NPLG 11.10.22: Curated PLG Charts

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 4,430, +154 since last week (+3.6%)

Share the PLG love: please forward to colleagues and friends! 🙏

Curated PLG Charts

I wanted to share a few of my favorite charts from the recent reports from OpenView and Battery.

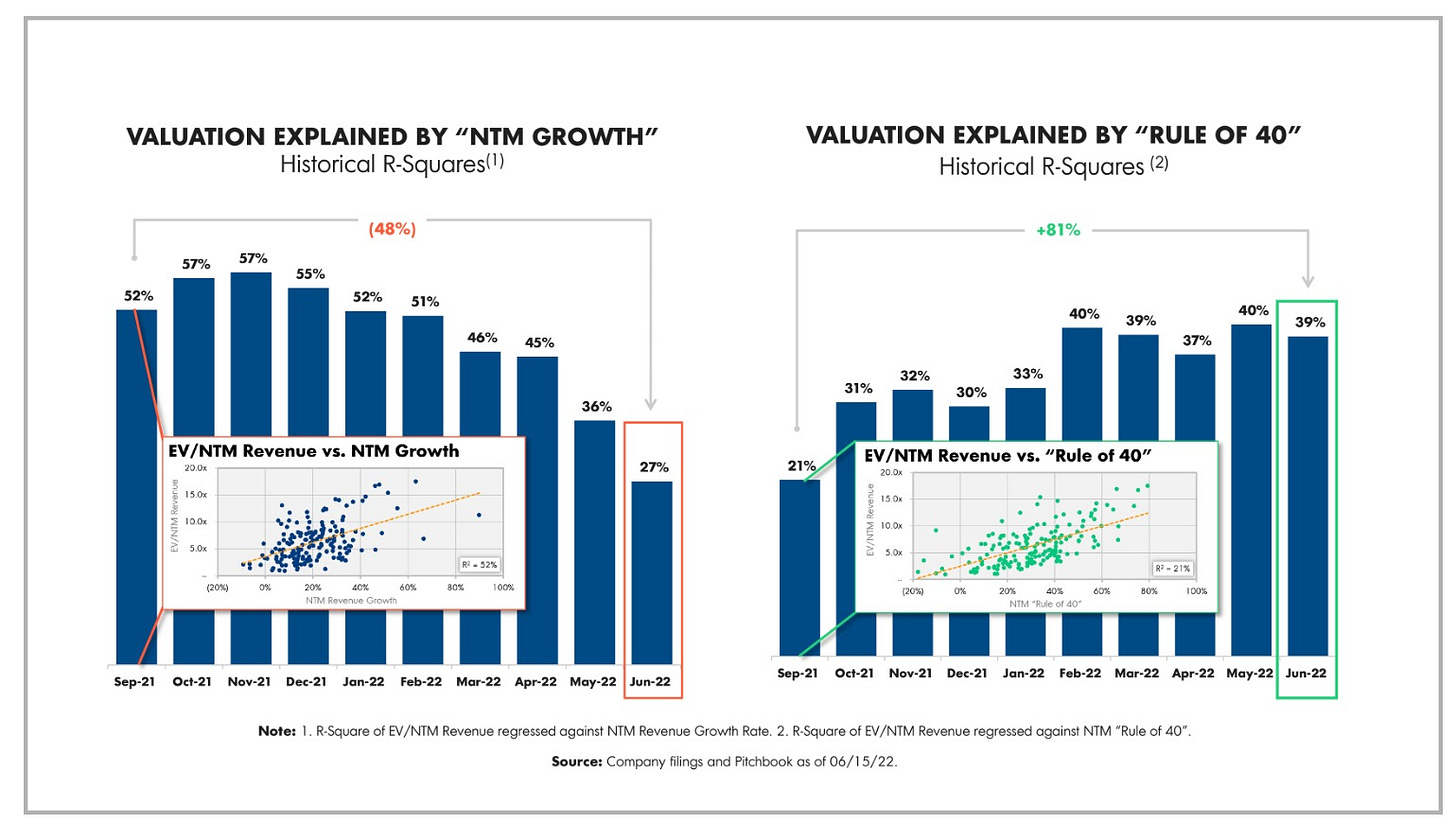

Profitability and cash flow are informing valuations, rather than purely topline growth:

