NPLG 11.30.23: The Power of Slack for PLG, Onboarding, and Support (Thena)

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 8,808, +54. since last week

Share the PLG love: please forward to colleagues and friends! 🙏

NPLG Startup of The Week: Thena

Even while working at a firm with <30 people, Slack can be chaotic. I’m on Slack all day every day and not only communicate with colleagues inside my firm, but founders and teams I work with outside the firm. When used correctly, Slack is an unblocking tool in that it help escalate problems and resolve issues in hours, not days. Forward-thinking companies are embracing Slack as a channel to onboard and service their customers, however the current tools in Slack can’t offer a world-class customer experience.

Enter Thena. Launched by a co-founder of Branch, a successful startup that has crossed $100M in ARR, Thena is AI-powered tooling built for Slack and Teams that helps companies acquire, service & grow customers. Using Thena, companies are able to scale serving their customers in places like Slack by keeping track of conversations, automating responses, providing analytics, and connecting Slack with other systems like CRMs. This enables vendors and customers to collaborate while staying in the places they're already working - Slack. Thena has raised ~$7M from top VCs including Lightspeed and First Round.

For this edition of Notorious PLG, Thena Co-Founder Mike Molinet shares his thoughts with the NPLG community on how to leverage Slack to improve the customer experience:

The Evolution of Slack Beyond Internal Teams

One trend that we’re seeing at Thena is the use of Slack, not just for internal communication, but as a strategic tool for PLG, onboarding, and customer support. While opinions on this shift may vary, one thing is certain: it's a change that's here to stay, and one that is redefining how businesses connect with their customers.

Traditionally, Slack has been used for internal communication. However, forward-thinking companies are tapping into its potential to acquire, support, onboard, and grow their customer base. There are two primary approaches gaining traction: Slack Communities and Slack Connect channels.

1. Slack Communities: More Than Just a Gathering Place

Companies like Linear, Common Room, and Incident.io are leveraging Slack Communities to support and connect with thousands or even tens of thousands of users. This approach goes beyond the conventional high-touch model, creating a centralized space where users can help each other. Think of it as a dynamic digital town square where knowledge flows freely (and with Thena's product ensuring that requests are tracked and addressed effectively). The scalability of this approach is a game-changer, allowing companies to serve a large user base efficiently.

However, there are limitations to open communities, such as the lack of privacy for sensitive account-related discussions. Users also need to remember to navigate to different community workspaces, which can be a hurdle compared to working within their own company’s Slack workspace. Which leads us to the second method - dedicated Slack Connect channels.

2. Slack Connect Channels: Redefining “Tech-Touch” Support

Slack Connect channels are increasingly popular for high-touch, enterprise customers. Here's where the controversy kicks in—Slack Connect channels with SMB and Mid-Market customers. The idea of engaging with a large number of customers via Slack may sound daunting (and a heavy burden for your client-facing teams), but it's a strategy that, when executed well and paired with technology like Thena, can yield remarkable results. These channels can be structured as unmanned spaces without dedicated CSMs or Solutions Engineers, allowing companies to interact with a broad customer base effectively, without requiring too much of a heavy lift from internal teams.

Customers in these channels can ask questions, file support requests, and engage with the product, all while being seamlessly connected with the vendor in a shared channel but without any dedicated vendor employees in the channel itself. Thena streamlines these interactions, from pushing and pulling information to facilitating proactive and reactive communication.

The Thena Advantage with Slack Connect

Thena bridges the gap between Slack and effective customer engagement. First, for Slack Connect channels, Thena can help detect, track, and alert on new customer requests - even if no one from your team is in the channel with the customer. Thena also enables your team to respond from other systems - such as your web chat or other ticketing systems like Zendesk. This allows you to have a pooled support or CS model for SMB and mid-market accounts where anyone from the pool can respond to the customer, all without being in the Slack Connect channel and without the customer having direct access to them going forward. Think of it like the slack-ified version of a support@company.com email support inbox.

Beyond providing tools for pooled responses and bidirectional syncing with other support ticketing systems, Thena enables companies to push proactive messages, marketing materials, and release notes directly to thousands of channels. This means information reaches customers where they are most likely to engage—in the digital HQ that is Slack.

Optimize your Slack communities effortlessly with Thena. Manage customer requests seamlessly by automating detection, setting up alerts for customer issues, and routing to platforms like Zendesk or Jira. Prioritize messages efficiently using Thena's AI, ensuring prompt responses and adherence to response time objectives. Additionally, create targeted content easily with pre-built templates for marketing and sales teams, enhancing collaboration within Slack. Thena simplifies community management, making it easy for organizations to handle the dynamics of active Slack channels.

In a world where capturing attention and driving user engagement is the key to success, leveraging Slack for PLG, onboarding, and support is not just a trend; it's a strategic imperative. Whether through community building or “tech-touch” Slack Connect channels, companies can navigate this new era with the right tools and approach - all while meeting their customers where they already are. The future of customer interaction is unfolding in real-time, and companies like Thena are leading the way by redefining what's possible in the realm of growth, onboarding, and support.”

