NPLG 11.10.23: Focus on Users + Experimentation (Weights & Biases)

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 8,652, +87 since last week

Share the PLG love: please forward to colleagues and friends! 🙏

NPLG Startup of The Week: Weights & Biases

AI is ushering in a new super cycle that will transform every industry. However, it is difficult to build reliable and scalable AI systems today. Developers and Machine Learning (ML) practitioners need better tools. Enter Weights & Biases. Weights & Biases is a powerful platform that helps ML teams streamline their AI workflows. Weights & Biases helps AI developers build better models faster by quickly tracking experiments, versioning and iterating on datasets, evaluating model performance and reproducing models. Weights & Biases has raised more than $250M in total funding from top VCs, most recently at a $1.3B valuation and works with top AI companies as customers including OpenAI, Anthropic, Cohere and Hugging Face.

For this edition of Notorious PLG, Weights & Biases VP of Growth Lavanya Shukla shares her GTM framework with the Notorious PLG community:

“By nature, machine learning is an experimental science. You have a hypothesis, you try it out, you fail, you iterate, you try again. You keep making tweaks until your models do what it is you want them to do but every failed experiment is vital because you learn from it. A great model is as much the product of smart engineering as it is the culmination of lessons learned.

We used a similar framework for PLG. And since everybody loves a good acronym, we call it FUEL.

The F stands for Funnel

Obviously, all work you’re doing in a Growth team is about filling the funnel so keeping it top of mind is crucial. Work that doesn’t fill the funnel isn’t growth work.

The U stands for Users

This was our reminder that we needed to keep our users front and center in everything we do. What do our users want? What could we provide them to get them excited about Weights & Biases? Thinking of users before thinking about tactics or medium was really important. If we’re creating partnerships, what ones will help our users grow in their career and help our company grow alongside them? Repositories was an early bet and we kept at it. But partnerships with popular YouTubers where we could provide unique value like code tutorials helped us stay where our users lived and give them something they could sink their teeth into. Work that doesn’t benefit your users isn’t growth work.

The E stands for Experiments

We made good bets and bad ones but we wanted to always remember to be experimental in the truest sense. Experiments require hypotheses and measurements. If the experiments are successful, how can make them more successful? If they failed, what could we change and try again? Work that isn’t experimental, work that doesn’t take a chance and make smart bets on the future isn’t growth work.

The L stands for Learnings

There’s obviously some overlap with the last paragraph here, but what are we taking away from our experiments? What did we learn? It oftentimes isn’t exactly what we expected. Being flexible about what we learned was as important as being brutally honest about what did and didn’t succeed. Sometimes, a small part of one experiment when combined with a small part of another is actually the recipe you need. Work that doesn’t give you learnings to build off isn’t growth work.

When hiring, I prioritized this. We didn’t need people who were expert in every part of this framework, but we needed people who would excel within it. Someone with experimental rigor would be a great addition, as would a young machine learning practitioner with great ideas and a network. Same goes for someone who cares about the ML community and prioritizes teaches that community. But we didn’t look for people who needed a playbook to follow and required constant management. We looked for people who were willing to roll up their sleeves, make smart bets, and execute.

Because like ML, not all experiments work. In fact, most of them fail. But the most successful teams, like the most successful companies, aren’t deterred by that. Failure is something to learn from as much or maybe more than the wins are. If you surround yourself with curious, humble experimenters, people who understand your product and your mission, your team will succeed. It will grow in scope as your company’s footprint grows along with it. Know your users, know where they live, and experiment till you find that spark. Because once you find it, all you need is a little fuel to help it grow.”

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track (zach@wing.vc).

