NPLG 5.5.23: Trends in Early Stage Financings

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 6,957, +77 since last week (+1.1%)

Share the PLG love: please forward to colleagues and friends! 🙏

Trends in Early-Stage Financings

Every year, my colleague Peter Wagner and our research team at Wing VC publish a report on the trends in early stage venture capital financings. You can read this year’s report here. The report is packed with interesting data, but I highlight some noteworthy charts below for your convenience.

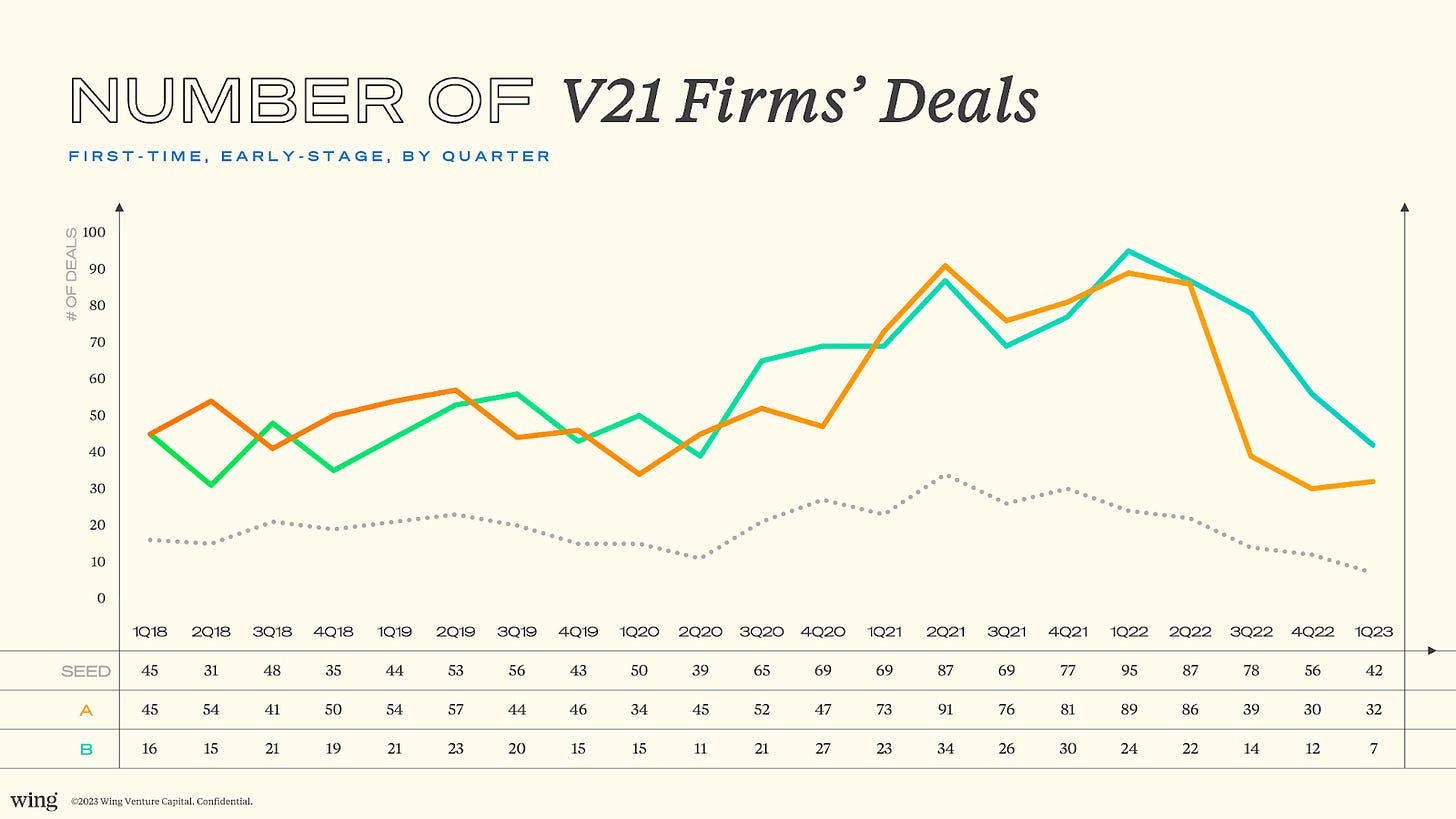

