Notorious PLG 7.7.22: How to Grow Fast Enough to Raise a Series A

Weekly update email on the most important product-led growth ("PLG") companies and strategies

Current subscribers: 2,022

How to Grow Fast Enough to Raise a Series A

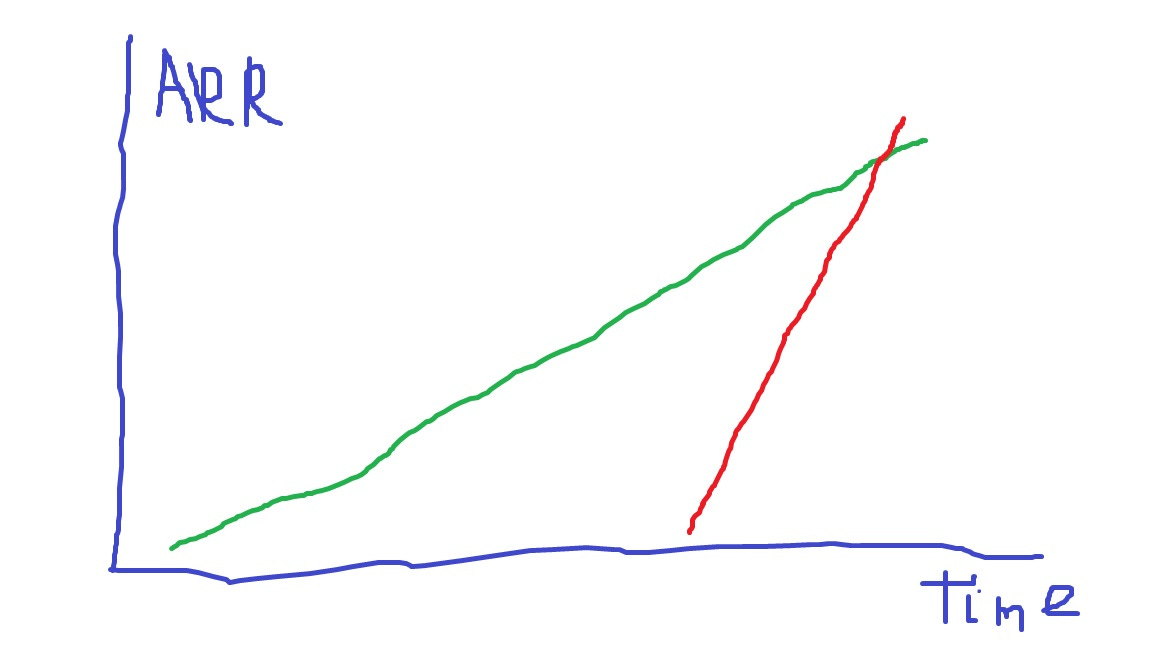

One of the most common questions I get asked by early-stage teams is: what amount of ARR do we need to raise our series [A/B/C etc]? On Tech Twitter, investors opine about various ARR benchmarks needed to unlock the next funding round. As a Series A investor, the slope matters much more to me than does the ARR amount. Investors tend to extrapolate your growth rate and the steeper the slope, the higher the projected ARR will be in future years. Ok, so what? This seems obvious that a company growing faster will have an easier time fundraising. It is - but the operating implications for early-stage startups are important.

I recommend that startups break the process of signing up paid users into smaller pieces. First, spend months (even years) searching for PMF with a free product before turning on a paid plan. Yes, it is easier to get users to try something that is free, but it is still very hard to get them to keep using it and love the product if it isn’t amazing. Once a startup has found PMF with a free product (this is hard work) and the blinking indicators are on - strong engagement, signs of virality, improving retention, etc (see prior series of NPLG writeups for relevant benchmarking metrics), then the startup should test a paid plan with a small number of customers to optimize conversion rates. Be very clear that the paid plan is still in beta. Once conversion rates are strong in beta, open the floodgates to a paid plan accessible to all users. Alongside a sales assist motion, the startup can convert a high percentage of free users and show a steep ramp in paid users.

Startups are often coached that they need to turn on pricing as early as possible to test if people like the product enough to pay. I think this is a mistake. Instead, do the heavy lifting searching for PMF with a free product. If "user love” isn’t apparent in the free product metrics, nobody is going to pay for the product anyways. Beta test a paid product with a small sample set. Once you can prove out reasonable conversion rates, open the floodgates and you are off to the races. After a few months of steep growth, it’s time to fundraise. You’ve proved both that users love your product and are willing to pay for it, all the while growing ARR quickly - this is the holy grail for a strong Series A.

