Notorious: Startup Revenue Growth Rates Are Slowing (Benchmarking)

Notorious: the best founders, startups, strategies, metrics and community.

Current subscribers: 11,702, +137 since last post

Share the love: please forward to colleagues and friends! 🙏

For this week’s Notorious, my friends at Standard Metrics previewed some of their benchmarking data on global startup revenue growth. I’d be curious to get your take on why revenue growth rates have been declining. The simple explanation might be that during the crazy years of 2021-2022, startups had more access to capital which meant more marketing spend and sales team growth which artificially inflated growth rates during that period. Big thanks to John Melas-Kyriazi, David Miller and Maile McCann and be on the lookout next week for the full benchmarking report!

Startup Revenue Growth Benchmarking

Standard Metrics is committed to answering an age-old question in VC and PE: how can I measure my or my portfolio company’s performance against other startups in the private markets?

When we first founded Standard Metrics in 2020, our product suite focused on creating tools to help build what we described as a “lingua franca” or common language between VCs and their portfolio companies. We invested in better data collection, time-saving analysis tools, and easy reporting tech like exportable tear sheets to streamline communication between investors and their portcos.

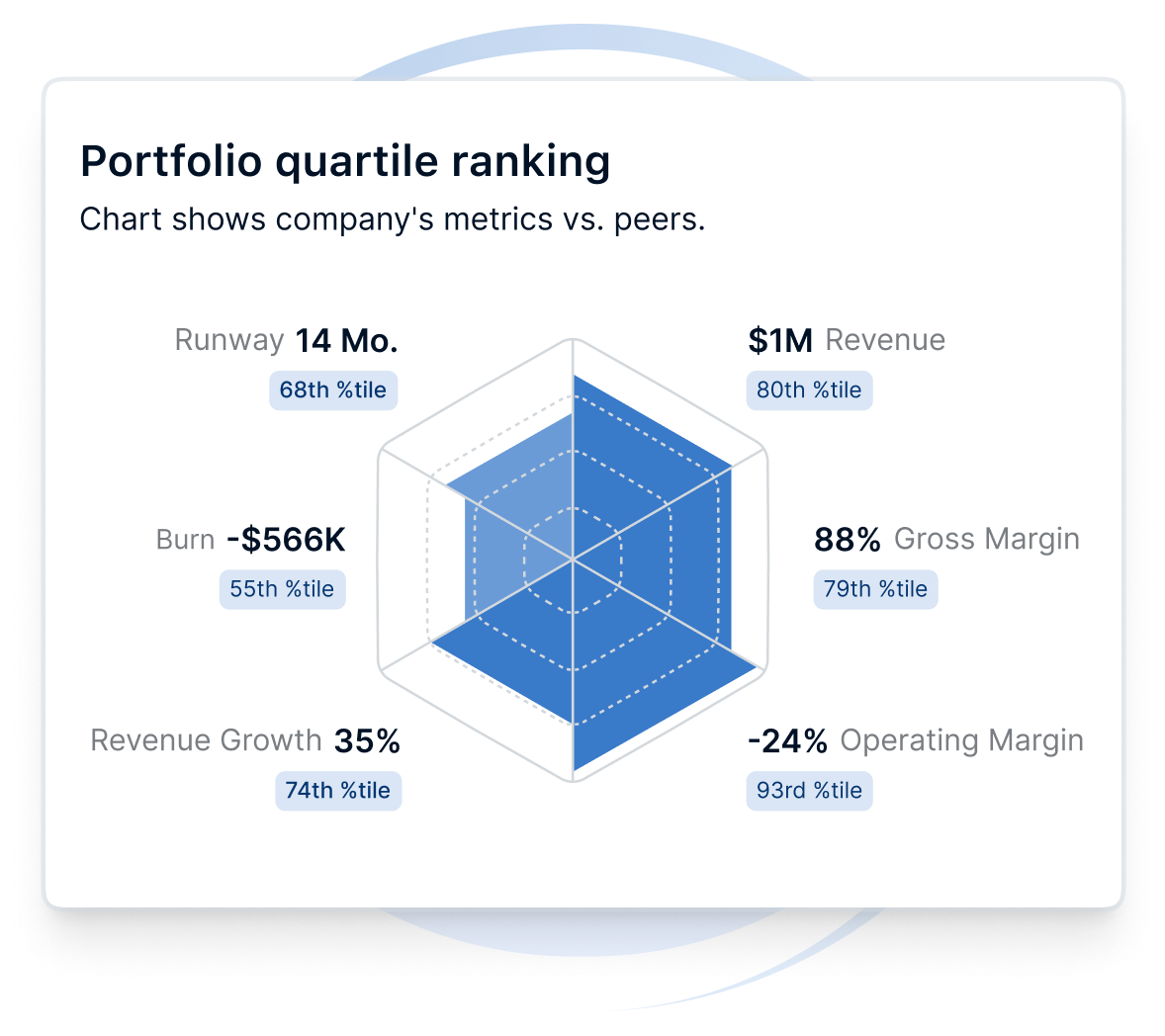

By 2024, we realized that our platform had become a treasure trove of private market data, with millions of performance data points built from the financial statements of hundreds of firms’ thousands of startups (across different industries, sizes, and regions). We decided to launch our first data product late that year — Global Benchmarking — to help our customers with a common problem: establishing a like-to-like comparison while assessing the performance of their portfolio. Today, over 9,000 startups have chosen to opt in to the product, helping us establish a robust data set of over four years of historical performance across metrics like revenue, runway, growth, and gross margin.

To highlight this data, we started sharing a series of free, ungated benchmarking reports, showcasing the stories that we found most interesting in our data each quarter. We’re publishing our full report next week, but are excited to give Notorious readers a sneak peak into how startups fared in Q1 2025 before it’s out.

How Global Benchmarking highlights a consistently tough Q1 in the private markets