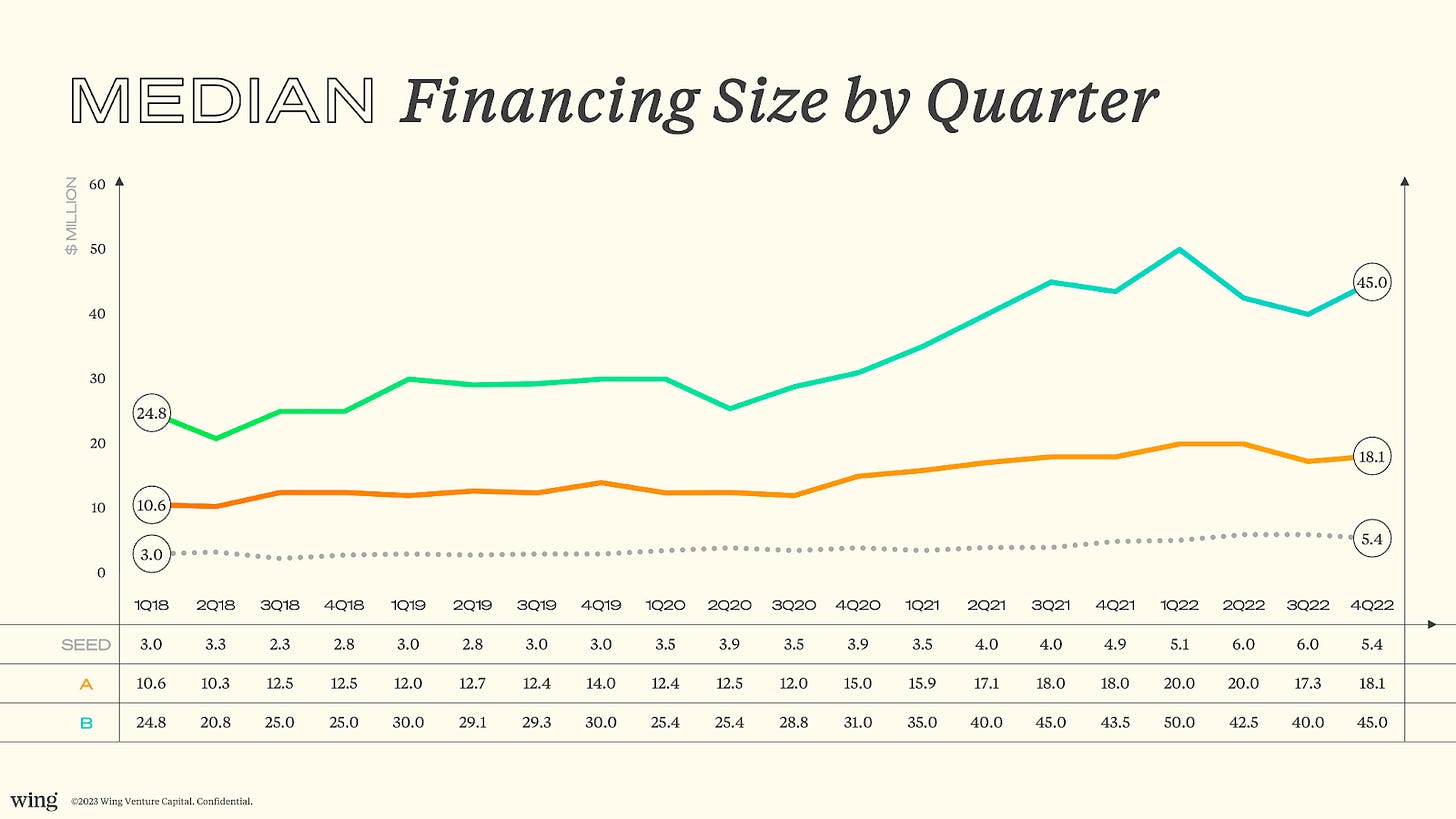

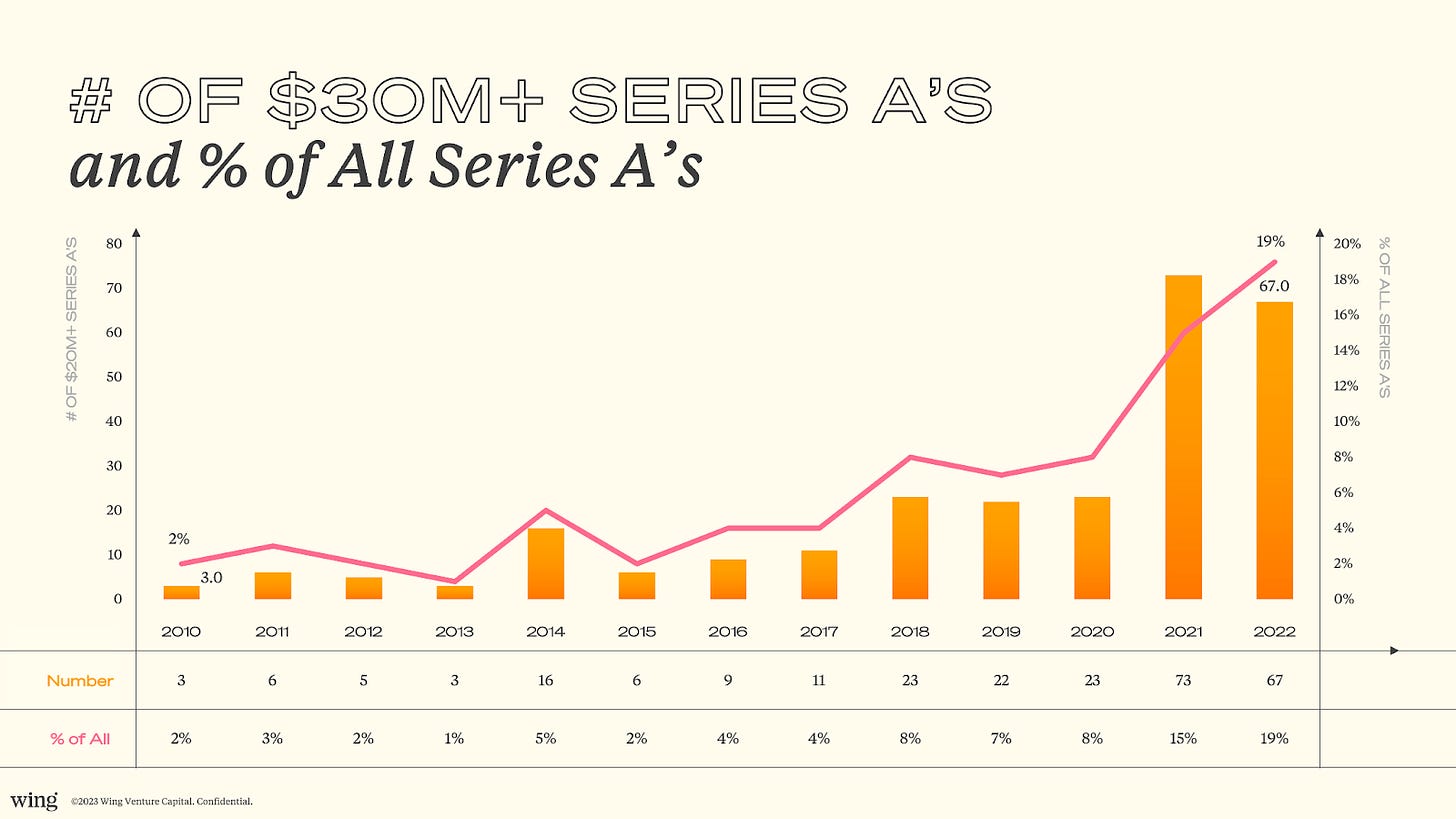

Preface: the mission of the V21 study is to examine early-stage financing dynamics amongst the industry’s highest quality startups. We analyze and report on the trends and characteristics of companies invested in by at least one of the 21 elite venture capital firms, the “V21." This year, the curated V21 dataset captures the details of 10,382 financings at 5,052 companies invested in by V21 venture capital firms at Seed, Series A, and Series B stages across 13 years.

Deal Slowdown

Generative AI Deals Gaining Share

Deal Sizes

Pre-Money Valuations

Jumbo Series A’s

Cumulative Capital Raised Prior to Round

Summary Round Sizes and Valuations

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

This is a new section! I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track.

Conversion rate (website → free user):

Best: 10%

Good: 5%

Activation rate (free user → activated user):

Best: 60%

Good: 30%

Paid conversion rate (free user → paid user):

Best: 8%

Good: 4%

Enterprise conversion rate (free user → enterprise plan):

