Notorious PLG 6.15.22: Don't Be Third

Weekly update email on the most important product-led growth ("PLG") companies and strategies

Current subscribers: 1,889

Don’t Be Third

In 2022, the name of the game is survive. There is a lot of great content being put out there (see Sequoia’s latest here) on how startups can extend their runway and how they should take in extra capital ASAP to stay alive. I wanted to add some advice to the mix: Don’t be third.

Yes, not surviving is a death sentence. But also being third is effectively a death sentence. If a startup cuts all of its costs and hibernates to survive the winter, there is a real risk other startups will race past them and steal the market. VCs rarely back a third place startup, if ever. I will caveat that I am referring to being third relative to other startups at similar stages. Of course startups will be ranked way behind incumbents in the early days, but startups will have a steeper slope and will be growing faster. That’s not what I am talking about. You don’t want to be passed by another startup, or even worse, passed by two startups.

When VCs say, “do whatever you can to survive”, they really mean “do whatever you can to survive while making sure you’re in 1st or 2nd place.” This is a shorter edition today, but it’s an important message.

I would love to hear your feedback. Please email me at zach@wing.vc

PLG Tweet(s) of the Week:

If you were forwarded this email and are interested in getting a weekly update on the best PLG companies (private + public), please click this subscriber button below:

Recent PLG Financings (Private Companies):

Seed:

Proper, a developer of modern financial data infrastructure for fintech designed to automate payment reconciliation and financial operations at scale, has raised $4.3M. The round was led by Redpoint Ventures, with participation from BoxGroup, Mischief and Y Combinator.

TestBox, a collaborative software platform intended to test multiple software options before purchasing the software, has raised $10M. The round was led by Felicis Ventures, with participation from SignalFire and Firstminute Capital.

Series A:

Finch, a developer of a universal API platform to connect corporate payroll, HR, and benefits systems, has raised $15M. The round was led by Menlo Ventures, with participation from General Catalyst, Bedrock, Sempervirens and Y Combinator.

Gantry, a software development platform designed to improve machine learning products with analytics, alerting, and human feedback, has raised $23.9M. The round was led by Coatue Management and Amplify Partners, with participation from Index Ventures, South Park Commons, GTMFund and Mantis VC.

LibLab, which bills itself as an “SDK-as-a-service” platform for engineers, has raised a $42M. The round was led by Insight Partners, with participation from Zeev Ventures, Stepstone, Sheva and Rainfall.

Magical, a developer of text expander software, has raised $35M. Coatue led the round, and was joined by Greylock, Bain, Lightspeed Capital, SV Angels and Blank Ventures.

Series B:

HYCU, a Boston-based cloud data protection company, has raised $53M. Acrew Capital led the round, and was joined by investors including Bain Capital Ventures, Atlassian Ventures and Cisco Investments.

Maze, a Paris-based software product research startup, has raised $40M. Felicis Ventures led the round, and was joined by Emergence, Amplify, Partech, Seedcamp, Atlassian Ventures, Zoom and HubSpot Ventures.

Middesk, a verification and underwriting automation startup, has raised $57M. Insight Partners and Canapi Ventures co-led the round, and were joined by Sequoia Capital, Accel and Gaingels.

Series C:

Codat, a London-based software startup that connects small businesses with financial institutions, has raised $100M at a $1.03B valuation. JPMorgan Chase led the round, and was joined by Canapi Ventures, Shopify, Index Ventures and PayPal Ventures.

Perimeter 81, an Israeli software-defined perimeter startup, has raised $100M at a $1B valuation. B Capital led the round, and was joined by ION Crossover Ventures and previous investor Insight Partners.

Recent PLG Performance (Public Companies):

Financial data as of previous business day market close.

15 Biggest Stock Gainers (1 month):

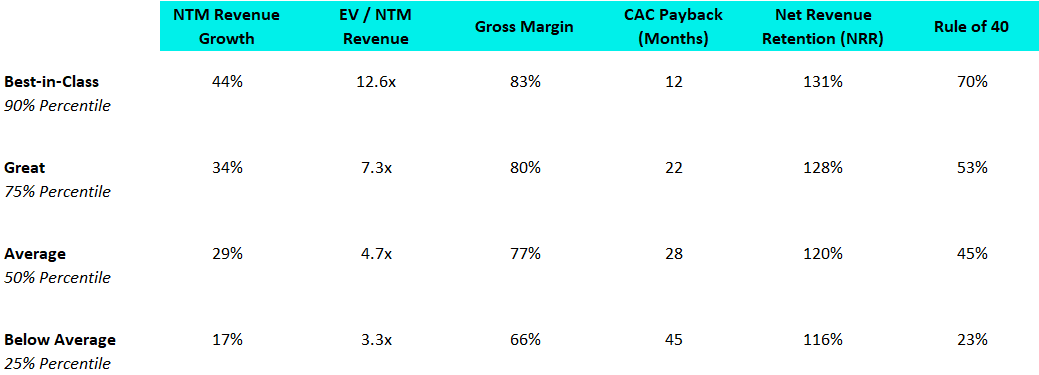

Best-in-Class PLG Benchmarking:

15 Highest EV / NTM Multiples:

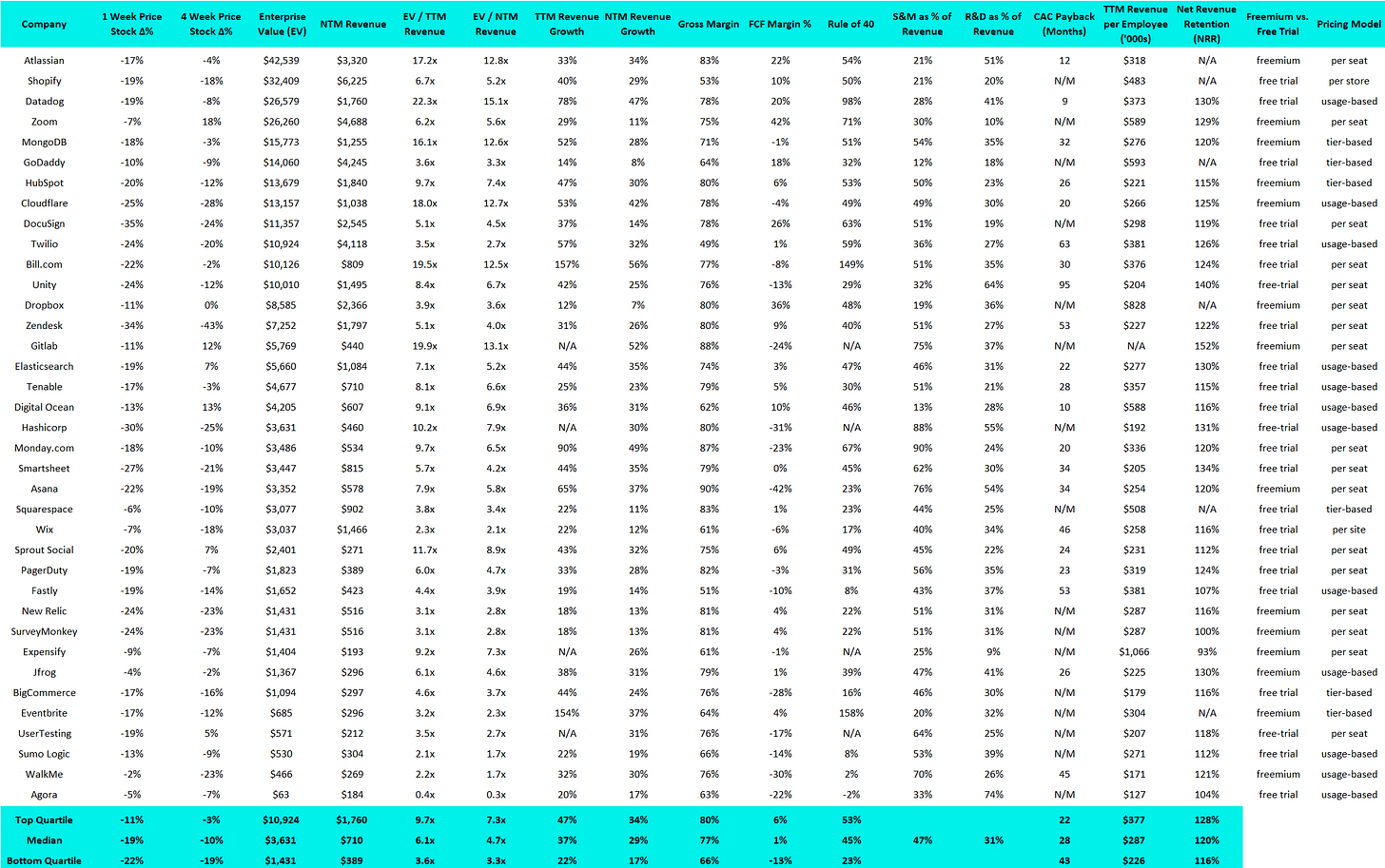

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.