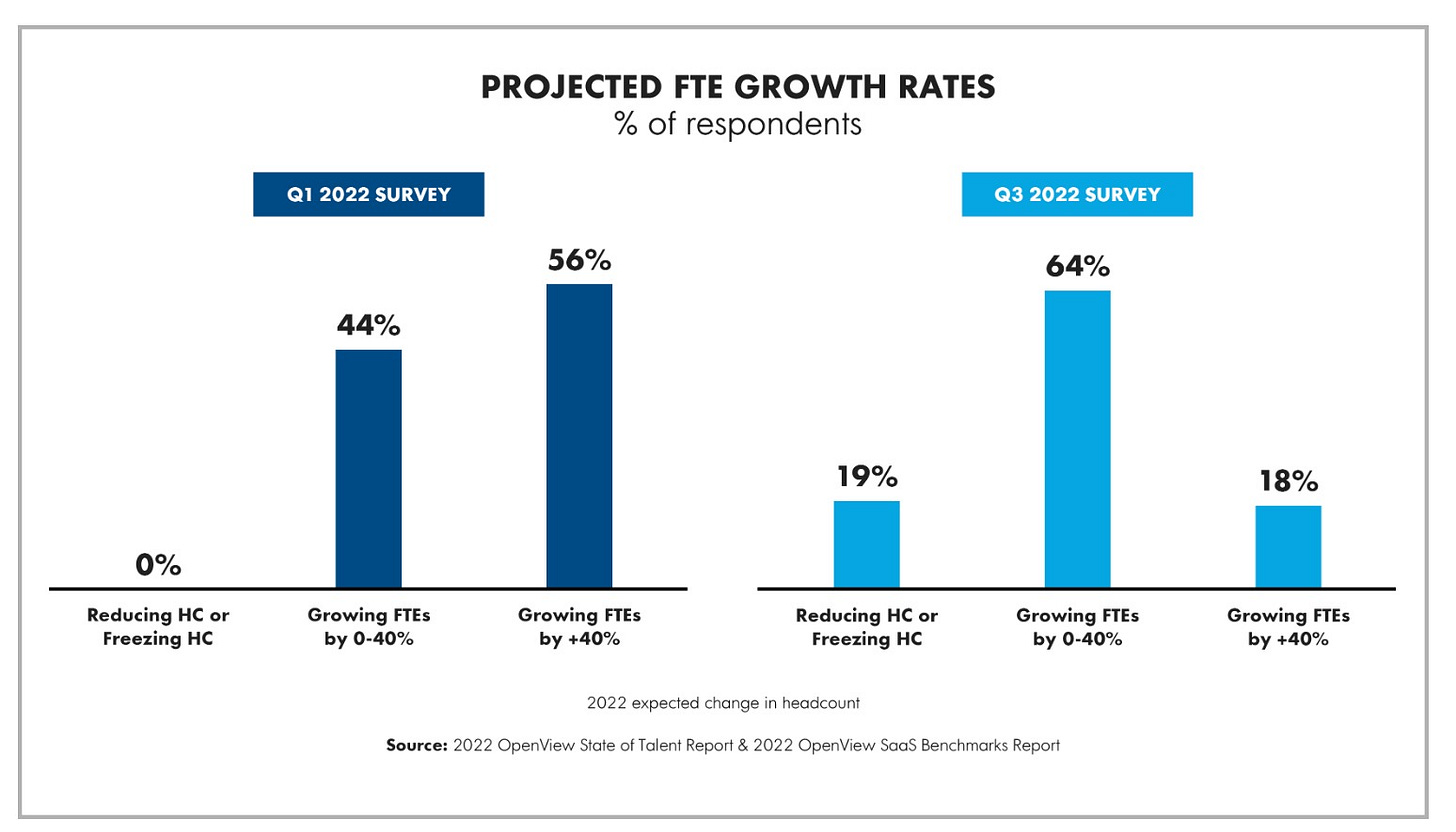

Startups are pumping the brakes on hiring:

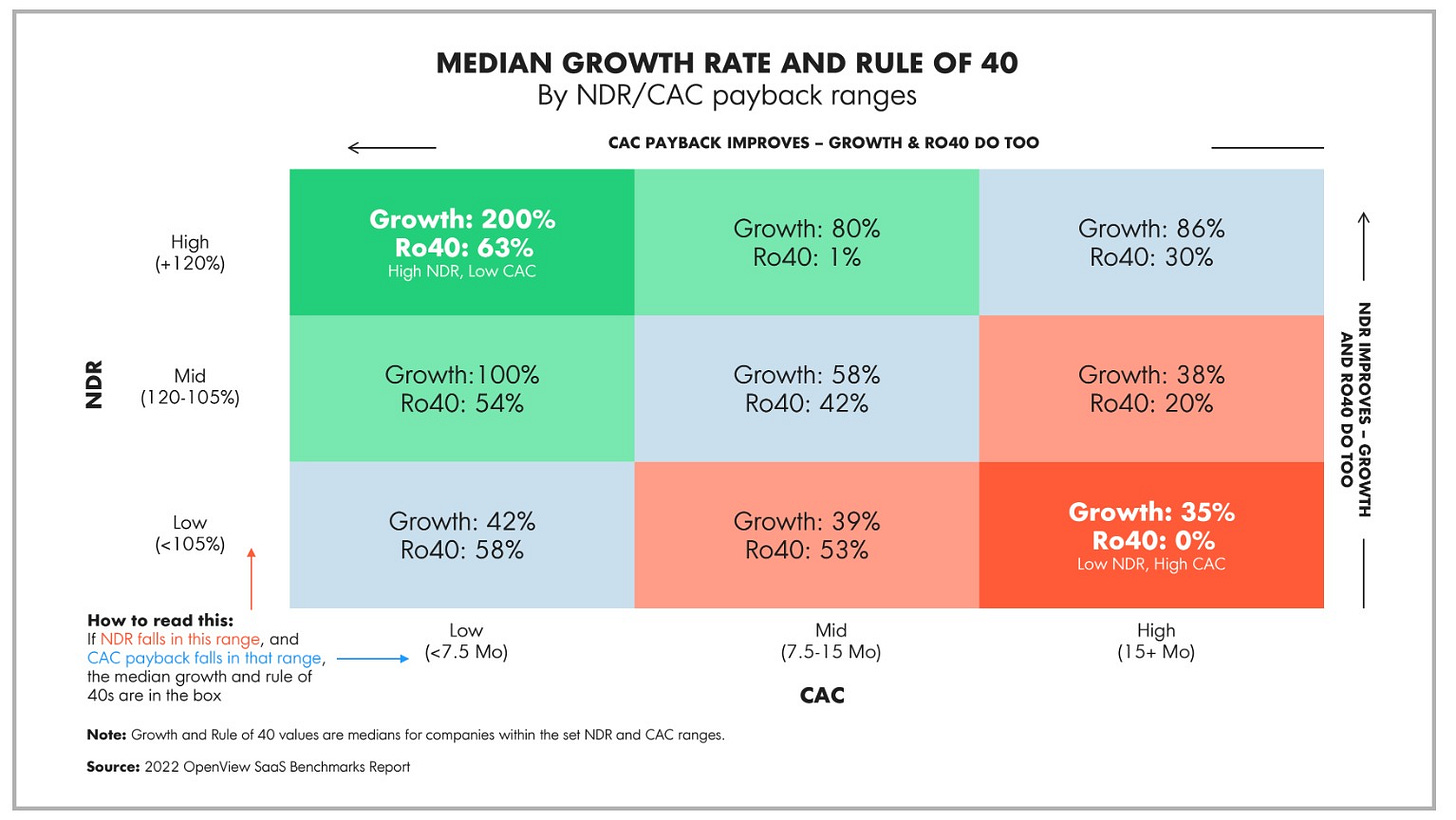

Net Dollar Retention (NDR) and Customer Acquisition Costs (CAC) are the two biggest drivers of important valuation metrics - Growth Rates and Rule of 40 (see top left):

