NPLG 3.2.23: Mastering Sales-Assisted PLG (Chameleon)

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 6,140, +70 since last week (+1.2%)

Thank you to everyone who filled out the subscriber survey last week. You helped me with new ideas to improve NPLG. For starters, I am adding a new section to the newsletter to benchmark some of the most important PLG startup metrics. Please ket me know what you think!

Share the PLG love: please forward to colleagues and friends! 🙏

NPLG Startup of the Week: Chameleon

Consumer gratification is getting faster (short Tiktoks over longer YouTube videos, groceries delivered within minutes, real-time health tracking and feedback etc.) and SaaS companies need to keep up: if a user doesn’t find their “aha moment” soon after signing up, they are likely to bounce and not return.

However most companies find it difficult to build and maintain variations and tests for their user onboarding, and typically don’t have the engineering resources to create a robust system of in-app nudges, walkthroughs, or other interactive self-serve help.

Chameleon solves this by offering easy-to-build and deploy codeless UX patterns (banners, tooltips, modals, highlights, checklists etc.) that can be customized and targeted to specific users and segments based on user data. Chameleon experiences help customers drive user engagement and product-led growth at a much higher ROI than building in-house adoption capabilities.

For this edition of Notorious PLG, co-founder & CEO Pulkit Agrawal shares how to balance self-service and sales-led or sales-assisted motions while operating within a product-led growth agenda.

Failing at PLG and pivoting to sales-led

“When we first started Chameleon, we thought the perfect GTM motion was the one that was most comfortable for us personally as buyers. As startup founders we preferred trying software ourselves and paying monthly via a credit card. In fact, a key reason for founding Chameleon was to enable more teams to provide interactive self-serve user onboarding experiences!

However we missed a key insight: we weren’t the target market! It took us some time to realize a few things:

The teams that cared most about solving this problem were the ones at some scale (many thousands of end-users; a built-out product team; someone owning new user activation)

Those teams were (sometimes more) comfortable buying software after going through a consultative sales process

If the price of the software was low enough to charge to a credit card it wasn’t considered serious or at parity with other more expensive solutions

This realization took years, because initially we were just trying to fix the problems in front of us (low success and high churn) by building more product. The push to challenge our GTM approach came most directly from our investors when we were running out of money -- they told us our revenue was “low quality” (i.e. lots of small companies, paying small amounts, and not clearly sources of expansion).

So eventually we bit the bullet and pivoted to a sales-assisted motion. I made sales my primary job and we focused on selling annual agreements in the range of $10-50k to mid-market (100 to 1000 employee) SaaS companies. Eventually this sales-assisted motion started working, and we ended up bootstrapping the business until raising a $13M Series A last year, led by Matrix.

However we never abandoned PLG, and we didn’t become sales-led. Our pricing was listed on our website, anyone could create an account, we still offered a self-service motion, and increased usage drove more growth. Too often folks assume a binary split: PLG or sales-led, but that’s a fallacy; every successful SaaS business has a mix of both.

How Chameleon does sales-assisted PLG

So, how do we implement a product-led, sales-assisted motion? Here are six things we do:

Personalize our website based on firmographic information

We use Clearbit Reveal to identify the company of any individual visiting our marketing site, and the size, location, and other parameters for that company. Based on that we then adapt our pages, including primary CTAs, using Mutiny.

For example, we know that smaller companies much prefer self-service, and want to try the product themselves. Smaller companies are also not a great fit for our sales-assisted process, and so we want to provide a clearer pathway for them into the product. Below is an example of this variation, which resulted in a 25% increase in free signups for the small company segment.

We also know that larger companies often prefer a sales-assisted process and that if we speak to them, we’re better able to explain our differentiators, and help them navigate the buying process effectively. Accordingly, we present chat-style popups to companies between 50 and 1000 employees, when they are returning to prompt booking a call. This has led to a 3x increase on demo conversion rates (after much testing)!

