NPLG 12.1.22: APIs & PLG

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 4,780, +150 since last week (+3.2%)

Share the PLG love: please forward to colleagues and friends! 🙏

NPLG Startup of the Week: Merge

Software is becoming more powerful and ubiquitous, but as new applications and platforms emerge it is becoming increasingly cumbersome to connect disparate systems and access external data. Enter Merge.

Merge is building a unified API. A unified API abstracts away complex systems to provide an interface that is opinionated, comprehensive, and flexible. It makes a developer’s life easier. The ethos of ‘unified’ informs not just our API, but every other aspect of our approach to building a next-generation platform. Each aspect of Merge— from our Dashboard experience, to our robust Logs and Issues Detection — is informed by what provides the greatest level of flexibility and ease to our customer.

Merge now has 3K+ free and paying organizations on its platform, including AngelList, TripActions, Ramp, Apollo.io and Gem. Merge has released 150 integrations in 2 years and its goal is to be the integration layer for every B2B company. Fresh off a $55M Series B from Accel, Co-founder Shensi Ding shares with me her approach to PLG:

How Merge Approaches PLG

“Here are Merge’s PLG strategies and specific examples of how we implement each strategy:

#1. Show Merge works!

API products have a longer implementation time than other SaaS tools. Our priority is to demonstrate that Merge “works” as soon as we can.

Given the newness of our category, there are a lot of ‘unified API’ skeptics. The low product quality and reliability of our competitors doesn’t help, either.

One way that we’ve solved this is with our Get Started section on our app. We designed an experience that both educates new users on key Merge terms and also allows them to ‘follow-along’ to validate that Merge works – quickly.

A revenue leader we were actively recruiting actually went through our onboarding process on his own in 30 minutes, no code required.

#2. Battle-test the product and company

Integrations are inherently reactive; you’re building a key product feature around multiple third-parties. This means you’re at the whim of response bodies coming back in different formats from what is displayed in the API providers’ documentation or returned from your partner sandbox account, along with headers changing, rate limiting, etc.

Structuring our entire product around integrations meant we had to either get good, or get out. We chose the former.

Our PLG model has helped us battle-test our product extremely quickly. Tens of thousands of end-users using our integrations gives us more data points on our integrations than anyone else in the industry. This allows us to take care of all of the edge cases and bugs more quickly than if you were to build in-house.

Customer Success is Your Product’s Success: As an added bonus, a high influx of users meant we had to become exceptional at handling large volumes of customer support early-on. Now, we’re recognized in the category as a leader in customer success.

#3. Reduce unwanted human interactions

We sell a developer tool. Developers don’t care about hopping on a call to ‘onboard’. They want to figure it out themselves without having to sit through a discovery call, a product demo, and then a signed contract.

We tried to make the developer experience as intuitive as possible.

We designed and built beautiful, responsive documentation to guide a developer through our API and our features. We also invested heavily in Guides and Help Center articles to complement our more complex features.

Our job is simple: give developers what they want.”

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing:

Thanks for reading Notorious PLG! Subscribe for free to receive new posts and support my work.

PLG Tweet(s) of the Week:

Recent PLG Financings (Private Companies):

Seed:

Popup, a no-code platform for the creation, management and hosting of online stores, from landing pages to ad campaigns to checkout, has raised $3.5M. The round was led by Accel, with participation from Seedcamp and 20VC.

Cradle, a startup aiming to create an AI-powered tool that tells scientists what new structures and sequences will make a protein do what they want it to, has raised $5.5M. The round was co-led by Index Ventures and Kindred Capital.

Narwhal, a build system for JavaScript code, has raised $8.6M. The round was co-led by Nexus Venture Partners and Andreesen Horowitz.

Payload, an operator of a headless CMS platform designed for creating and managing content, has raised $4.7M. The round was led by Gradient Ventures, with participation from MongoDB, Grand Ventures, Exceptional Capital, Y Combinator and SV Angel.

Supernova, a design-to-code platform intended to accelerate the workflow for designers and developers, has raised $4.8M. The round was led by Wing Venture Capital, with participation from Kaya VC, EQT Ventures, Credo Ventures, Y Combinator and Expedite Ventures.

Series A:

EngFlow, a company that creates tools to help developers speed up builds, has raised $18M. The Fund, Tiger Global Management, Andreessen Horowitz and Firstminute Capital participated in the round.

MotherDuck, a startup independent of the original DuckDB that’s focused on commercializing open source DuckDB packages, has raised $47.5M at a $175M valuation. Redpoint led the seed while Andreessen Horowitz led the Series A — other investors include Madrona, Amplify Partners and Altimeter.

