NPLG 12.22.23: Is PLG the Right Go-To-Market Strategy for My Startup? Three Key Questions to Ask

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 8,943, +65 since last week

Share the PLG love: please forward to colleagues and friends! 🙏

Is PLG the Right Go-To-Market Strategy for My Startup? Three Key Questions to Ask (Battery Ventures)

Happy holidays to the NPLG community! I want to reshare a recent post from friends at Battery Ventures. You can find the full post here. I enjoyed this writeup from Neeraj and Sudhee:

“So, you’ve taken the plunge into entrepreneurship and decided to build a brand-new SaaS company. You assembled a team, identified a pain point, raised some capital from investors and started building the product. As the next six to twelve months unfold, a pivotal decision awaits: How should we go to market?

Often not a primary focus for early-stage startup founders, go-to-market (GTM) strategy carries profound implications for the revenue trajectory of a business. This decision will also shape your organization’s DNA – how you build products, set up your marketing and sales teams, who you hire and more – for years to come.

Consider the case of Zoom. In the realm of video-conferencing software, Zoom wasn’t the first to market; competitors like WebEx, GoToMeeting and BlueJeans* had already established themselves. What set Zoom apart, in our view, was its adoption of a product-led growth (PLG) go-to-market strategy. Unlike its competitors, Zoom allowed users to sign up and use the product freely without the conventional intervention of a sales rep. The brilliance of this approach lay in empowering enthusiastic users, who, enamored by Zoom’s capabilities, naturally drew their team members onto the platform. This organic and user-driven growth catalyzed Zoom’s remarkable success: Today, the company boasts over 300 million daily active users and commands a >50% market share.

While PLG can be a game-changer, it’s not a one-size-fits-all solution for every software business, and it is often complemented, or even eclipsed, by a more traditional, enterprise-sales model once a company reaches a certain scale. This article delves deeper into three essential factors to make PLG work for your early-stage business, as you’re just starting out.

#1 Does your product support single-player mode?

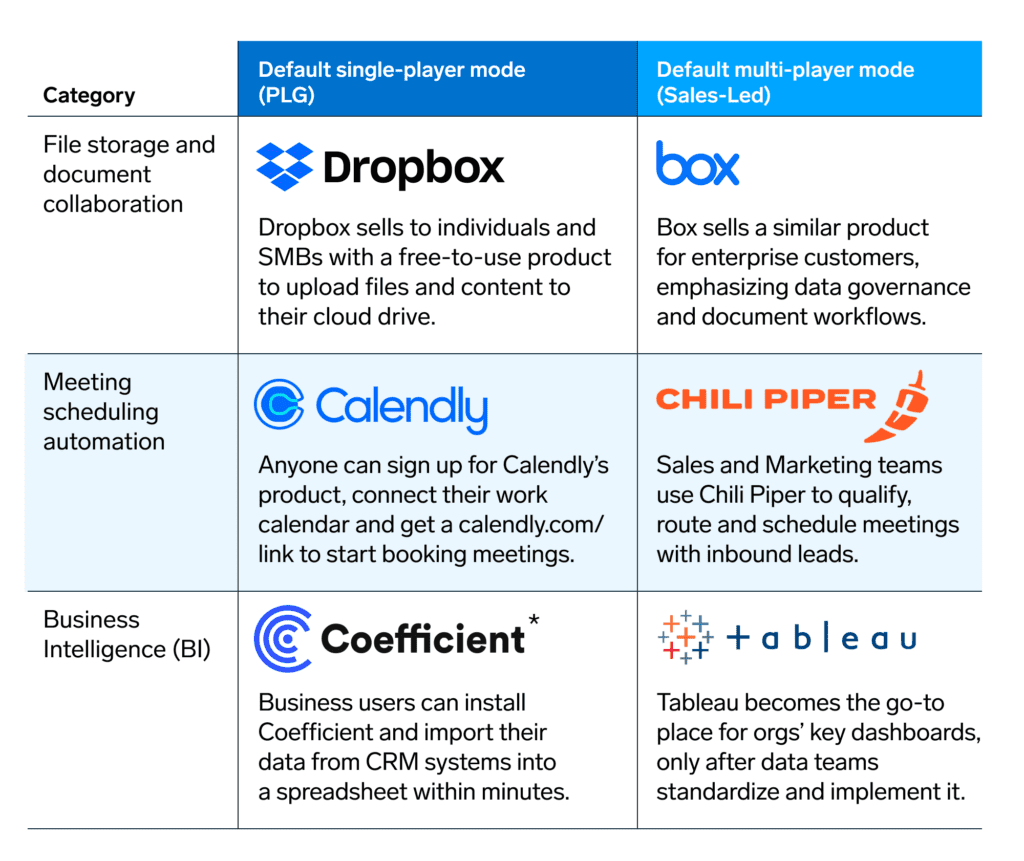

Consider some successful PLG products, like those of Grammarly, Dropbox and Zoom, for example. You may notice that they all support single-player mode. What does this mean?