I would love to hear your feedback. Please email me at zach@wing.vc

PLG Tweet(s) of the Week:

If you were forwarded this email and are interested in getting a weekly update on the best PLG companies (private + public), please join our growing and vibrant community by clicking this subscriber button below:

Recent PLG Financings (Private Companies):

Seed:

AI Squared, an online platform designed to connect data science and analytic workflows to turn data into transformative business insights, has raised $6M at a $24M valuation. The round was led by Sofina, with participation from Index Ventures and OMERS Ventures.

Series A:

Normalyze Security, a provider of cloud data security solutions intended to secure data across multiple cloud environments, has raised $22.2M at a $72.2M valuation. The round was co-led by Lightspeed Enterprise Companions and Battery Ventures.

Series B:

Incredibuild, a platform that drastically speeds up the shipment of code and related collateral during building and testing for game building, has raised $35M at a $800M valuation. The round was led by Hiro Capital, with Insight Partners also participating.

Kaiko, a blockchain analytics startup, has raised $53M. The round was led by Eight Roads, with participation from Revaia, Alven, Point Nine, Anthemis and Underscore.

Snowplow, a behavioral data management platform designed to serve data teams, has raised $40M. The round was led by New Enterprise Associates, with participation from Atlantic Bridge Capital and MMC Ventures.

Speechmatics, an AI tech company, has raised $62M. Susquehanna Growth Equity led the round, with AlbionVC and IQ Capital also participating.

Series D:

FrontApp, a customer communication software maker, has raised $65M at a $1.7B valuation. The round was led by Salesforce Ventures and Battery Ventures, with participation form Sequoia Capital, Threshold Ventures, and Uncork Capital.

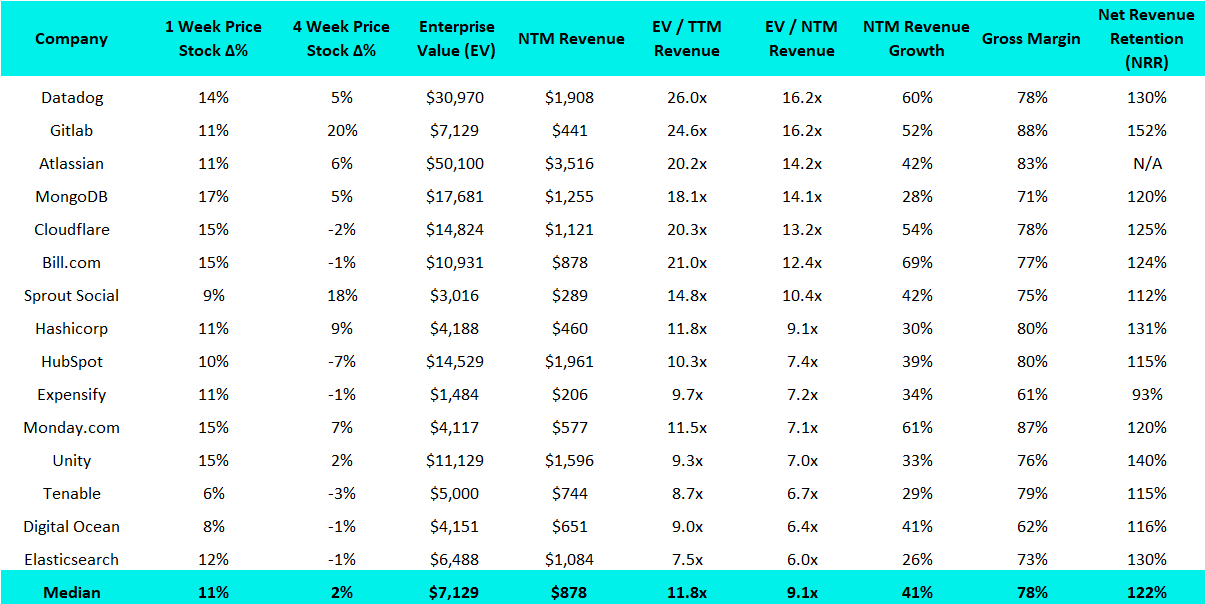

Recent PLG Performance (Public Companies):

Financial data as of previous business day market close.

15 Biggest Stock Gainers (1 month):

Best-in-Class PLG Benchmarking:

15 Highest EV / NTM Multiples:

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.