Access to a personal sandbox environment

To leverage Chameleon, our customers install their Chameleon code snippet in their product, then use our Chrome Extension “Builder” to create their notifications/announcements/microsurveys, etc. They do all the building from within their own application, so they have the right context, styling, content, positioning etc. for what they’re creating.

However, it is a high friction point to install a code snippet into your product, or even to download a Chrome Extension (which may not work if the app has a content security policy blocking third-party extensions) so we built a sandbox environment to let anyone that creates a Chameleon account play with the Builder and get familiar easily.

Contextual self-serve help on relevant pages

Installation of the Chameleon code snippet is a significant step in finding value from Chameleon and can be tricky. There are many different methods for installation, and this can vary by the product’s tech stack. We wanted to make accessing help easy, but without overwhelming users with lots of noisy information on the page.

Therefore, we use a dynamic self-serve menu with relevant links based on where you are in your flow. We have a general version in our left-hand side navigation, and a specific one for the installation flow. We actually built these using Chameleon’s own Launchers product :)

Personalized warm outreach sequences based on ICP fit

There is a lot to learn about how to use a product adoption platform effectively; most teams only scratch the surface, but when we can show them relevant use cases and best practices tailored to their goals, they are often wowed. We can also take them through a managed trial / proof-of-concept to ensure they effectively test and validate all key requirements before deciding to use Chameleon.

Accordingly, we encourage all qualified sign-ups (using firmographic, technographic, and usage data) to speak with us and send highly personalized emails to motivate them to book a call.

Empty states for upsells

Most products do a bad job of empty states: the UI before a user takes any action is often just the same interface but without any data. This is key real estate at a sensitive juncture in the customer journey, and products should instead be “marketing” the feature, instead of presenting a default blank state.

We apply two principles in thinking about this: (1) don’t hide any features and (2) offer personalized empty states.

For (1) this means that we must show all features, even if they are not available to the user on the current plan. We have to instead display them as disabled or locked. However, we try to show as much as possible to give customers a true sense of the art of the possible.

For (2) instead of showing the mechanics of how to use an unavailable feature, we show a mini-landing page that emphasizes the benefits/value of the feature, with a glimpse of the UI. We also personalize this based on the state of the user (e.g. whether they have installed the Chameleon code snippet or not).

Leaning in to Search

Many of our users also work with a variety of other popular SaaS tools (e.g. Notion, Slack etc.) and so UX patterns get quickly established and expected. One example of this is CMD+K search; to find anything and to access help.

We implemented this in our own product, and brought together not only navigation but also all the fantastic content that lives outside of our product in a variety of places: help articles, developer docs, blog posts, recipes, etc. We know we need to make our current users experts to help them become advocates and fans. Bringing this content to them in their app facilitates that.

We enabled this using a new Chameleon product, the HelpBar, which allows any company to offer this keyboard shortcut-based omnisearch (across help center, developer docs, blog etc.) without coding. Sign up for the waitlist here.”

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing:

PLG Benchmarking (Startups):

This is a new section! I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track.

Conversion rate (website → free user):

Best: 10%

Good: 5%

Activation rate (free user → activated user):

Best: 60%

Good: 30%

Paid conversion rate (free user → paid user):

Best: 8%

Good: 4%

Enterprise conversion rate (free user → enterprise plan):