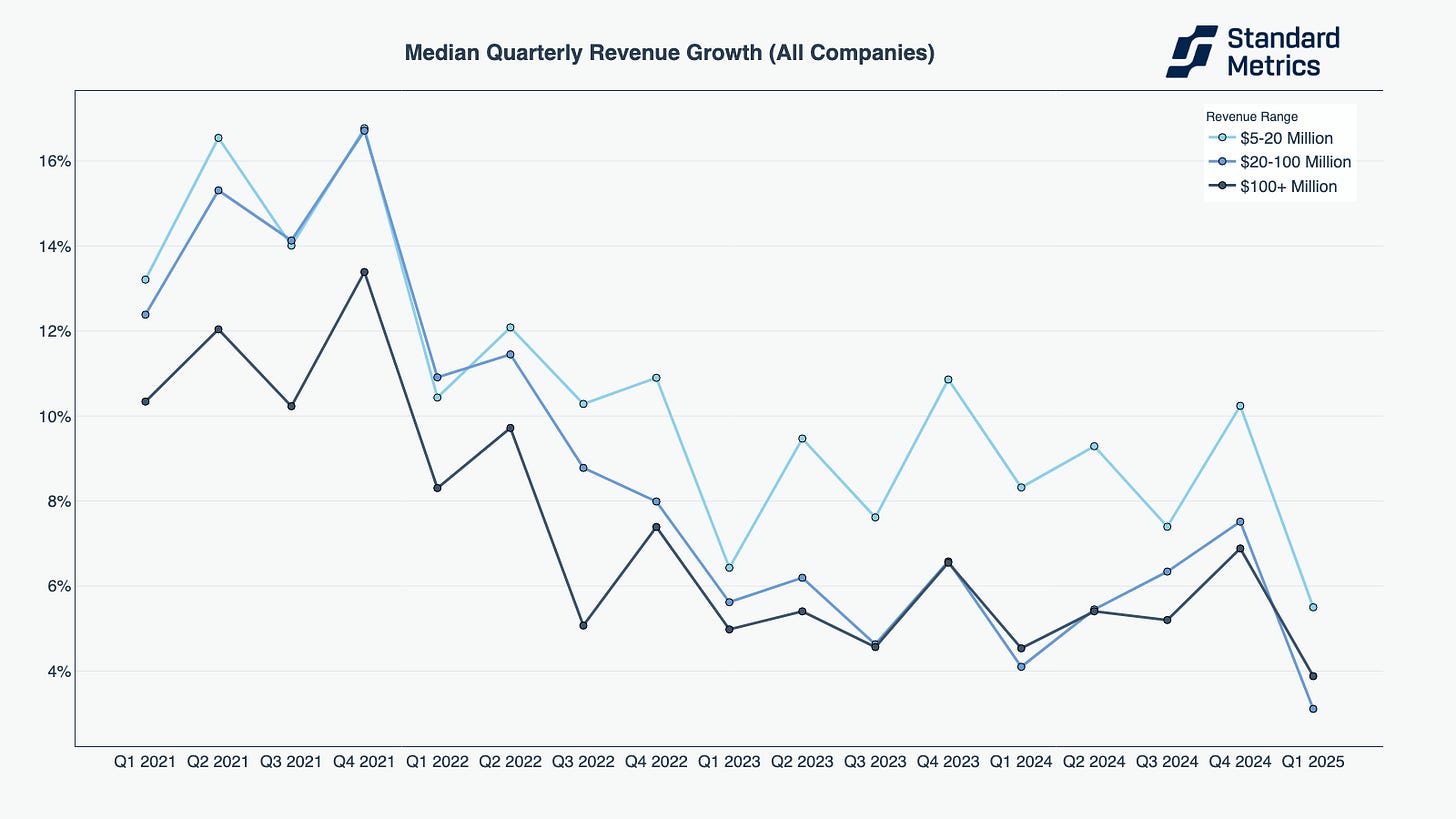

Standard Metrics’ Global Benchmarking data highlighted a significant drop in quarterly revenue growth across companies of all sizes in Q1 this year — with median quarterly revenue growth dropping between 3 and 5 percentage points quarter-over-quarter. Interestingly, this isn’t just a point-in-time trend: since 2021, we’ve seen companies consistently increase in quarterly revenue growth in Q4, then decline in quarterly revenue growth in Q1.