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

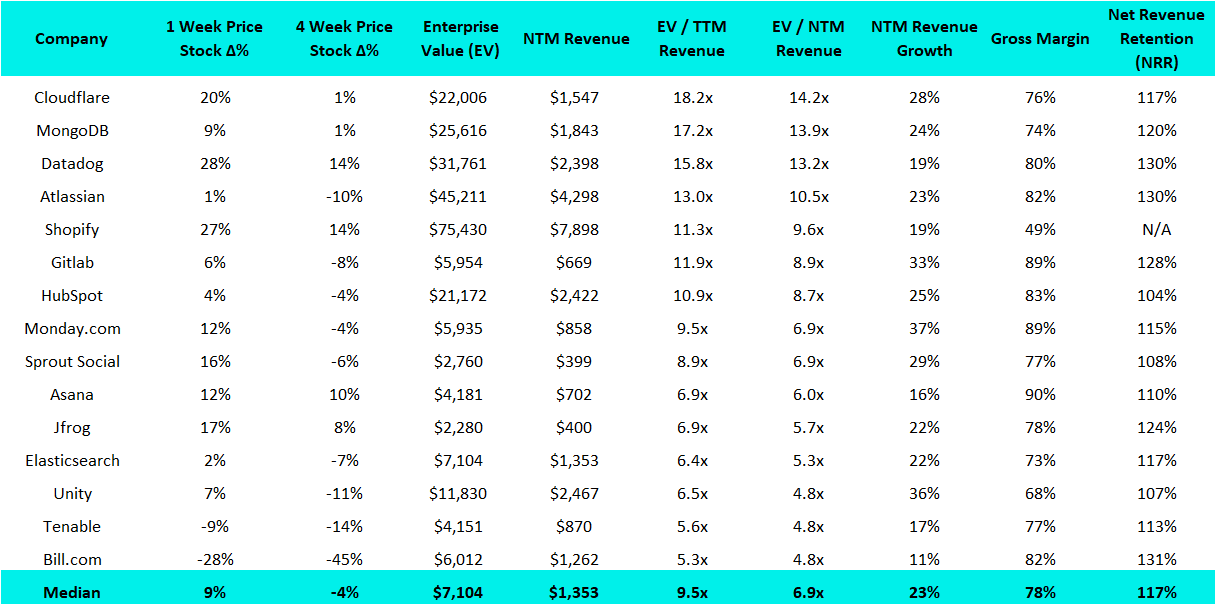

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

Factory, a developer of an AI based platform designed to bring autonomy to software engineering, has raised $5M. The round was led by Sequoia Capital and Lux Capital, with participation from PrayingForExits, BoxGroup and SV Angel.

Fero, a checkout portal designed to provide a personalized payment service, has raised $3M. The round was funded by Coatue Management, Volta Ventures and Antler.

Luna, a sales assistant platform intended to offer personalized professional interaction services to clients, has raised $2.5M. The round was led by CapitalT, with participation from Crosspring, Hello World Investments, Pitchdrive and Notion Capital.

P0 Security, a cloud management platform designed for security engineers to manage entitlements and drive continuous least privilege in their public clouds, has raised $5M. The round was led by Lightspeed Venture Partners and SV Angel.

Responsiv, a developer of a legal knowledge platform designed to provide quick access to legal information and answers, has raised $3M. The round was led by Greylock Partners, with participation from Permanent Capital and On Dean Investments.

Series A:

Guidde, a company that leverages generative AI to automatically create embeddable video clips that instruct on how to use different web-based software apps, has raised $11.6M. The round was led by Norwest Venture Partners, with participation from Entree Capital, Honeystone Ventures, Crescendo Ventures and Tiferes Ventures.

Vespa.ai, a big data serving engine, has raised $31M just weeks after breaking off from Yahoo. Blossom Capital led the round.

Series B:

Chainguard, a supply chain security software designed to make the software lifecycle secure by default, has raised $61M at a $411M valuation. The round was led by Spark Capital, with participation from Sequoia Capital, Amplify Partners, Mantis VC and Banana Capital.

Fracttal, a cloud-based enterprise asset management software designed to optimize all the maintenance operations of a company, has raised $10M. The round was led by Kayyak Ventures, with participation from GoHub Ventures, Banco Bilbao Vizcaya Argentaria, Amador Holdings and Seaya Ventures.

Growth/Expansion:

FusionAuth, a company that provides authentication and user management tools for developers, has raised $65M. The round was led by Updata Partners.

Anthropic, an AI startup that is the biggest rival to OpenAI, has raised $2B at a $25B valuation. An initial $500M will come up front from Google, with a further $1.5B to follow at a later date.

I believe one of the challenges about the AI pricing different from per user, it is challenging to imagine how much "work" is going to be done, could drive concerns about over budget situation. Needs to pass a while untill the model change IMO