Notorious PLG 7.14.22: Tips for Thriving as a PLG Company in this Downturn

Weekly update email on the most important product-led growth ("PLG") companies and strategies

Current subscribers: 2,091

NPLG Startup of the week: HeadsUp

There’s a Buffett quote that goes “Only when the tide goes out do you discover who's been swimming naked.” Similarly, a bear market often separates the best-in-class companies from those that are merely doing alright.

Within PLG, there is a wide chasm between companies that are efficient and the median performer. Historically, companies like Slack and Dropbox converted 3-5x the number of self-serve users than the median. This allows the winners to be even more efficient with GTM, growing revenue without needing to grow headcount.

Today’s featured startup is building a tool that unlocks that level of productivity and efficiency for the masses. HeadsUp lets PLG sales and go-to-market teams identify which accounts they should upsell, based on how these accounts are using your product.

PLG sales teams have thousands of self-serve users they can engage. The question often becomes, where should they best spend their limited time? Using a combination of analytics, and cleverly-built workflows, HeadsUp helps sales teams answer that question without any code.

I spoke with HeadsUp’s founder Momo Ong and Head of Marketing Nathan Wangliao about the product. Momo stressed that he didn’t just want to pitch the product, he also wanted to share a few learnings about how top PLG sales teams are reacting to the recent downturn.

Surviving and thriving as a PLG company in this downturn: 3 top tips

In the past 6 months, HeadsUp has interviewed 40+ GTM leaders from top PLG companies on their Product Led Sales podcast. This includes the founders of Algolia, Heap.io, CROs of Shogun, Vercel, and more.

“The cool thing about top PLG teams is that they don’t need to massively change course despite the downturn. We met several sales teams that stressed discipline and efficiency even in 2020-21”, Momo recounts.

According to HeadsUp, there are 3 tactics PLG sales teams should adopt to keep delivering great results despite the need for higher efficiency.

1. Build a ‘conversion engine’ that identifies PQLs effectively

Some of the successful PLG companies hoover up all the usage data from your database or Segment, and enrich it with firmographic data. They then look at the data to find where the untapped opportunities are within their user base.

This is exactly what HeadsUp has built. You can instruct the tool to look for cross-sell opportunities, upsell opportunities from one tier to another. It can even look out for pre-conversion users that just need a little help from sales to move along the self-serve journey (a tactic now known as ‘sales-assist’).

Why is this important?

When Momo was doing his customer research while building HeadsUp, he found that PLG sales teams waste upwards of 75% of their time on non-revenue-generating activities. This includes working on leads that have no chance of closing, or mis-firing on good opportunities because sellers couldn’t see how these users were using their product.

Even amongst companies that had a PQL process set-up, many sellers simply weren’t using it. The PQLs were often hidden in some obscure spreadsheet. It was just too time-consuming moving between janky internal tools and your CRM.

That’s why HeadsUp focused not just on clever data science. The tool is also finely tuned to the workflows of sales teams, overlaying its output on top of Salesforce or Hubspot.

Before HeadsUp, companies like Heroku built out such a ‘conversion engine’ in-house. Of course, it took a team of engineers months, if not years, to get it completely right. HeadsUp believes it can give this kind of superpowers to teams quickly and at a much lower cost.

The end result should be that each seller can deliver much more revenue. And costly engineering resources are spared. All of which should be music to your ears if as a company, you now need to keep delivering ambitious growth with an economical amount of resources.

2. Use transparency and documentation to scale sales efforts

HeadsUp spoke to Alex Younes, an early employee at Dovetail. Dovetail is a customer research tool that’s undergoing explosive growth, and raised a $63m Series A last year.

Despite its growth, Dovetail was very scrappy in its early years. Alex set up its first sales team, and for a long time it had just 2 sellers engaging a self-serve user base of tens of thousands. Interestingly, being Australian-founded, the timezone difference with the US forced Dovetail to be even more efficient. There just wasn’t that much overlap so every interaction had to be high-quality.

“One big thing for us was to be as transparent as possible.” Alex suggests. As a result, the sales team was able to share a lot of information without having to repeat them within calls. This skipped calls ahead to the most gnarly or contextual discussions.

Dovetail took a fine-toothed comb and found many opportunities for transparency:

They shared pricing for many of their tiers, so no one ever reached out to them just to find out about price.

The sales team worked closely with product and marketing to deliver great documentation for users. Everyone in the company was given the ability to update documentation.

They removed the need to swipe a credit card to access the free product.

They systematically reviewed their enterprise deals to look for all the things customers required, and pushed themselves to make as much of it public as possible. This included tax documents, security certificates, even legal documents.

3. Develop the discipline to triage each opportunity

Alex Kudelka is the VP of Sales at Bitrise, a mobile devops platform. In an interview with HeadsUp, he reflected that sales efficiency often requires a lot of discipline.

“It’s tempting when faced with a higher quota to just say, ‘okay, let’s go at it with headcount.’ However, that’s just not sustainable.”

