NPLG 2.23.23: Subscriber Survey

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 6,070, +53 since last week (+0.9%)

Share the PLG love: please forward to colleagues and friends! 🙏

NPLG Subscriber Survey

I want to keep improving this newsletter to make it more valuable for you. Can you please take 2 minutes to fill out a quick subscriber survey? All feedback is anonymous. Thank you!

PLG Tweet(s) of the Week:

Recent PLG Financings (Private Companies):

Seed:

Caldera, a no-code web3 infrastructure platform, has raised $9M across two rounds. The two rounds were led by Sequoia Capital and Dragonfly Capital, with participation from Neo, 1kx and Ethereal Ventures.

Command K, a developer of a configuration management platform designed to prevent data leaks and simplify governance, has raised $3M. The round was led by Lightspeed Venture Partners, with participation from All In Capital and Mango Capital.

Descope, a developer-focused authentication and user management platform, has raised $53M. The funding came from Lightspeed Venture Partners and GGV Capital, with additional funds contributed by Dell Technologies Capital, TechAviv and J Ventures.

Pydantic, a developer of an open-source data validation framework designed to validate data in python using type hints, has raised $4.7M. The round was led by Sequoia Capital, with participation from Partech and Irregular Expressions.

Series A:

Puzzle, a financial infrastructure platform intended to enhance speed, trust and confidence in making financial decisions, has raised $15M. The round was led by General Catalyst, with participation from Fog Ventures.

Recent PLG Performance (Public Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

