Notorious PLG 6.1.22: What It Takes To Raise a Series A Today

Weekly update email on the most important product-led growth ("PLG") companies and strategies

Current subscribers: 1,829

What It Takes to Raise a Series A Today (PLG)

There has been a lot written recently about how startups should manage a downturn (e.g. here and here). The most common advice is to survive which translates to having enough cash in the bank to fund company operations for 24 months. The market is actively resetting now in terms of valuation multiples and what metrics are necessary to raise a round. Given this uncertainty, I want to layout what it takes for a PLG startup to raise a Series A in the current financing environment.

To raise a Series A, PLG startups need to demonstrate product-market fit (PMF). To be clear, at the Series A, it is much more important to demonstrate PMF than to reach a certain revenue threshold, especially since revenue can be purchased through heavy marketing spend. At the earliest stage, revenue does not equal PMF. PMF for early-stage PLG startups is demonstrated in the product usage metrics (engagement, growth + retention). Below are the most important metrics (in descending order) for PLG startups to focus on before raising a Series A:

User growth: 10% month over month growth for monthly active users (MAU) for 6 months+. Another important metric for user growth is how many times per day, or week unique users use the app and is this increasing over time. User growth and engagement are markers of PMF.

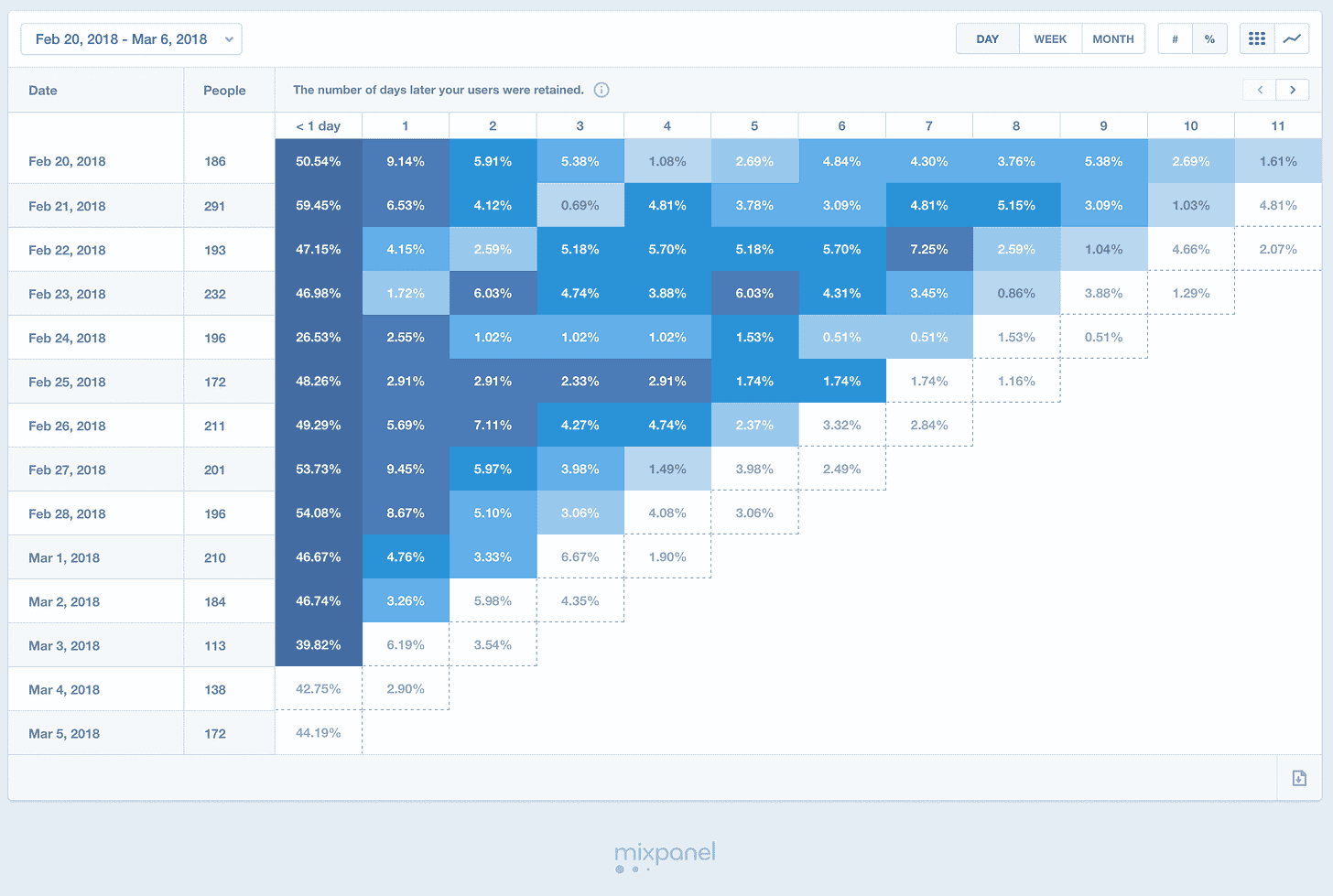

User retention: retention benchmarks differ by category (Lenny does a nice job benchmarking retention here), but an indication of PMF is that cohorts are improving over time (if you look down the columns, retention %s should be increasing in more recent cohorts as the product improves):

Gross margins: 50%+ gross margins are needed to raise a Series A today, however founders should strive for 70%+ which is usually the threshold for what investors consider “software gross margins”.

