Notorious: The Secret to Finding PMF is Focus

Notorious: the best founders, startups, strategies, metrics and community. Every week.

Current subscribers: 10,042, +65 since last week

Share the love: please forward to colleagues and friends! 🙏

Focus to Find PMF

Many founders I speak with aim to go horizontal, meaning they want to serve a wide range of customer types with various use cases. They often draw inspiration from companies like Airtable and Zapier. The allure is understandable—large markets, diverse customers, and products used daily, leading to multi-billion dollar valuations.

However, the hidden truth about horizontal companies is that a small handful of use cases, driven by one or two key personas, account for over 75%+ of their revenue. For instance, Airtable’s core users are marketing teams, while Zapier's primary use cases are sales workflows.

I admire Bobby’s post above. Bobby is a talented founder who is building Equals, backed by A16Z and Craft. Equals has ambitious plans to build a next-gen spreadsheet and initially pursued a horizontal strategy. Through learned experience, Bobby is convinced that focus leads to success. He is now sharing his insights with the founder community, urging them to narrow their focus to achieve repeatable and scalable growth.

What does it mean to focus? Founders can concentrate on a few areas to find Product-Market Fit (PMF):

Focus on a specific company type and size.

Focus on a particular persona (e.g., Head of Marketing) within that company.

Focus on this persona’s most pressing pain points and problems.

Tailor the product positioning to catch the attention of this persona.

Design the product experience to highlight features that address the most urgent pain points. For every new feature you add, remove 1.5 old features. Check out this great interview with Figma CEO (12.5B valuation) on the importance of simplifying the product as much as possible. “The more you add, the more complex it gets, the worse it gets.”

Align the team around a specific, well-defined go-to-market (GTM) strategy.

Be honest with yourself and your team—are you focused enough? For most early-stage startups, the answer is likely no.

Thanks for reading. By way of background, I am an early-stage investor at Wing and a former founder. Please reach out to me on X @zacharydewitt or at zach@wing.vc. Some of the early-stage PLG + AI companies that I have the privilege to work with and learn from are: AirOps, Copy.ai, Deepgram, Hireguide, Slang.ai, Tango and Tome.

Operating Benchmarks (from PLG Startups):

I will continue to update these metrics and add new metrics. Let me know what metrics you want me to add (zach@wing.vc)

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior Notorious episode.

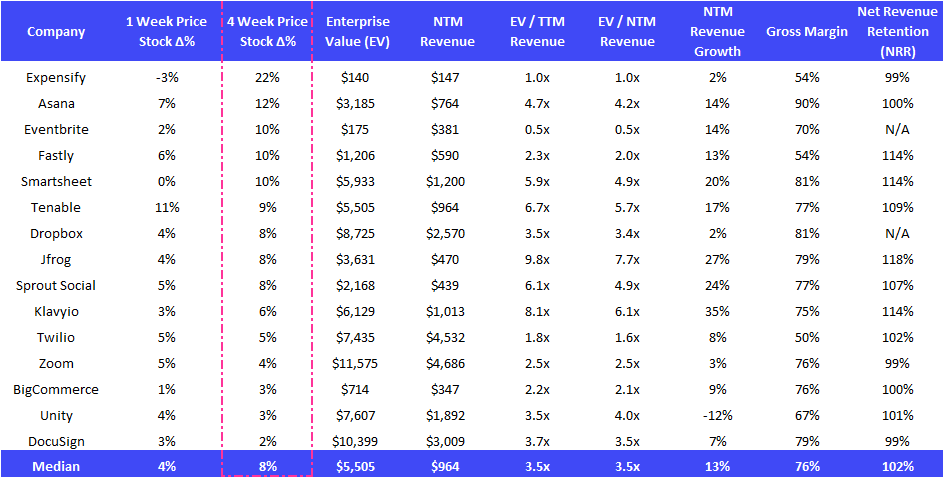

Financial Benchmarks (from PLG Public Companies):

Financial data as of previous business day market close.