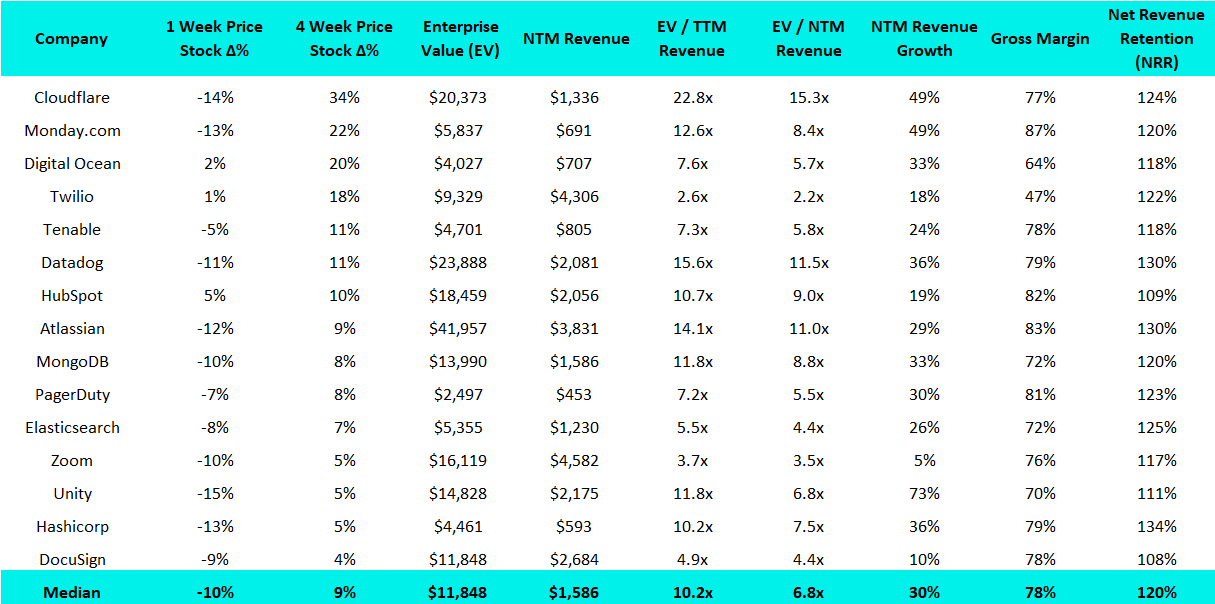

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

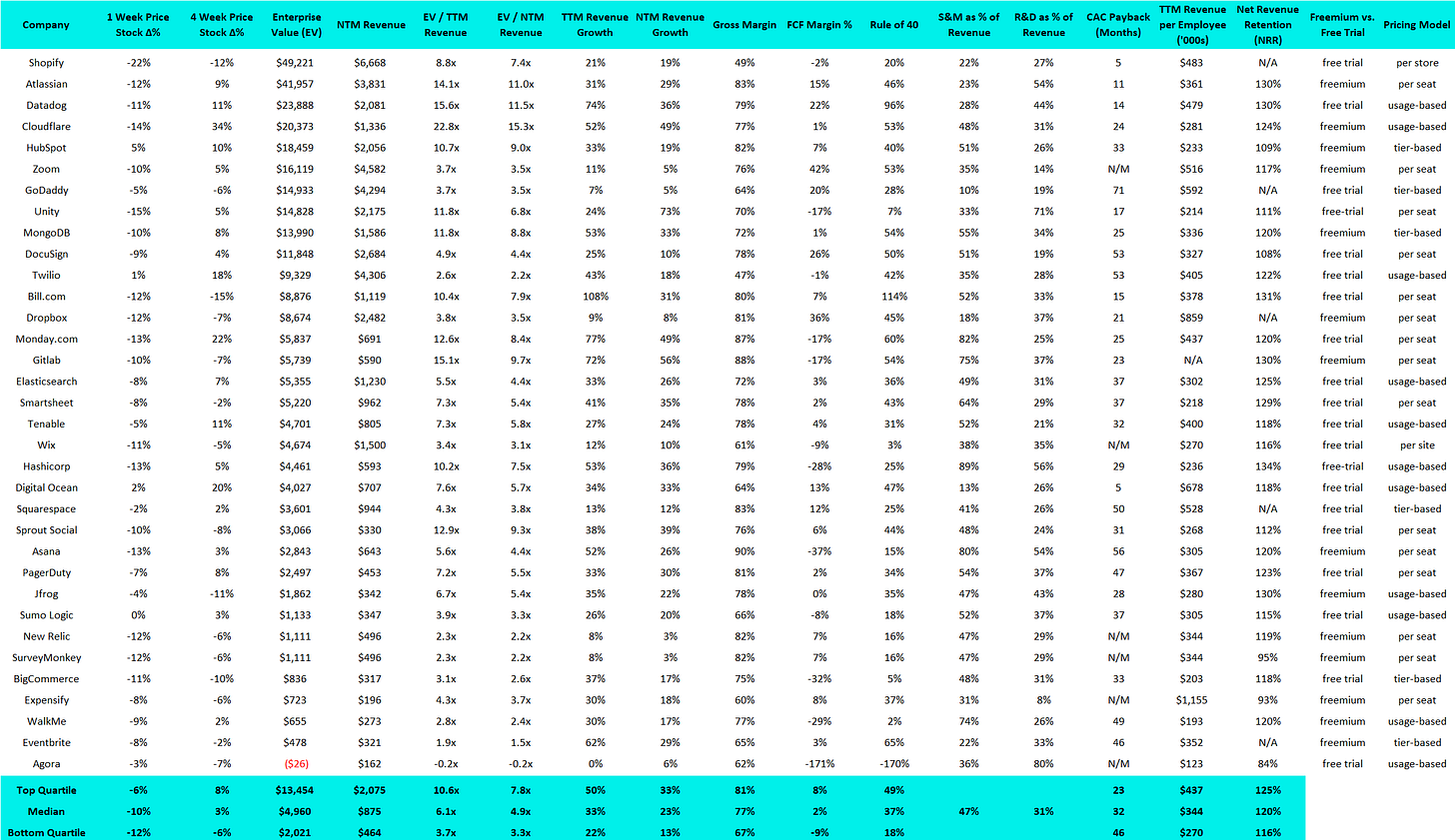

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.