NPLG: 6.15.23: Warehouse-Centric PLG (Hightouch)

Current subscribers: 7,347, +82 since last week +1.1%

Share the PLG love: please forward to colleagues and friends! 🙏

NPLG Startup of the Week: Hightouch

The modern data stack is a suite of products used for data integration and analysis by the more technology-forward companies. To stay relevant and compete effectively, companies are rapidly adopting the modern data stack.

One of the emerging components of the modern data stack is Hightouch. Hightouch has raised ~$54M from ICONIQ, Bain, Amplify, Afore and YC. This year, Hightouch was voted to the Enterprise Tech 30 list as one of the most promising technology companies by a panel of 100+ VCs.

Hightouch is a leading provider of Data Activation and Customer Data Platform (CDP) solutions, enabling marketing and data teams to activate customer data directly from their data warehouse to over 200+ destinations like ad platforms and CRMs. Hightouch is used by leading organizations like Cars.com, Spotify, TripAdvisor and GameStop to unlock a fast, flexible, and scalable CDP alternative by enabling them to activate audiences and other customer data points directly from their organization's single source of truth - the data warehouse out to the many business tools it is needed in.

For this edition of Notorious PLG, Hightouch Co-founder and Co-CEO Kashish Gupta share his PLG strategy with the Notorious PLG community:

Warehouse-Centric PLG

“What’s most unique about product-led growth (PLG) at Hightouch is how heavily we use the data warehouse and our own product to monetize sign ups. Hightouch’s fundamental value proposition: we activate data from wherever organizations have it stored (such as a warehouse) to their downstream tools. We’re “walking the walk” by running our PLG initiatives directly from our data warehouse, activating key data into downstream tools, using our own Hightouch platform.