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track (zach@wing.vc).

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

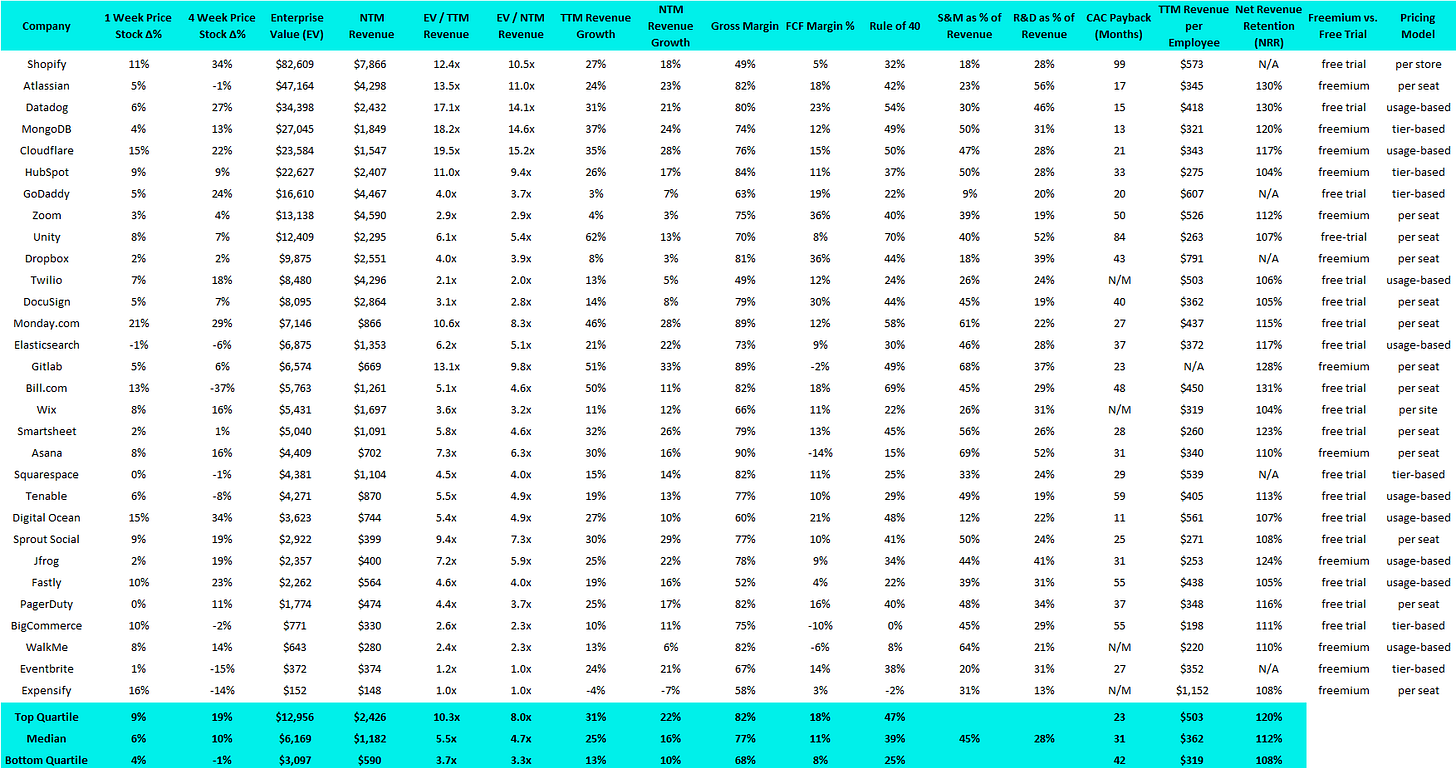

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

Expanso, a provider of managed IT services intended to help clients streamline their workflows in the Bacalhau Project, has raised $7.5M. The round was led by General Catalyst and Hetz Ventures, with participation from Array Ventures.

Series A:

Cradle, an algorithm and artificial intelligence tool designed to help biologists design improved proteins, has raised $24M. The round was led by Index Ventures, with participation from Kindred Capital.

Privy, a builder of simple APIs to help developers manage user data privately in Web3, has raised $18M. The round was led by Paradigm, with participation Sequoia, BlueYard Capital and Archetype.

Vendelux, a sales and event marketing platform designed for marketers to have assistance in engaging with their customers, has raised $14M. The round was led by FirstMark Capital, with participation from Cervin.

Series C:

AI21 Labs, a startup developing a range of text-generating AI tools, has raised $208M at a $1.4B valuation. The round was led by SCB 10X, Pitango Venture Capital, and Walden Catalyst, with participation from b2venture, Samsung NEXT Ventures, Google Israel, Nvidia, Intel Capital, Comcast Ventures, Ahren Innovation Capital, Heliad Equity Partners and Goodface Capital.

LucidLink, a startup offering a platform that enables teams to work on files without having to download or sync them, has raised $75M at a $400M valuation. The round was led by Brighton Park Capital, with participation from Headline, Adobe Ventures and Baseline Ventures.