Unlike traditional B2B software companies that sell to the buyers (heads of departments) with seat-based pricing plans, PLG companies design products that work well for the individual user as well as the buyer. These companies begin their go-to-market strategy by having one user sign up for the product, derive value and then invite their whole team to the product.

A crucial point: if your product is not set up to drive success for individual users (aka single-player mode) then PLG will not be a suitable go-to-market strategy for your business.

Let’s look at examples of very similar products but with two distinctive go-to-market approaches: Dropbox and Box. Both companies may be solving a similar problem – secure content collaboration – but deriving value from Box requires multiple teams (sales, marketing, finance, etc.) to adopt the platform. But with Dropbox, any individual user can sign up and start using the product from day one without disrupting any workflows.

The best PLG products are designed for the individual users to sign up and experience value within the same hour or same day.

Not all software applications are designed to offer immediate value to the users; and sometimes, it takes time to build value after the product is adopted throughout the organization. For a product like Salesforce, users derive value only after the CRM is adopted across the sales org and becomes the source of truth for customer data.

#2 Can you acquire your user persona through organic channels?

A PLG business relies primarily on organic channels like search engines (keyword searches), product virality (in-app features), user referrals and word of mouth to acquire users. The best-in-class PLG companies acquire >80% of their users via organic search or direct traffic.

Let’s double-click into this chart and try to understand the why and the how.

As you will notice, a common thread among successful PLG companies is that they target a large total addressable market (TAM) with a low price point.

Large TAM: PLG companies cater to a large market with customer personas spanning multiple functions and industries. This allows them to amass a large user base (usually in the order of millions) and monetize a portion.

Low price point: They also price the product at a $10-$50 per month range, which an individual business user can easily expense and get reimbursed by their employer.

The questions you should ask yourself are: Who’s your user persona? Are there enough users out there whom you could acquire and convert through organic channels? If you think you can, then PLG could be a great strategy to grow your business.

Organic channels aside, some of you might be pondering, what if I can hack my growth using paid marketing? It’s a relevant question. Paid marketing channels like Google and Facebook Ads can be a good way to bootstrap your organic growth. In fact, this approach becomes almost indispensable, especially when you’re operating in a saturated market – or as some might say, a ‘red ocean.’

Take the example of Monday.com, the maker of popular project management software, which operates in a crowded market filled with incumbents like Adobe Workfront, Atlassian Jira and Smartsheet and newcomers like Airtable, Asana and ClickUp. Yet, in less than a decade, Monday.com has scaled to over $250M of ARR.

So, what’s the secret to their growth? You guessed it right – a hefty dose of paid marketing.

To break down the numbers, during its early years of growth (2019), a staggering 80% of Monday’s sales and marketing expenditure was advertising costs. The company artfully combined performance-driven campaigns with personalized landing pages, casting a wide net to capture leads ranging from agile startups to Fortune 500 companies.

The Monday.com onboarding journey typically starts with a 14-day free trial, after which users are nudged to either remain on a limited free plan or transition to a paid subscription. As users choose the latter, they often become evangelists within their organizations, championing Monday’s software. This is a good example of how strategic paid initiatives can eventually snowball into organic, referral-driven growth.

Monday.com 2019-2022 Sales and Marketing and Ad Spend as a % of Revenue

But here’s a caveat to this approach. As is the case with any smart strategy, there’s a metric to watch — the customer acquisition cost (CAC) payback period.

CAC Payback = Sales & Marketing Expenses in a Quarter / (Net New MRR Acquired in Quarter * Gross Margin)

It’s essential to keep CAC payback under the 12-month mark. And if you’re looking to join the ranks of the best-in-class SaaS companies, aim to bring this down to 5-9 months.

#3 Is your product viral enough to scale from single-player to multiplayer?

Another crucial facet of product-led growth is harnessing existing users to drive new user acquisitions from within and outside the organization. While numerous PLG companies excel at new user acquisition using inbound marketing channels, the most successful companies master the latter by embedding viral features at each turn inside their product.

