NPLG 10.20.22: Engineering Customer Success

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 3,961, +183 since last week (+4.8%)

Share the PLG love: please forward to colleagues and friends! 🙏

NPLG Startup of the Week: June

When I was an early-stage founder, it was difficult to pull reports on user behavior. Founders and early teams continue to struggle with this. Part of the problem is in the tools we use to measure how people use our products. They’re cold and intimidating. Whereas they should be warm and welcoming. They allow you to answer the most complex questions, but are not helping you answering the fundamental ones. Enter June.

June is a user-friendly, opinionated analytics product for B2B SaaS companies. With June you get out of the box reports on your Acquisition, Activation, Retention and Active Companies. For this edition of Notorious PLG, CEO and Founder Enzo Avigo shared with me more about June’s PLG strategy. I love how June assigns rotating engineers to jump on customer support and success issues. This is a brilliant way for the builders to stay close to the customer and I think other PLG companies should adopt this strategy. Read more below:

Engineering Customer Success

“The first years of work on a product should be on things that compound over time.

One of the things we’re doing that we think will compound over time is making our engineers take care of customer support and success.

Every week, we rotate and a different engineer is in charge of fixing reactive bugs, answering conversations in Intercom and making sure each sign up gets the most out of our product.

Because of this as engineers we can better prioritise work that has an impact on our customer’s experience of going from sign up to converting.

Every quarter, as a team, we run through our product lifecycle. This helped us identify some of our the most impactful work we’ve done.

The way we do it is very systematic and I think can be adopted by many product-led companies, that want their product to do the heavy lifting in activating and converting customers.

From the bottom to the top

As a first step we draw our product journey from the end to the start:

Converting - Upgrading to our Growth plan

Activating - Opening more than 10 reports

Setup - Starting to send data

Signing up - Our sign ups, excluding gmail users and invites

We start from the bottom of the funnel because there, every optimisation will both increase our revenue in the short term, and reduce our acquisition costs in the future.

We then take the cohort of users that signed up in the past 3 months, and calculate the number of users at each step (using June)

Then starting from the bottom of the funnel we look at each of the numbers and try to add context to it.

For the converted users, we ask ourselves questions like:

Why did they start paying?

What kinds of companies are they?

What are the features they use the most?

How much do they use the product?

How did they learn about June?

Are they using our SDK or Segment?

Did they have a call with us?

We then move to all the companies that activated, but didn’t convert and keep asking questions until we got to a good sense of why these companies that activated, didn’t end up converting.

We repeat these steps for users that successfully got setup and signed up.

In the end we form a list of what we think are the biggest problems to be solved in our customer journey.

Then at our weekly planning we prioritise what we think are the most important problems and come up with our best guesses on how to solve them!”

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing:

PLG Tweet(s) of the Week:

Recent PLG Financings (Private Companies):

Seed:

Relay, a business software intended to streamline business teams' workflows and automate daily tasks, has raised $5M. The round was led by Khosla Ventures, with participation from Neo, BoxGroup and SV Angel.

Series A:

Meilisearch, an open-source search engine API platform designed to provide a ready-to-go solution for everyone wanting a powerful, fast, and relevant search experience for their end-users, has raised $15M. The round was led by Felicis Ventures, with participation from ESOP Trust, Phoenix Court, Seedcamp, Mango Capital and CRV.

nxyz, a provider of blockchain data intended to empower creatives and entrepreneurs to build a better internet for all, has raised $40M. The round was led by Paradigm, with participation from Coinbase Ventures, StarkWare, Optimism, Moonshots Capital, Greylock Partners, Sequoia Capital, 20VC and Xoogler.co.

Series B:

Katana, an enterprise resource planning platform for small- and medium-sized manufacturers, has raised $34M. The round was led by Northzone, with participation from Lightrock, Atomico and 42CAP.

Stairwell, a developer of cybersecurity software intended to empower security teams to outsmart attackers, has raised $45M at a $300M valuation. The round was led by Section 32, with participation from Gradient Ventures, Lux Capital, Accel and Sequoia Capital.

Series C:

Factorial, a company building HR technology for SMBs, has raised $120M at a $1B valuation. Led by Atomico, the round also included GIC as well as Tiger Global, CRV, K-Fund and Creandum.

Series G:

TripActions, a corporate travel management and payments platform designed to keep travelers safe and control costs with actionable real-time data, has raised $304M at a $9.2B valuation. Lightspeed Venture Partners, Zeev Ventures, Andreessen Horowitz, Group 11, Base Partners, Greenoaks Capital Partners, Addition and Premji Invest participated.

Recent PLG Performance (Public Companies):

Financial data as of previous business day market close.

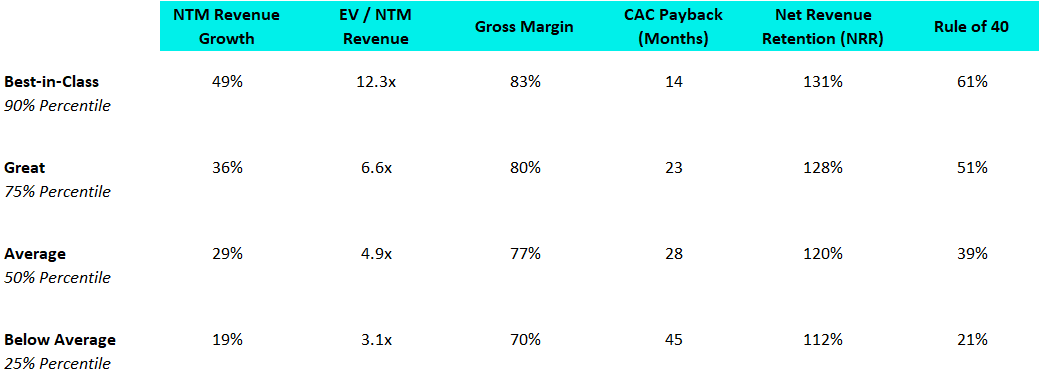

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.