Best: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Best: 30%

Good: 15%

Conversion from website to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

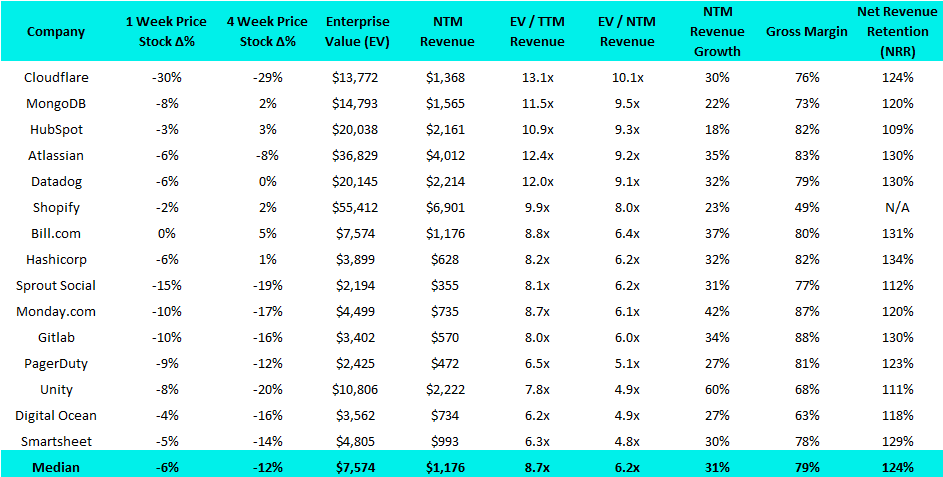

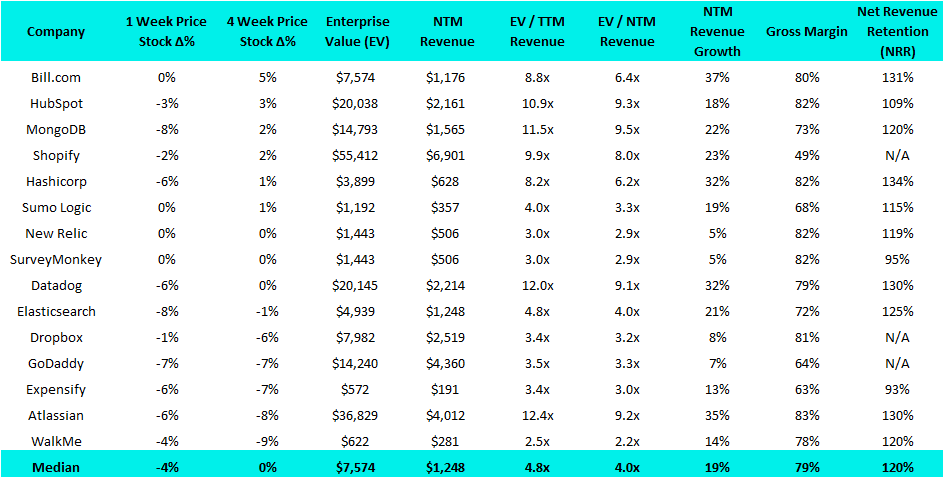

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

AirOps, a startup developing tools to create AI Apps that seamlessly integrate large language models, has raised $7M. The round was led by Wing VC, with participation from Founder Collective, XFund, Village Global and Apollo Projects.

aiXplain, a developer of artificial intelligence solutions designed to make AI and ML accessible to everyone, has raised $8M. The round was led by Transform VC and Calibrate Ventures.

Astral, a developer of Python linter technology intended to make the Python ecosystem more productive by creating powerful development tools, has raised $4M. The round was led by Accel, with participation from Caffeinated Capital.

Consensus, an AI-based search engine platform designed to find answers from scientific research, has raised $3M. The round was led by Draper Associates, with participation from Nomad Capital and Winklevoss Capital.

Luca, a developer of a smart pricing platform for e-Commerce and marketplaces designed to assist operators to decide the prices of their products and when to update their prices, has raised $2.5M. The round was led by Menlo Ventures, with participation from Soma Capital and Y Combinator.

Oblivious, a developer of a data analytics platform intended to secure the privacy of data that is impactful for business success, has raised $5.8M. The round was led by Cavalry Ventures, with participation from Act VC, Atlantic Bridge, Firestreak Ventures, Expeditions Fund and Hustle Fund.

Openlayer, a developer of a debugging workspace platform designed to eradicate failure patterns and biases in machine learning models, has raised $4.8M. The round was led by Quiet Capital, with participation from Picus Capital, Hack VC, Liquid 2 Ventures, Mantis VC and Y Combinator.