Net Dollar Retention (NDR) and Customer Acquisition Costs (CAC) benchmarking:

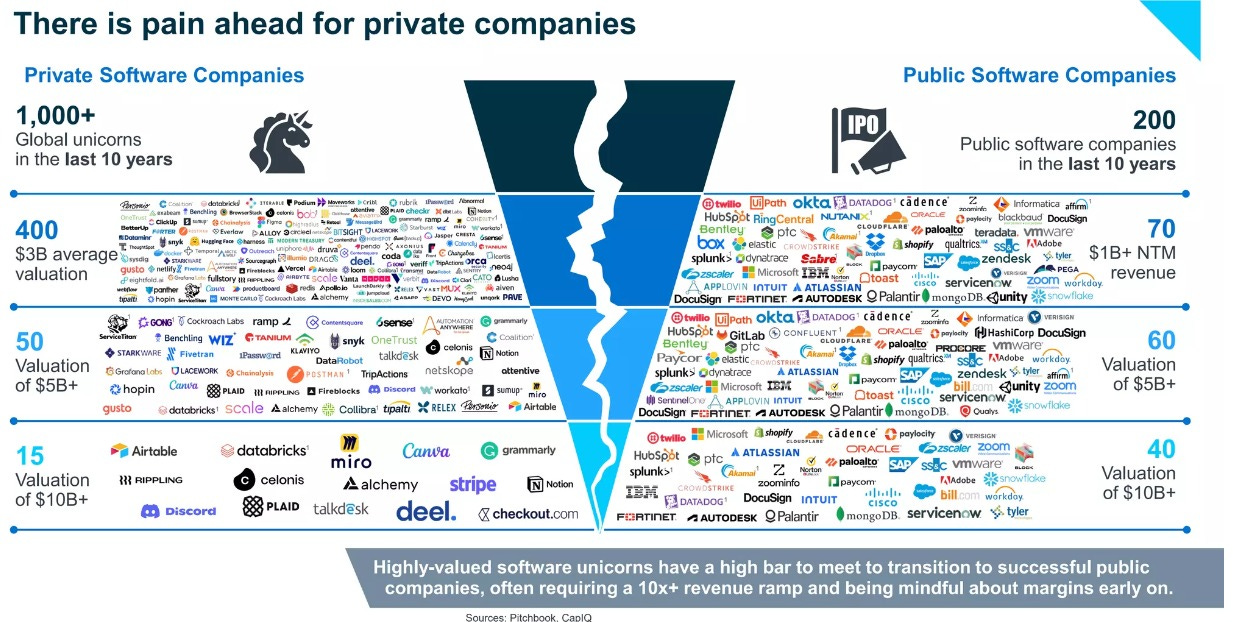

Private companies are generally overvalued:

Value-based pricing positions for expansion:

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing:

PLG Tweet(s) of the Week:

Recent PLG Financings (Private Companies):

Seed:

Momento, a cache management platform intended to manage caches by providing a serverless caching solution, has raised $15M. The round was led by Bain Capital Ventures, with participation from The General Partnership.

Series A:

Galileo, a data intelligence platform designed to improve the world of machine learning, has raised $18M. The round was led by Battery Ventures, with participation from The Factory, Walden Catalyst and FPV Ventures.

Gitpod, a developer of computer language engineering and corresponding software designed to help businesses and engineers to be more productive by providing highly efficient software tools, has raised $25M. The round was led by Tom Preston-Werner, founder and former CEO at GitHub, with participation from existing investors General Catalyst, Crane Venture Partners, Vertex Ventures US, Speedinvest, Pebblebed, GTMfund and MongoDB Venture.

Roam, a new kind of virtual office software that allows employees to communicate less formally and more efficiently, has raised $30M. IVP led the round.

Series B:

Dataloop, an AI data annotation company, has raised $33M. The round was led by Nokia Growth Partners Capital and Alpha Wave Global.

Orum, a developer of enterprise software intended to help businesses boost their sales, has raised $22M. The round was led by Tribe Capital, with participation from Unusual Ventures and Craft Ventures.

Recent PLG Performance (Public Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.