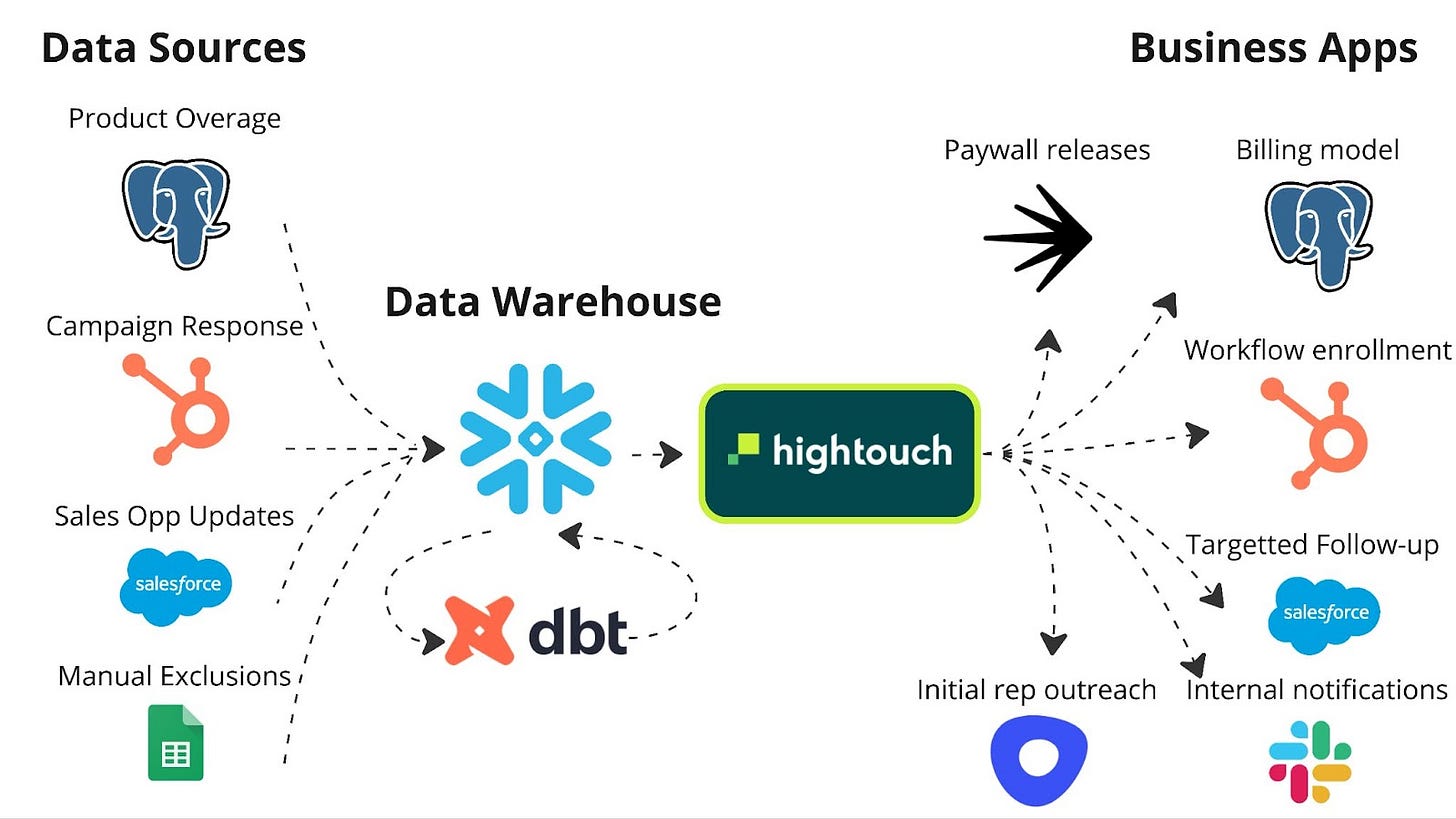

This chart above shows exactly how we’re actually doing this. We unify data from disparate sources into our data warehouse, and transform/model that data with dbt. Then, we use Hightouch to automatically activate that data to the apps that our business team members use daily. This allows our business teams to work directly in their daily tools such as Salesforce to engage with leads or Hubspot to trigger workflows and email marketing campaigns. This approach has two essential benefits:

Data Completeness: We can easily join data from different systems using SQL inside of our warehouse, and reconcile different object types (such as accounts in our CRM or organizations in our production database). These data-modeling actions can be version-controlled, organized, and are searchable and traceable. Because audiences are defined in the warehouse, it's easy to generate incredibly powerful funnel conversion and experiment reporting—something that would not be possible with traditional tools.

Business Team Velocity: Moving logic to the warehouse, and then activating it via Hightouch to our downstream tools (such as marketing platforms) ensures that everyone is operating off of the same customer definition. Each tool is kept up-to-date with key information like customer stage and most recent actions. Our business users can experiment and engage customers through their regular tools without requiring engineering resources.

We’ve been able to run PLG like a much larger company because of the benefits and automation we’ve reaped from our warehouse-centric strategy. We actually don’t have anyone fully dedicated to PLG at Hightouch— instead, multiple business users impact our growth here through their regular tools and workflows. We’re confident that warehouse-led approaches are the best route forward for a myriad of business use cases, including PLG— and that Hightouch’s platform is the best way to activate that warehouse data.”

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

This is a new section! I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track.

Conversion rate (website → free user):

Best: 10%

Good: 5%

Activation rate (free user → activated user):

Best: 60%

Good: 30%

Paid conversion rate (free user → paid user):

Best: 8%

Good: 4%

Enterprise conversion rate (free user → enterprise plan):

Best: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Best: 30%

Good: 15%

Conversion from website to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

Contextual.ai, a developer of large language models like paradigm-shifting tools designed to build enterprise-focused language models, has raised $20M. The round was led by Bain Capital Ventures, with participation from Lightspeed, Greycroft and SV Angel.

Fileread.ai, a developer of a google-like AI search software designed to find the information against the CVE and NIST databases, has raised $6.49M. The round was led by Hacker Fellowship Zero.

Monster API, a developer of a machine learning pipeline platform intended to enable developers to create a wide range of applications, has raised $1.1M. The round was led by Carya Venture Partners, with participation from Rebright Partners.

Series C:

Cohere, a Toronto-based generative AI startup, has raised $270M at a $2.02B valuation. Inovia led the round, and was joined by Nvidia, Oracle, Salesforce Ventures, SentinelOne, Index Ventures, Alphabet, DTCP, Mirae Asset Wealth Management and Schroders Capital.

Instabase, a developer of operating system software designed to create real value for businesses using innovative AI, has raised $45M at a $2B valuation. The round was led by Tribe Capital, with participation from Andreessen Horowitz, New Enterprise Associates and Spark Capital.