Revenue: before this market meltdown, PLG companies could get away with raising a robust Series A round without revenue if their engagement, growth and retention metrics were strong enough. In today’s environment, we are seeing Series A deals get done with ARR in the range of ~$250 - $500K. Most Series A investors that I have spoken with in the last few weeks are now mandating revenue for a Series A. A key question for every startup “are people willing to pay for this product?” and proving this out before the Series A is a necessary milestone.

It is important to note that is much better to turn revenue on and have it grow quickly rather than have it grow steadily over a longer period. The slope matters. Thus, companies that go from $0 to $250K of revenue in 3 months vs. in 1 year will be looked at very differently for the Series A. The advice I always give to founders is to experiment relentlessly with the free product first to find and deepen PMF and then start monetizing your user base all at once to show a steep slope in revenue growth.

Net revenue retention (NRR) of 120%+ is an important metric, but many Series A companies won’t have a full year of retention data yet. NRR will become an increasingly important metric as the startup scales.

CAC payback: customer acquisition cost (CAC) payback should be <12 months.

Burn: Burn is important, but it is not uncommon for seed-stage PLG companies to take a few years to find PMF (i.e. Figma, Loom). Thus, at this stage burn is more often a indication of long it took to find PMF rather than a true measure of GTM efficiency since the startup has likely only been monetizing for a few months.

Total capital burned: Series A investors will look at how much capital was raised and spent to get to the current metrics. If a startup only needs $3-5M to get to $500K of ARR, this means the business both found PMF rather quickly and is efficient in its early GTM endeavors.

Burn multiple: The burn multiple is net burn divided by net new ARR in a given period. Investors will focus more on the burn multiple in the growth stages to benchmark GTM efficiency, but Series A startups should have a burn multiple less than 2. I wouldn’t overly rotate on the burn multiple at the Series A, but it is important to have a narrative around how the burn multiple will decrease as the business scales.

I would love to hear your feedback. Please email me at zach@wing.vc

PLG Tweet(s) of the Week:

If you were forwarded this email and are interested in getting a weekly update on the best PLG companies (private + public), please click this subscriber button below:

Recent PLG Financings (Private Companies):

Seed:

Keep Financial, a platform that aims to help employers provide retention bonuses in the form of forgivable loans, has raised $9M. The round was led by Andreessen Horowitz, with Launchpad Capital, Thomvest Ventures, Cambrian Ventures, and Worklife Ventures also participating.

Series A:

A.Team, a marketplace for product specialists, has emerged from stealth with $60M of financing. The Series A was co-led by Tiger Global Management, Insight Partners, and Spruce Capital Partners, and the previously undisclosed $5M seed round was led by NFX, and joined by Box Group, Village Global, and firstminute Capital.

Heartex, a startup that bills itself as an open-source platform for data labeling, has raised $25M at a $125M valuation. The round was led by Redpoint Ventures, with participation from Unusual Ventures, Bow Capital and Swift Venture.

Pipedream, an online integration platform designed for developers to build and execute workflows, has raised $20M. The round was led by True Ventures, with participation from CRV, Felicis Ventures and the World Innovation Lab.

Series B:

Bravado, a professional sales network designed to help professionals take control of their careers, has raised $26M. The round was led by Tiger Global, with participation from existing investors Redpoint Ventures, XYZ Ventures, Freestyle Capital and Precursor.

Instabug, a startup that aims to help mobile developers monitor, identify and fix bugs within apps, has raised $46M at a $410M valuation. Insight Partners led the round, with Accel, Forgepoint Capital and Endeavor joining.

Komodor, a troubleshooting platform for DevOps and site reliability teams designed to take control over modern distributed systems, has raised $42M. The round was led by Tiger Global, with participation from Felicis, Accel, NFX Capital, Pitango First, Vine Ventures, and OldSlip Group.

Storyblok, a startup that has built a headless CMS designed both for technical and non-technical users, has raised $47M. The round was led by Mubadala Capital and HV Capital, with 3VC and firstminute Capital also participating.

Series C:

Glean, a company that helps employees parse information across networks, has raised $100M at a $1B valuation. The round was led by Sequoia, with participation from Lightspeed, General Catalyst, Kleiner Perkins and the Slack Fund.

Unit, which makes software that allows companies to offer banking products such as payments, lending and credit cards, has raised $100M at a $1.2B valuation. Insight Partners led the round, with participation from Accel, Better Tomorrow Ventures, Flourish Ventures, Moving Capital and Stepstone.

Series D:

Imply, a company that provides data insights immediately, has raised $100M at a $1.1B valuation. Thoma Bravo led the round, with participation from OMERS Growth Equity, Bessemer Venture Funds, Andreessen Horowitz and Khosla Ventures.

Cribl, an observability tools developer, has raised $150M at a $2.45B valuation. The round was led by Tiger Global, with participation from CRV, IVP, Redpoint Ventures, Sequoia, and Greylock Partners.

Recent PLG Performance (Public Companies):

Financial data as of previous business day market close.

15 Biggest Stock Gainers (1 month):

Best-in-Class PLG Benchmarking:

15 Highest EV / NTM Multiples:

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.