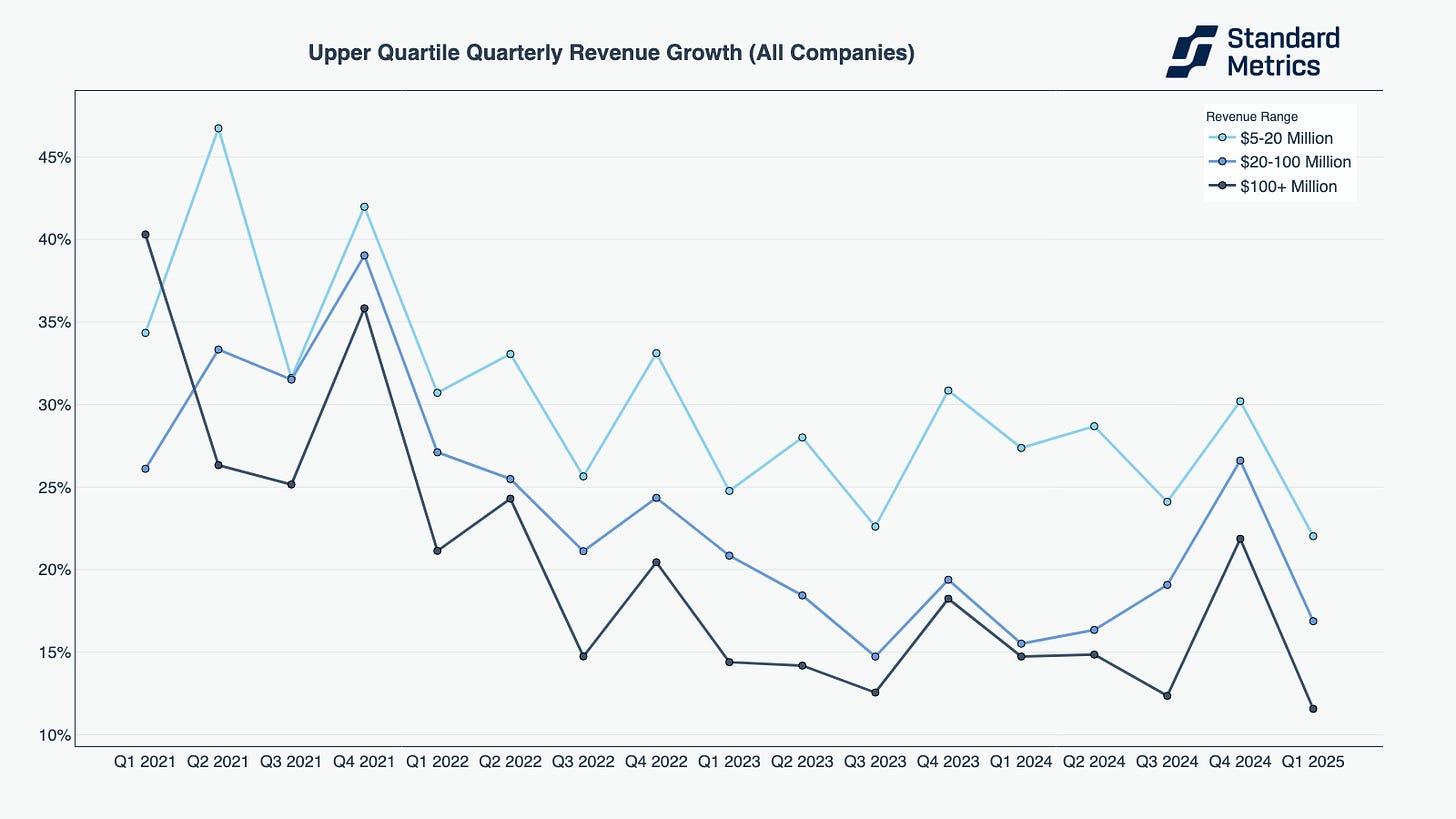

This is even true for top performing companies: upper quartile revenue growth dropped by 8 to 10 percentage points quarter-over-quarter in Q1 2025.