Best-in-Class Benchmarking:

15 Highest EV/ NTM Revenue Multiples:

15 Biggest Stock Gainers (1 month):

Complete Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG + AI Financings:

Seed:

Gumloop, a no-code platform designed for automating workflows with AI, has raised $3.1M. The round was led by First Round Capital, with participation from WndrCo, Theory Forge Ventures, Liquid 2 Ventures, Ludlow Ventures and Y Combinator.

Noded AI, a developer of note-taking and task management software, has raised $4M. The round was led by Boldstart Ventures, with participation from Bessemer Venture Partners, 20VC and First Hand Ventures.

Promptfoo, a CLI and library for evaluating and red-teaming LLM apps, has raised $5M. The round was led by Andreessen Horowitz.

Rift, a sales platform focusing on automating operational sales work, has raised $5M. The round was led by Sequoia, with participation from Y Combinator and Soma Capital.

Cypris, a NYC-based provider of an AI research platform for R&D teams, has raised $5.3M. The round was led by Vocap Partners, with participation from Activate Venture Partners and Blue Tree Venture Capital.

Series A:

Docket, a startup aiming to transform revenue enablement through AI-driven solutions, has raised $15M. The round was led by Mayfield and Foundation Capital.

Lakera, a startup that protects enterprises from LLM vulnerabilities, has raised $20M. The round was led by Atomico, with participation from Citi Ventures, Dropbox Ventures and Redalpine.

Momentum, a customer intelligence platform that enables enterprise listening and automation, has raised $13M at a $36M valuation. The round was led by FirstMark Capital, with participation from Stage 2 Capital, Basis Set Ventures and Leadout Capital.

TigerBeetle, an open-source database engineered for financial online transaction processing, has raised $24M at a valuation of ~$100M. The round was led by Spark Capital, with participation from Amplify Partners and Coil.

Uplimit, an AI enterprise learning company, has raised $11M at a $56M valuation. The round was led by Salesforce Ventures, with participation from GSV Ventures, Greylock, Cowboy Ventures, Translink Capital, Workday Ventures and Conviction.

Series B:

Pearl, one of only three startups that has an FDA clearance to use AI to assist dentists make accurate diagnoses, has raised $58M. The round was led by Left Lane Capital, with participation from Smash Capital, Alpha Partners, Craft Ventures and Neotribe Ventures.

QA Wolf, a platform that makes QA for mobile and web apps easier by automating aspects of creating and running tests, has raised $36M. The round was led by Scale Venture Partners, with participation from Threshold Ventures, Ventureforgood, Inspired Capital and Notation Capital.

Series C:

Chainguard, an open-source security startup, has raised $140M at a $1.09B valuation. The round was led by Redpoint Ventures, Lightspeed Venture Partners, and IVP, with Amplify, Mantis VC, Sequoia Capital and Spark Capital also participating.

Harvey, a startup building an AI-powered copilot for lawyers, has raised $100M at a $1.5B valuation. The round was led by GV, with OpenAI Startup Fund, Sequoia Capital, Kleiner Perkins and SV Angel participating.

Level AI, a startup that offers a suite of AI-powered tools to automate various customer service tasks, has raised a $39.4M. The round was led by Adams Street Partners, with participation from Cross Creek, Brightloop, Battery Ventures and Eniac Ventures.

Series D:

Cohere, a generative AI startup co-founded by ex-Google researchers, has raised $500M at a $5.5B valuation. The round was led by Public Sector Pension Investment Board, with participation from Nvidia, Salesforce Ventures, Oracle, Cisco Investments, Fujitsu, AMD Ventures, Export Development Canada, IronArc Ventures, Gauntlet Ventures, Strategxy Ventures and Thomvest Ventures.

Series F:

Clio, a Canadian software company that aims to help law practices run more efficiently with its cloud-based technology, has raised $900M at a $3B valuation. New Enterprise Associates led the round, with participation from JMI Equity, Sixth Street Partners, CapitalG, Tidemark, Ebridge Ventures, TCV and Goldman Sachs Asset Management.