Series C:

Contentstack, a company offering a headless CMS geared toward enterprise customers, has raised $80M. The round was led by Georgian and Insight Partners, which also saw participation from Illuminate Ventures.

Descript, an audio and video editing platform, has raised $50M at a $575M valuation. The round was led by the OpenAI Startup Fund, with Andreessen Horowitz, Redpoint Ventures and Spark Capital participating.

Matter Labs, an Ethereum scaling startup, has raised $200M. Blockchain Capital and Dragonfly co-led the round, and were joined by LightSpeed Venture Partners, Variant and Andreessen Horowitz.

Series D:

Weka, a company that has come up with a way to virtualize data to make it easier to move between sources without having to make a copy first, has raised $135M at a $750M valuation. Generation Investment Management led the round, with participation from 10D, Atreides Management, Celesta Capital, Gemini Israel Ventures, Hewlett Packard Enterprise, Hitachi Ventures, Key1 Capital, Lumir Ventures, Micron Ventures, Mirae Asset Capital, MoreTech Ventures, Norwest Venture Partners, NVIDIA, Qualcomm Ventures, and Samsung Catalyst Fund.

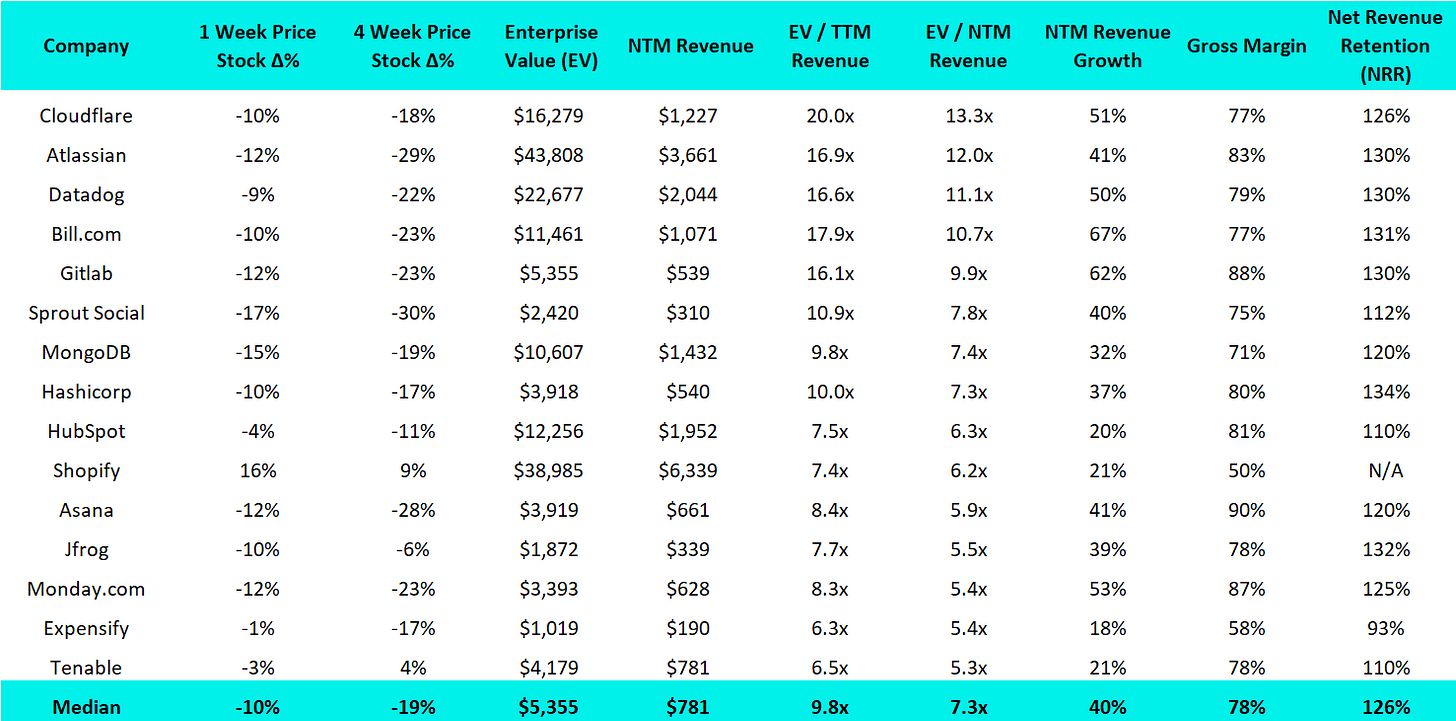

Recent PLG Performance (Public Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.