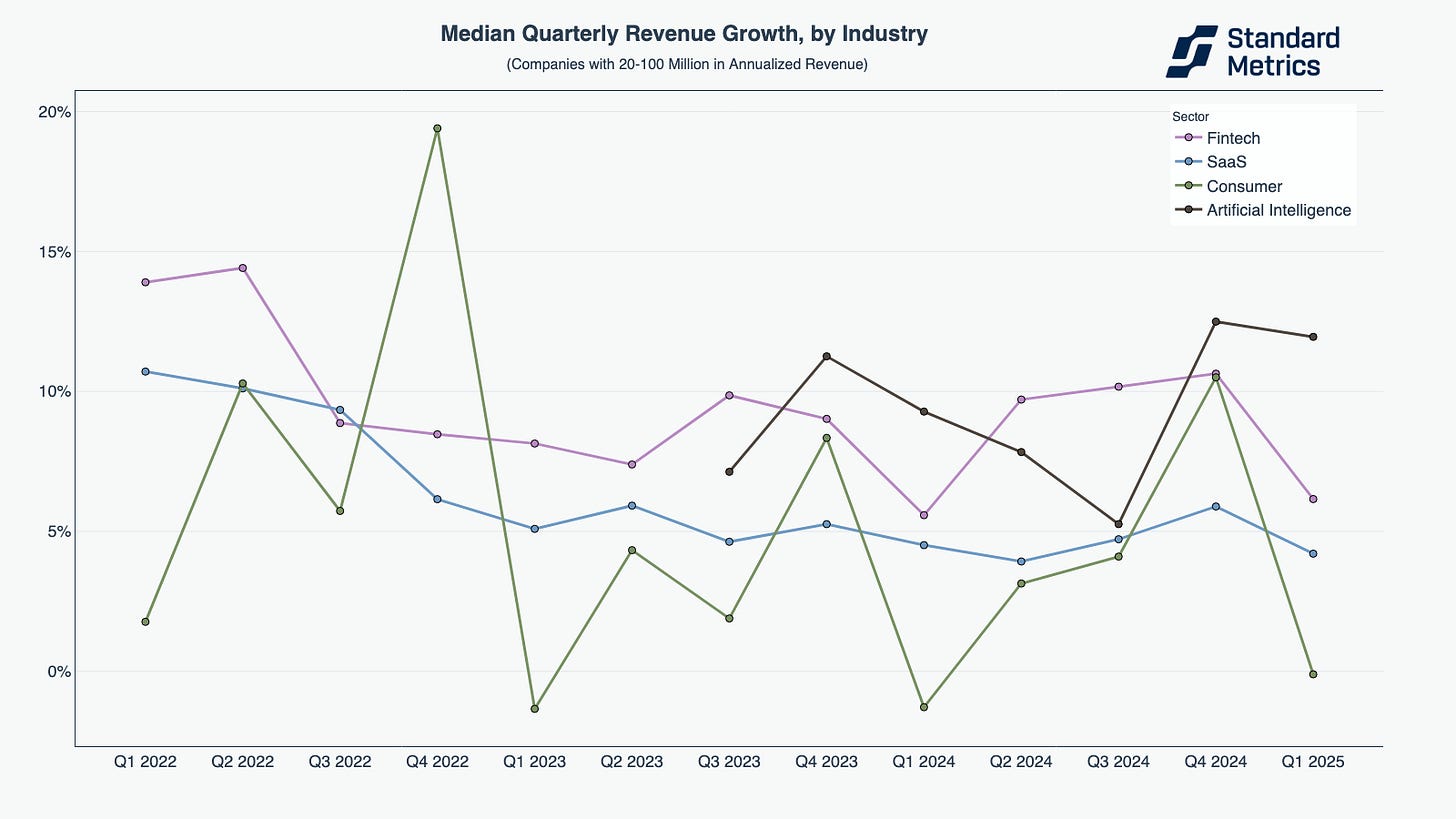

We were curious if this trend was being influenced by industry biases. Consumer startups, for example, have an almost unavoidable December holiday boost and January post-holiday slump. While consumer startups were most affected by this trend, we saw the same results in other industries like fintech, SaaS, and even AI.

We were also curious if this performance decrease was affected by macroeconomic headwinds. However, given the cyclical nature of this trend, Standard Metrics didn’t necessarily see tariffs wildly affecting startups in Q1 2025, though future effects remain to be seen. (While President Trump began to research tariffs in February, more active implementation began in April, after the quarter closed.)

Instead, some combination of holiday sales, lower household discretionary income, and startups pushing big deals to close before the holidays may have all been more likely explanations for this consistent Q1 drop.

Why (we think) this matters and what’s next

A value that we think that Standard Metrics’ Global Benchmarking data can bring to both firms and startups is an ability to contextualize, both in comparison to other startups and in comparison to other startups over long periods of time. When a company’s performance is looked at in isolation, it’s easy to over- or under- appreciate wins as well as miss important signs of trouble.

A new company examining a revenue growth drop in isolation, for example, might initially panic at the performance. But with our Q1 2025 data, they’d have the context of a market-wide downturn in the metric to better understand performance.