Operant, a developer of a runtime application security platform intended to provide analytics and enforcement across APIs, networks and data layers, has raised $3M. The round was led by Felicis.

Qdant, a developer of a vector database & vector similarity search engine that deploys as an API service providing search for the nearest high-dimensional vectors, has raised $7.5M. The round was led by Unusual Ventures, with participation 42cap and IBB Ventures.

WunderGraph, a developer of open-source framework designed to access all data through a single API, has raised $3M. The round was led by Aspenwood Ventures.

Series A:

Ditto, an SF-based distributed database startup, has raised $45M. Acrew Capital led the round, and was joined by U.S. Innovative Technology Fund, True Ventures and Amity Ventures.

Harvey, a developer of a generative AI legal tech application designed to help law practitioners with their tasks, has raised $21M. The round was led by Sequoia Capital, with participation from OpenAI Startup Fund , Conviction Investment Partners and SV Angel.

Series B:

CoreWeave, a GPU-focused cloud compute provider, has raised $221M at a $2B valuation. The round was led by Magnetar Capital, with participation from Nvidia.

Pinecone, a developer of a vector database platform intended to deploy complex machine learning applications at scale and with ease, has raised $100M at a $750M valuation. Th round was led by Andreessen Horowitz, with participation Wing VC, ICONIQ Growth and Menlo Ventures.

Replit, an IDE startup developing a code-generating AI-powered tool called Ghostwriter, has raised $97.4M at a $1.16B valuation. Andreessen Horowitz led the round, with participation from Khosla Ventures, Coatue, SV Angel and Y Combinator.

Weaviate, an open-source vector database designed to store data objects and vector embeddings from ML-models, and scale seamlessly into billions of data objects, has raised $50M at a $200M valuation. The round was led by Index Ventures.

Series C:

Semgrep, a platform for developers to build secure apps, has raised $53M. The round was led by Lightspeed Venture Partners, with participation from Felicis Ventures, Redpoint Ventures and Sequoia Capital.