The best way to understand the virality of your product is through the K-factor. K-factor is a concept borrowed from epidemiology to measure the transmissibility of viral infections. In the context of PLG, it answers the simple question: How many new users does an existing user bring to the product?

K-factor = I x C

I = avg. number of referrals/invites per user

C = avg. referral conversion rate (%)

A K-factor of 1 means each user brings 1 new user to the platform. When the K-factor is >1 , it leads to exponential user growth (as seen in the chart below).

The best PLG companies understand the importance of this and embed viral loops at every turn of their product to improve their K-factor score.

Calendly probably has the best K-factor amongst B2B SaaS applications. They achieve this by building viral loops into their product to get their existing users to directly or indirectly invite new users into their product.

Below are some of their popular viral features:

Collaboration/team features: multi-party scheduling

Embed Calendly inside your website – driving visibility to external users

Another way to scale your product virally is by leveraging your user community. A good example of a community-led viral loop is the “Run in Postman” button by Postman*, an API-development platform with over 25 million developers.

Five years ago, Postman introduced their “Run in Postman” button, which empowers API developers to seamlessly integrate their Postman API collections into their developer portals. This integration not only facilitates a smoother start for users interacting with APIs but also strategically redirects them to a login or sign-up page upon clicking. Postman’s team aggressively marketed this feature and got enterprises like Microsoft and Okta to embed this button on their API documentation pages. This approach has resulted in new users discovering and sign up for the Postman product.

The bottom line

In conclusion, PLG can be a powerful go-to-market strategy for software businesses, but it’s not for everyone. To recap, to determine if PLG is right for your startup, ask yourself the following questions:

Does your product support single-player mode? PLG products are designed for individual users to sign up and experience value within the same hour or on the same day.

Can you acquire your user persona through organic channels? PLG businesses rely primarily on organic channels like search engines, product virality, user referrals and word of mouth to acquire users.

Is your product viral enough to scale from single-player to multiplayer? Successful PLG companies have viral features built into their product and/or leverage their user community to drive new user acquisitions from within and outside the organization.

If your product meets at least two of these criteria, then PLG can be a viable go-to-market strategy to drive fast and efficient customer growth. If it meets all three criteria, then you can confidently pursue a PLG motion.”

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track (zach@wing.vc).

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

ARR per employee for startups <$5M ARR:

Great: $150K

Good: $75K

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

Chalk, a big data platform intended to deploy analytics and machine learning, has raised $10M. The round was led by General Catalyst and Unusual Ventures, with participation from Conversion Capital, Core Innovation Capital and Xfund.

Delphina, a software company developing predictive AI, has raised $7.5M. The round was led by Costanoa Ventures and Radical Ventures.

Distributional, an enterprise platform for AI testing, has raised $11M. Andreessen Horowitz led the round, and was joined by Operator Stack, Point72 Ventures, SV Angel and Two Sigma.

Twelve Labs, a video search and understanding company, has raised $10M. The round was funded by Nvidia, Intel Capital and Samsung NEXT Ventures and Korea Investment Partners.

Series A:

Dynamic, a non-fungible token wallet platform designed to accelerate the adoption of wallet-based authentication and identity, has raised $22.3M at a $64.3M valuation. The round was led by Andreessen Horowitz and Founders Fund, with participation from Castle Island Ventures and Breyer Capital.

Essential AI, a company developing full-stack AI products, has raised $56.5M. The round was led by March Capital, with participation from AMD, Franklin Venture Partners, Google, KB Investment, NVIDIA and Thrive Capital.

Mistral AI, a Paris-based OpenAI rival, has raised $415M at a $2B valuation. Andreessen Horowitz led the round, with Lightspeed Venture Partners, Salesforce, BNP Paribas and General Catalyst joining.

Great post. The only thing I'd add to this list (not to break a list of three 😂) is "time to ah-ha". A quick path from signup or first use of the app does wonders for a self-serve and viral motion.

Think of the Zoom example. First time using it, whether as a newly signed up user or as someone invited to a call: "wow, I didn't lost my connection once!" There's an ah-ha on first use.

Or something like Linear, near immediately upon use, there's the recognition of incredible speed/efficiency in the app.

In any example of successful PLG SaaS, the "ah-ha" is directly related to the core product use case. For Linear, a work management app, an ah-ha based on efficiency is killer. For Loom, it was the speed and simplicity of record+share without needing to think about upload and ACL. Etc.