We hope the other stories we examine in our upcoming report — how fintech vs. SaaS are handling an AI sea change and how companies are stacking up in IPO-readiness — also bring readers more global context into the private markets.Get in touch if you’d like us to send it to you next week when it launches!

Thanks for reading. By way of background, I am an early-stage investor at Wing and a former founder. Please reach out to me on X @zacharydewitt or at zach@wing.vc.

Operating Benchmarks (from PLG Startups):

I will continue to update these metrics and add new metrics. Let me know what metrics you want me to add (zach@wing.vc)

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior Notorious episode.

Financial Benchmarks (from PLG Public Companies):

Financial data as of previous business day market close.

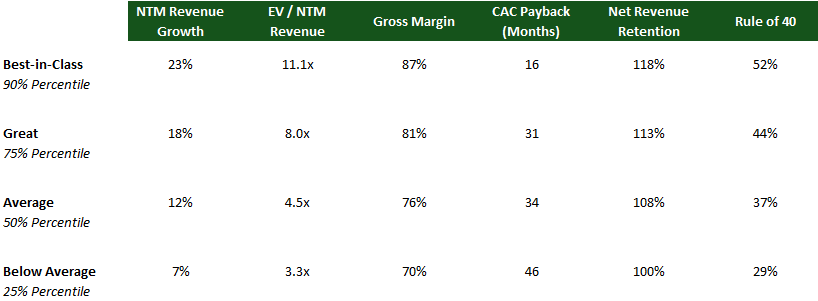

Best-in-Class Benchmarking:

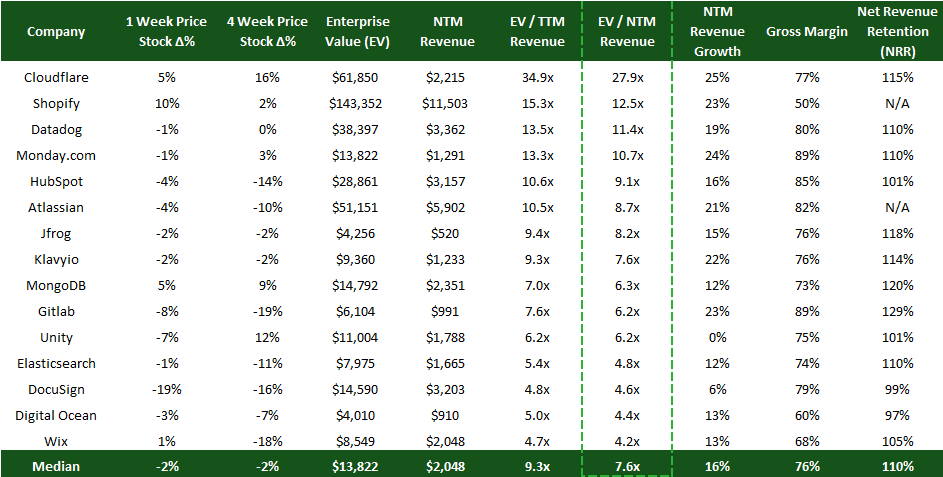

15 Highest EV/ NTM Revenue Multiples:

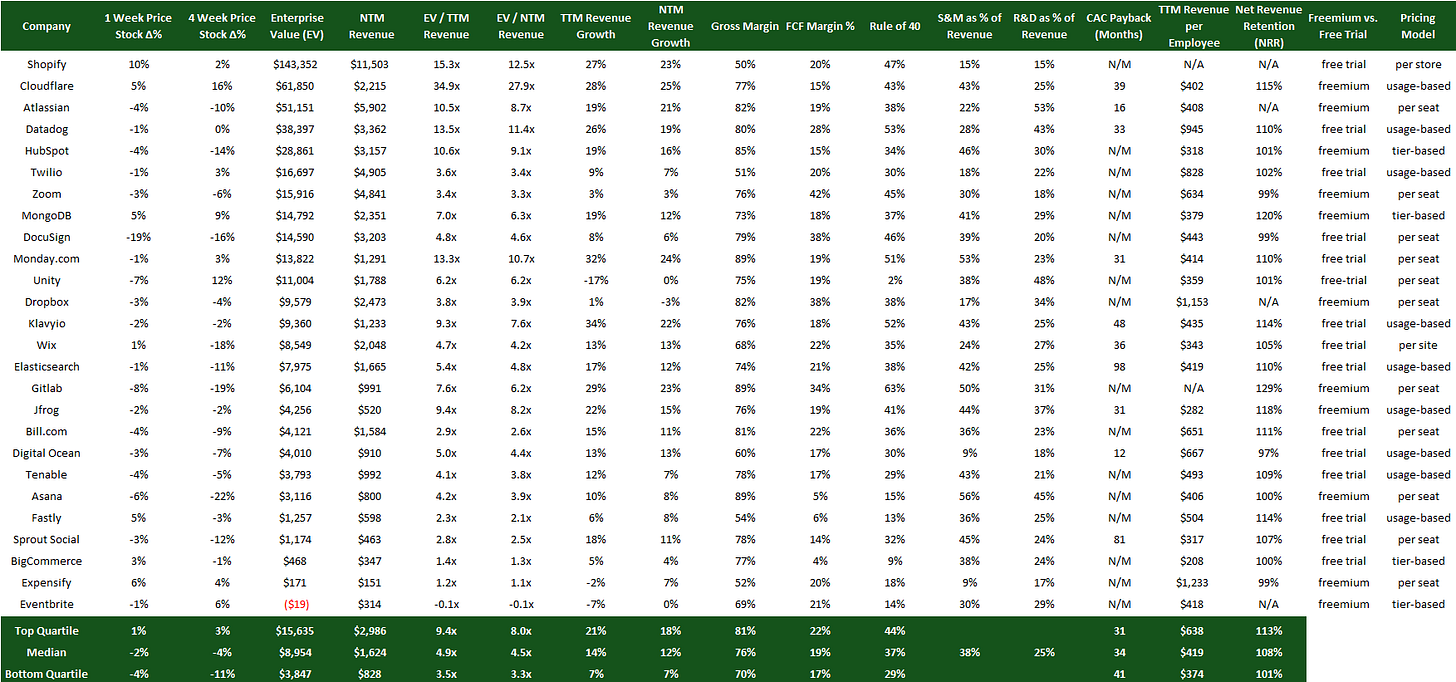

Complete Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG + AI Financings:

Seed:

Amperos Health, a multi-modal AI billing platform built specifically for healthcare providers to reduce denials and streamline claims collections, has raised $4.8M. The round was led by Nebular, Uncork Capital and Neo.

Archil, a default storage platform for cloud applications built for data teams, has raised $6.7M. The round was led by Felicis, with participation from Lombardstreet Ventures, Peak XV Partners, Wayfinder Ventures, General Catalyst, Twenty Two Ventures and Y Combinator.

Console, a startup specializing in automating IT help desk tasks using AI, has raised $6.2M. The round was led by Thrive Capital, with participation from Zeal Talent Ventures.

Deepdots, an end-to-end AI platform that unifies and analyzes customer feedback at scale, has raised $6.2M. The round was led by Dawn Capital, with participation from Maki.vc.

Delpha, a startup developing an autonomous AI agent focused on commercial data quality, has raised $2M. The round was led by 50 Partners.

Hirundo, a startup offering technology designed to surgically remove unwanted data and behaviors from already-trained AI models, has raised $8M. The round was led by Maverick Ventures Israel, with participation from SuperSeed, Tachles VC, Alpha Intelligence Capital, AI.Fund and Plug and

Latent Technology, a game technology company focused on AI-driven physical animation, has raised $8M. The round was led by Spark Capital and AlbionVC, with participation from Root Ventures and Alumni Ventures.