Bitrise applies multiple filters to an opportunity, including buying propensity – which product usage data helps determine – projected customer lifetime value, and projected deal velocity and complexity. Only deals that are sufficiently large and involve complex use cases are funneled to sales.

For example, Alex highlights that a large financial institution may seem like a customer to assign by default to an enterprise sales rep. But instead of assuming a high account value Bitrise has built a sales stack which can pull firmographic and product usage data to determine the appropriate level of sales touch to be applied to the user at different points in time. They even build out hierarchies of the organizations they are selling to to understand if there are cross-sell opportunities.

Here too, HeadsUp’s tool could help. It integrates with solutions like Clearbit to help its users filter accounts based on not just usage, but also firmographic and demographic data.

I would love to hear your feedback. Please email me at zach@wing.vc

PLG Tweet(s) of the Week:

If you were forwarded this email and are interested in getting a weekly update on the best PLG companies (private + public), please join our growing and vibrant community by clicking this subscriber button below:

Recent PLG Financings (Private Companies):

Seed:

Adaptive, a software startup that aims to give construction teams better tools to manage their back offices, has raised $6.5M. Andreessen Horowitz led the round, with participation from 3KVC, BoxGroup, Exponent and Definition.

Early Stage:

Shop Circle, a London-based provider of e-commerce software for brands, has raised $65M. NFX and QED Investors co-led the round, and were joined by 645 Ventures, FirstMinute Capital and Tripoint Capital.

Series A:

Hebbia, a developer of AI productivity tools designed to make decisions more confidently and quickly with insights, has raised $28.1M at a $136.1M valuation. The round was funded by Human Capital, Index Ventures and Floodgate Fund.

Traba, a jobs board designed to help entry-level workers find available shifts at fulfillment centers and event venues, has raised $20M at a $120M valuation. Khosla Ventures led the round, with participation from Founders Fund, General Catalyst, SciFi VC and Atomic.

Series B:

Tesorio, a developer of cash flow management software designed to predict a company's overall financial health, has raised $17M. The round was led by BAMCAP, with participation from FundersClub, Floodgate Fund, First Round Capital, Hillsven, Xplorer Capital, Mango Capital, Madrona Venture Group and Carao Ventures.

Recent PLG Performance (Public Companies):

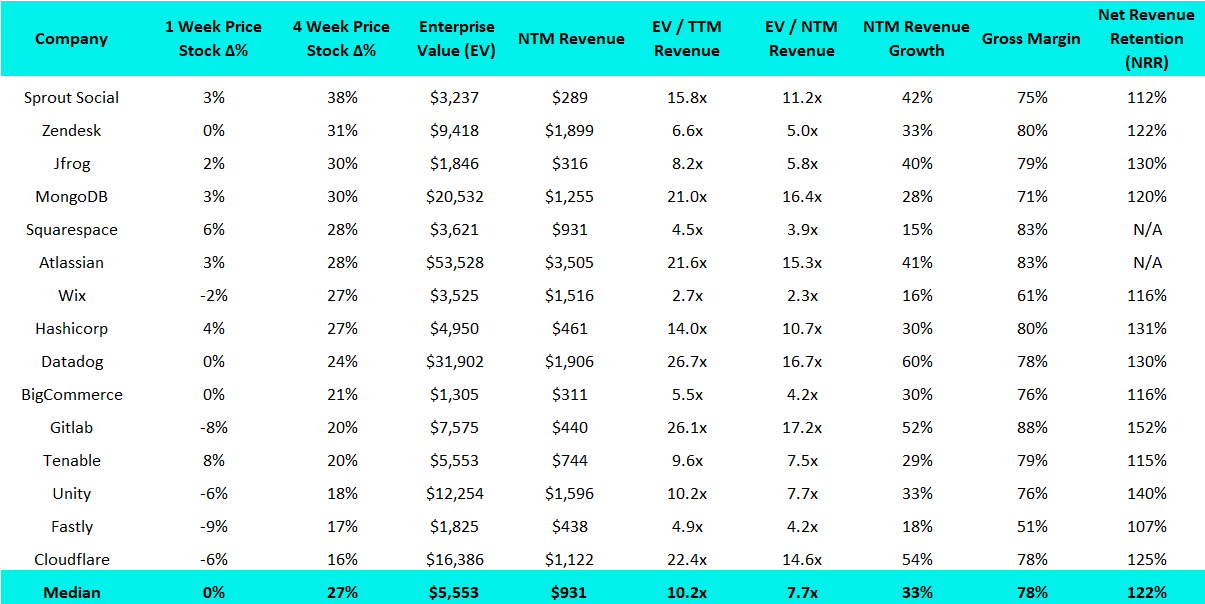

Financial data as of previous business day market close.

15 Biggest Stock Gainers (1 month):

Best-in-Class PLG Benchmarking:

15 Highest EV / NTM Multiples:

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.