, don’t take big R&D risk, you’ve got to immediately find product-market fit. OpenAI raised a billion dollars of capital before any product at all. It took us 4.5 years after we started to release something, and when we released it we didn’t talk to users for awhile…We didn’t do it the same way and it still worked.”

I read through Sam’s blogs from 2015 and other advice that wasn’t followed, at least in the early years, while building OpenAI was:

“Figure out a way to get your product in front of users.” (here)

“Obsess about your growth rate, and never stop.” (here)

“Don’t forget to make money.” (here)

“Raise money on clean terms.” (here)

The takeaway is startups are snowflakes - each company and set of challenges are uniquely different. Sam’s advice during the YC days was typically for startups building applications that usually have lighter-weight products. OpenAI is an infrastructure company with a different set of challenges. Good for Sam to admit his early startup advice may have been flawed, especially for more R&D-intensive companies. In a 2015 blog post after listing 94 pieces of startup advice, the most important advice is the 95th: “The best startups are defined by exceptions; all of these rules are probably breakable, but probably not all at the same time.”

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

This is a new section! I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track.

Conversion rate (website → free user):

Best: 10%

Good: 5%

Activation rate (free user → activated user):

Best: 60%

Good: 30%

Paid conversion rate (free user → paid user):

Best: 8%

Good: 4%

Enterprise conversion rate (free user → enterprise plan):

Best: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Best: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

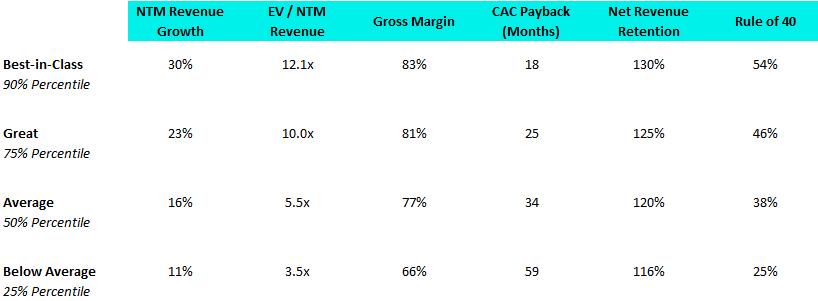

Best-in-Class PLG Benchmarking:

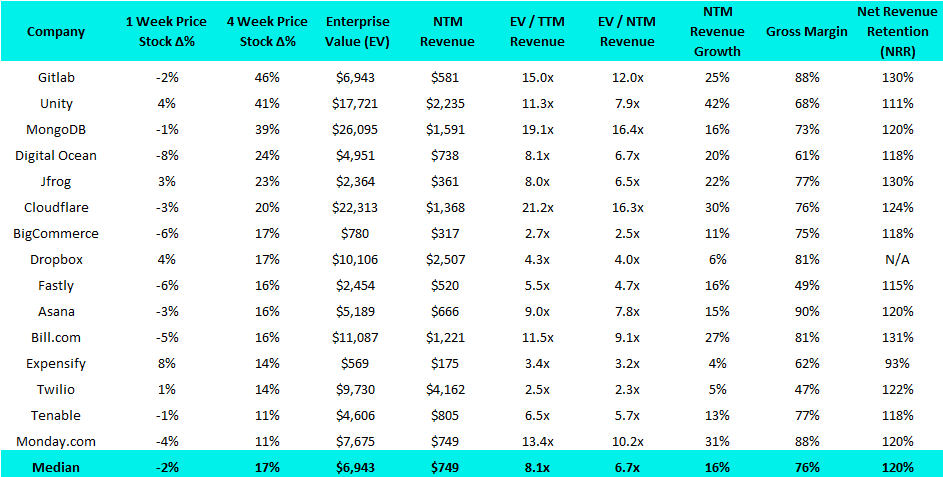

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

Apron, a developer of a payments platform intended for business owners to reconcile their invoices, has raised $5.9M at a $14.4M valuation. The round was led by Bessemer Venture Partners.

Masthead, a developer of a data observability platform designed to improve data quality and decision-making, has raised $1.3M. The round was led by Focal, with participation from Joint Journey Intelligent Investments, SMOK Ventures, DEPO Ventures, Monochrome Capital and Alchemist Accelerator.

Mistral AI, a French AI company, has raised $113M at a $373M valuation. Lightspeed Venture Partners led the round, with Eric Schmidt, Xavier Niel and Bpifrance all joining. Notably, this is the largest seed round raise for any European company.

Normal, a developer of a full-stack technology designed for critical enterprise applications, has raised $8.5M. The round was led by Celesta Capital and First Spark Ventures, with participation from Micron Ventures.

Series A:

Elastio, a developer of automated data protection platform designed for DevOps, has raised $18M. The round was led by Venture Guides, Capri Ventures, and Alumni Ventures, with participation from Bain Capital Ventures and Uncorrelated Ventures.

Gensyn, a developer of data nodes designed to train models on any data using decentralized machine learning nodes, has raised $43M. The round was led by Andreessen Horowitz, with participation from CoinFund, Protocol Labs, Canonical Crypto, Eden Block, Maven 11, Peer VC, Zee Prime, Id4 and M31 Capital.

I guess OpenAI was in a way one of a kind. As you also mentioned, it's an infrastructure company. I would also add, that it has a well known founder, so most probably raising money was a bit easier. But nevertheless, is a good reminder that, though there are best practices, in the end, startups are not a franchise.