Best: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Best: 30%

Good: 15%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

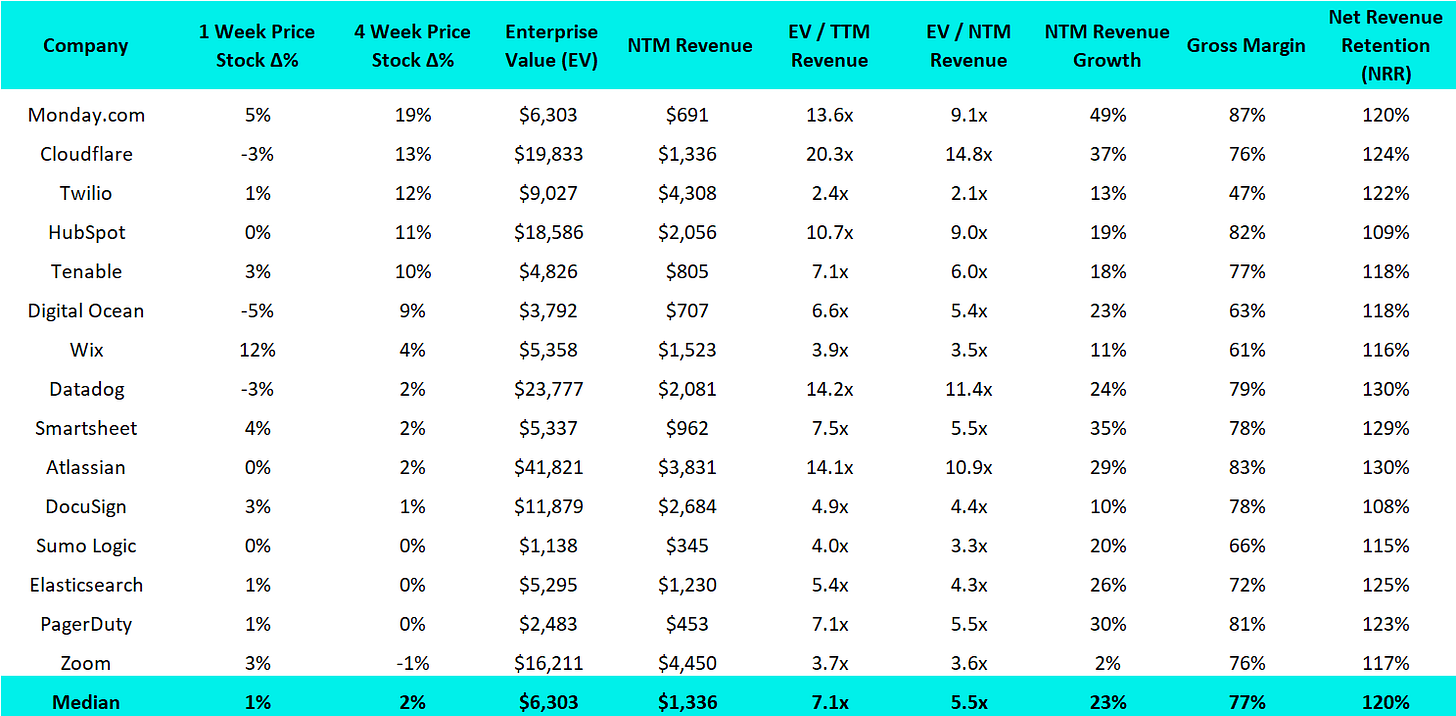

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

Chronicle, a startup trying to simplify presentation tools, has raised $7.5M. Accel and Square Peg led the round.

Cycle, a product management platform that connects customer feedback to product delivery workflows, has raised $6M. The round was led by Boldstart, with the participation from eFounders, Base Case, The 20VC Fund, SV Angel, BoxGroup and Hummingbird Ventures.

Series A:

Towns has raised $25.5M at a $110.5M valuation. This is Ben Rubin’s new project. The round was led by Andreessen Horowitz.

Replicate, a startup that runs machine learning models in the cloud, has raised $17.8M Seed and Series A. The Series A was led by Andreessen Horowitz, with participation from Y Combinator and Sequoia, while the funding sources for the previously undisclosed Seed round weren’t named.

Series B:

Finch, a platform that helps companies connect to various HR apps, services and systems, has raised $40M. The round was co-led by General Catalyst and Menlo Ventures, with participation from QED Investors, Altman Capital and PruVen Capital.

Tome, a storytelling tool designed to reduce the time required for designing slides, has raised $43M at a $300M valuation. The round was led by Lightspeed Venture Partners, with participation from Coatue Management, Greylock Partners and Wing Venture Capital.