Solidroad, an AI-powered QA and training platform for modern customer experience teams, has raised $6.5M. The round was led by First Round Capital, with participation from Y Combinator.

Tenzai, a startup operating in stealth at the intersection of cybersecurity and artificial intelligence, has raised $32M. The round was funded by Battery Ventures and Greylock.

Thunder Code, a generative AI-powered software testing platform that uses agents to mimic human testers, has raised $9M. The round was led by Silicon Badia, Titan Capital and Janngo.

Veris.AI, an end-to-end platform for teaching AI agents to perform enterprise tasks, has raised $8.5M. The round was led by Decibel Partners and Acrew Capital, with participation from The House Fund.

Series A:

Aive, an AI platform that automates video post-production for businesses, has raised $13.5M. The round was led by The Invus Group, with participation from BNP Paribas Développement.

Handoff, an AI assistant designed specifically for residential construction contractors, has raised $5.7M at an $87.65M valuation. The round was led by Masco Ventures, with participation from Nemetschek Group, Afore Capital, Initialized Capital Management, Greycroft and Y Combinator.

Impart Security, an AI-powered security platform designed to operate autonomously in production environments, has raised $12M at a $62M valuation. The round was led by Madrona Venture Group, with participation from 8-Bit Capital and CRV.

Infisical, an open-source encrypted tool that helps developers manage secrets and environment variables across teams, devices, and infrastructure, has raised $16M. The round was led by Elad Gil, with participation from Gradient Ventures, Y Combinator and Dynamic Funds.

MIND, a data security platform that automates data loss prevention (DLP) and insider risk management (IRM) programs, has raised $30M. The round was led by Crosspoint Capital Partners and Paladin Capital Group, with participation from Okta Ventures and YL Ventures.

Netic, an AI-based platform that helps home services firms automatically reach out to clients in need of maintenance or upgrades, has raised $13M at a $111M valuation. The round was led by Founders Fund, with participation from Greylock, Hanabi Capital Management, Day One Ventures and SV Angel.

Sema4.ai, an enterprise AI agent platform that runs natively on Snowflake, has raised $25M at a $505M valuation. The round was funded by Benchmark, Snowflake Ventures, Cox Enterprises, Rocketship.vc, Mayfield Fund and MVP Ventures.

Thread AI, an AI-powered platform that enables enterprises to build, connect, and manage workflows and agents, has raised $20M. The round was led by Greycroft, with participation from Index Ventures, Scale Venture Partners, Meritech Capital Partners, Homebrew and Plug and Play Tech Center.

Toma, an AI automation platform for building personalized AI agents that automate customer communications and operational tasks for automotive dealerships, has raised $17M. The round was led by Andreessen Horowitz, with participation from Holman Growth Ventures, Flex Capital and Y Combinator.

Trustifi, an AI-powered cybersecurity platform specializing in email security, has raised $25M. The round was led by Camber Partners.

Wordsmith, an AI-powered platform designed for in-house legal teams to automate contract and policy reviews, has raised $25M. The round was led by Index Ventures and Kinnevik.

Series B:

Simetrik, a B2B SaaS platform that provides finance teams with AI-driven automation tools for reconciliation, compliance, and transactional control, has raised $30M. The round was led by Growth Equity at Goldman Sachs Alternatives.

Speedata, the developer of an ASIC processor designed to accelerate complex analytics workloads, has raised $44M. The round was funded by Viola Ventures, Walden Catalyst, 83North, Koch Disruptive Technologies, Pitango Venture Capital and ArtofIn.

Series C:

Anysphere, a startup that offers a code editor called Cursor, which uses AI to automate programming tasks, has raised $900M at a $9B valuation. The round was led by Thrive Capital, with participation from Andreessen Horowitz, Accel and DST Global.

Love this!

Standard Metrics called it cyclical, but why are those quarterly revenue growth charts going DOWN over the last 3 years?