Notorious PLG 5.20.22: How Mutiny Combines PLG + Account-Based Marketing (ABM)

Weekly update email on the most important product-led growth ("PLG") companies and strategies

Current subscribers: 1,810

NPLG Startup of the Week: Mutiny

In prior NPLG writeups, I have talked about how the best PLG founders think about their website as a core part of the product experience (more here). However, many PLG websites are static and thus, are under optimized. Enter Mutiny. Mutiny is building powerful software that can identify users when they land on your website and then serve them personalized pages. Using ML, Mutiny can even automatically write headlines for select audiences. This is a powerful value proposition as dynamic, intelligent websites can bring more potential users into your product activaton funnel.

For this edition of NPLG, CEO Jaleh Rezaei and Head of Content Stewart Hillhouse shared with me how Mutiny is dogfooding their product to up the game for PLG Account-Based Marketing (ABM). To be honest, I am quite impressed with this strategy and it’s generous they shared their playbook with the NPLG community.

“Here's how: Using Mutiny, we create personalized landing pages for every one of our contacts at a target account. Here's an example of a personalized page for Alchemy. You'll notice that the headers, images, logos, copy, and even the content is personalized based on the relevance to the account. Our sales team then reaches out to these target accounts through email. The email includes a link to the personalized landing pages, and a custom music video (examples: Seismic & Outreach). The result: more meetings booked with enterprise customers who already understand how Mutiny can help them grow.

We've seen this tactic work extremely well for a few reasons:

1) It shows the product in action: PLG is about doing more showing than telling. We're "eating our own dogfood" with this tactic by demonstrating how we use our own product. It's also infinitely scalable as our ABM program matures and hyper-personalized (right down to the value propositions we mention in the copy). This helps us get our prospects to the product's "Aha moment" in a matter of seconds. They can't help but begin to imagine what they could use this tool for in their job. This makes the sales call much more engaging because the prospect already knows they want Mutiny, it's just a matter of confirming it's a technical fit.

2) It converts directly into sales calls (and revenue): Mutiny is an enterprise tool, and therefore our go to market strategy involves sales ensuring there's a technical fit with the prospect. That's why we have a calendar on the landing page that allows the prospect to schedule a call to discuss their specific use case. Most companies who sell to enterprises first require you to give your email before downloading a whitepaper or other gated content, and then reach out to you to schedule a call. Our PLG motion removes that unnecessary step and allows recipients the ability to schedule a call when intent is highest. This has greatly accelerated our deal velocity and reduced time to close.

3) It keeps our CAC low: As we're seeing in the news the last few weeks, companies who relied exclusively on paid acquisition as their primary growth lever are struggling. As the cost of acquiring a customer (CAC) increases and access to growth capital dries up, CAC will be a big question every company is going to need to have an answer for as they review their finances. At Mutiny, we're able to keep our CAC low by using these PLG landing pages for both inbound (organic traffic) and outbound (ABM) traffic, both of which are cheaper growth channels than paid acquisition. This allows us to invest in our creative and content to help stand out.”

I would love to hear your feedback. Please email me at zach@wing.vc

PLG Tweet(s) of the Week:

If you were forwarded this email and are interested in getting a weekly update on the best PLG companies (private + public), please click this subscriber button below:

Recent PLG Financings (Private Companies):

Seed:

Inflection.io, a B2B marketing automation platform for product-led companies, has come out of stealth and raised $5M.

Bubbles, a contextual collaboration tool designed to communicate asynchronously, has raised $8.5M. The round was led by Khosla Ventures, Craft Ventures, Streamlined Ventures, 468 Ventures and Bain Capital.

Fullview, a customer support platform designed to improve technical support services, has raised $7.5M. The round was led by Lightspeed Venture Partners, with participation from previous investors Cherry Ventures and Seedcamp.

Highlight, a developer of NFT and SaaS-based fan engagement platform for artists and celebrities, has raised $11M at a $36M valuation. The round was led by Hone Ventures, with participation from Coinbase Ventures, Polygon Studios, Three Six Zero, DAO Jones, Mischief Venture Capital, WME Capital, Thirtyfive Ventures, Method Management, Offline Ventures, A.Capital Ventures, 1kx, SciFi VC and Floodgate Fund.

Series A:

BVNK, a London-based provider of banking services and payments for crypto-native businesses, has raised $40M at a $340M valuation. Tiger Global led the round, and was joined by The Raba Partnership, Avenir, Kingsway Capital, Nordstar, Concentric and Base Capital.

Moralis, a platform offering developer tools for web applications built on top of blockchains, has raised $40M at a $215M valuation. Coinbase Ventures, EQT Ventures, Fabric Ventures and Dispersion Capital all participated in the round.

Predibase, a low-code platform for building AI models, has raised $16.25M. The round was led by Greylock, with participation from the Factory.

Series B:

Komodor, an Israeli continuous reliability platform dedicated to Kubernetes, has raised $42M. Tiger Global led the round, with participation from by Felicis Ventures.

Series C:

Hugging Face, a community-driven machine learning platform, has raised $100M at a $2B valuation. The round was led by Lux Capital, with participation from Sequoia, Coatue, Addition and Betaworks.

Paddle, a company that has built a business out of providing the billing backend for SaaS products, has raised $200M at a $1.4B valuation. The round was led by KKR, with participation from FTV Capital, 83North, Notion Capital, Kindred Capital and Silicon Valley Bank.

Series D:

Aiven, a Helsinki-based cloud database platform, has raised $210M at a $3.2B valuation. Eurazeo led the round, and was joined by BlackRock and previous investors IVP, Atomico, Earlybird, World Innovation Lab and Salesforce Ventures.

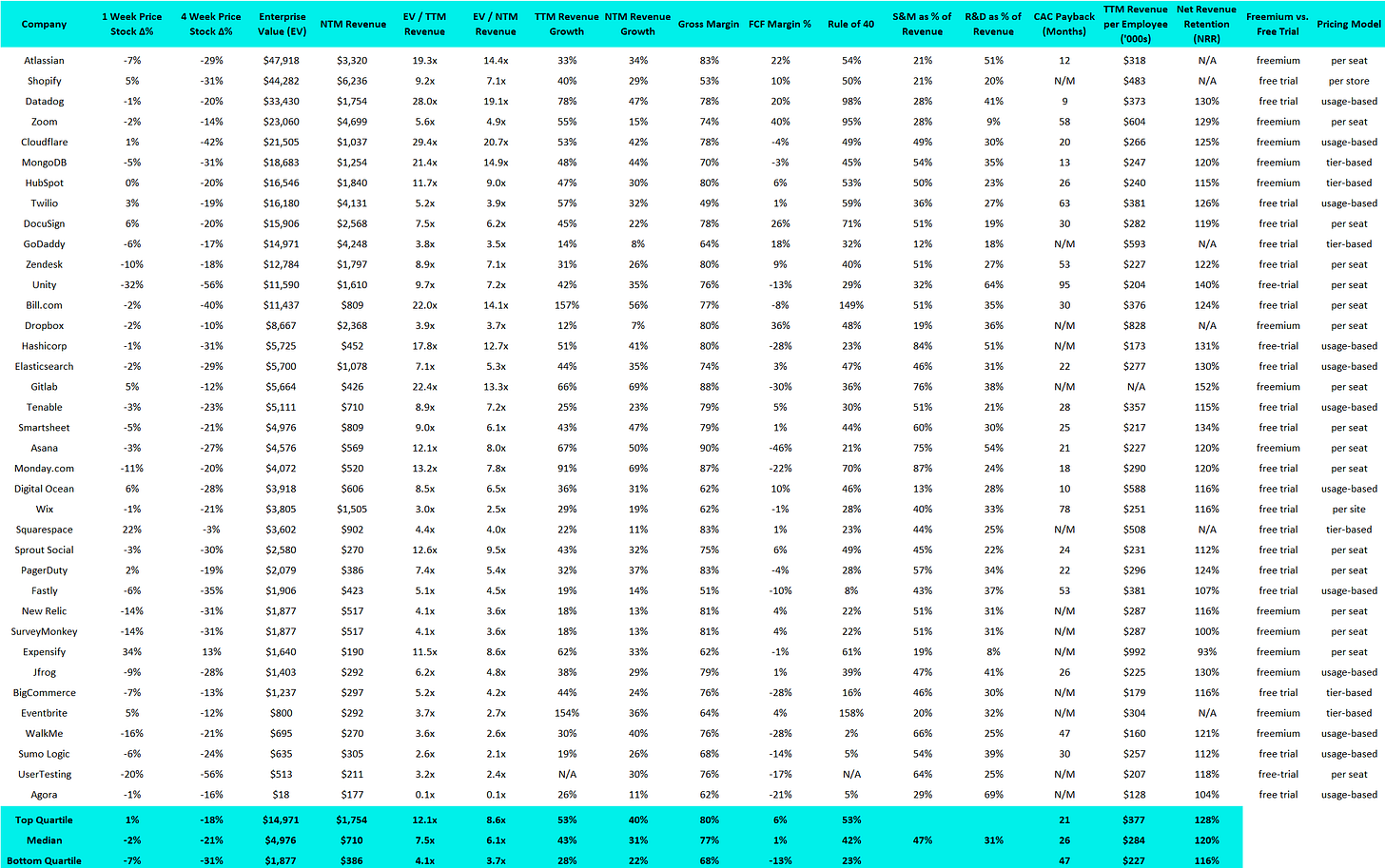

Recent PLG Performance (Public Companies):

Financial data as of previous business day market close.

15 Biggest Stock Gainers (1 month):

Best-in-Class PLG Benchmarking:

15 Highest EV / NTM Multiples:

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.