Notorious PLG 5.12.22: The Free User U-Curve

Weekly update email on the most important product-led growth ("PLG") companies and strategies

Current subscribers: 1,788

The Free User U-Curve

PLG companies have two types of users: free and paid. When first launching, founders will naturally focus on the free user expereince as they need to first prove that users love the product before monetizing. After finding product-market fit with the free product, founders shift their focus to the paid product and work to improve conversion rates from free to paid. Unfortuantely (and understandably), the free product often becomes a second class citizen relative to the paid product since paying users keep the lights on.

However, the best PLG companies continue to obsess over the free product experience. More specifically, they obsess over the free user journey. There is a magical window in time when free users are becoming hooked as they use the product more and more, but before they become bored or complacent. This is when PLG companies should encourage users to upgrade from free to paid. For some companies, this window happens days after sign up. For other companies, it is months.

So how do you determine when this magical window occurs? Here are some signs that users are climbing their way up the U-curve:

Usage increases

Discovers and uses more of the product’s features

Invites friends or colleagues

Here are some signs that the users are falling off the U-curve:

Exploration inside the product abates

Collaboration slows

Usage flattens

Some of this may sound obvious, but you’d be surprised how many PLG companies both push their users to start paying before they have had enough soak time with the product or push them to sign up to paid after they have already become bored and are ready to move on. The analogy is a pushy car salesman either bothering you before you have walked the showroom or pressuring you on the way out the door. It’s expensive and resource-intensive to convert free users to paid so study the journey of your free users, determine when they are in the magical window and focus on converting them to paid. If you forward this to your head of product or product marketer today, do they know when your company’s free users are in this magical window?

I would love to hear your feedback. Please email me at zach@wing.vc

PLG Tweet(s) of the Week:

If you were forwarded this email and are interested in getting a weekly update on the best PLG companies (private + public), please click this subscriber button below:

Recent PLG Financings (Private Companies):

Seed:

Bardeen, an application software intended to replace repetitive tasks with a single shortcut and control web applications from anywhere, has raised $18.8M. The round was funded by 468 Capital and FirstMark Capital.

Dock, an online customer management platform designed to empower companies to engage with their customers in a more personalized manner, has raised $3M. The round was led by Altman Capital, with participation from Flexport and Operator Collective.

Switchboard, a shared workspace platform designed to make teams more productive, organized, and collaborate instantly, has raised $13.8M. The round was led by Sequoia and XYZ Ventures, with participation from The General Partnership, Spark Capital and Cleo Capital.

Tactic, a crypto accounting platform that's built to save businesses time, has raised $2.6M. The round was funded by Ramp and Founders Fund.

Series A:

Graphite, a software release management platform designed to bring modern deployment practices to app development, has raised $20M at a $80M valuation. The round was led by Andreessen Horowitz.

Sleuth, a deployment tracker software designed to streamline continuous delivery of software deployment, has raised $22M. The round was led by Felicis, with participation from Menlo Ventures and CRV.

Toplyne, a company that’s automating the process of identifying promising leads and figuring out what go-to market strategies will work best for each of them, has raised $15M. The round was led by Tiger Global and Sequoia Capital India, with participation from Together Fund, Sequoia India’s Surge program, Canva, Vercel and Zomminfo.

Series B:

LinearB, a startup that helps engineering leaders optimize the workflow of their development teams, has raised $50M. The round was led by Tribe Capital, with Salesforce Ventures, Battery Ventures and 83North joining.

LottieFiles, a company that turns animations made in software like Adobe After Effects into Lotties so they can be placed in apps, has raised $37.05M at a $282.05M valuation. The round was led by Square Peg Capital, with participation from XYZ Venture Capital, GreatPoint Ventures, 500 Startups and M12.

Prisma, a startup that’s built a platform based around a server-side library that lets users write in the languages that are most intuitive to them, has raised $40M. Altimeter led the round, with Amplify Partners and Kleiner Perkins also participating.

Tailscale, a zero-trust IT security company, has raised $100M at a $1B valuation. The round was co-led by CRV and Insight Partners, with participation from Accel, Heavybit and Uncork Capital.

Traceable, a startup offering services designed to protect APIs from cyberattacks, has raised $60.18M at a $180.18M valuation. The round was led by IVP, with participation from BIG Labs, Unusual Ventures and Tiger Global Management.

Series C:

Teleport, a platform that assigns identities to hardware, software, and users to replace the need for passwords, has raised $110M at a $1.1B valuation. The round was led by Bessemer Venture Partners, with Insight Partners, Kleiner Perkins and S28 Capital joining.

Series E:

Sentry, a company that helps software developers with performance monitoring for their applications, has raised $90M at a $3.19B valuation. The round was led by BOND and Accel, with participation from NEA and K5 Global.

Recent PLG Performance (Public Companies):

Financial data as of previous business day market close.

15 Biggest Stock Gainers (1 month):

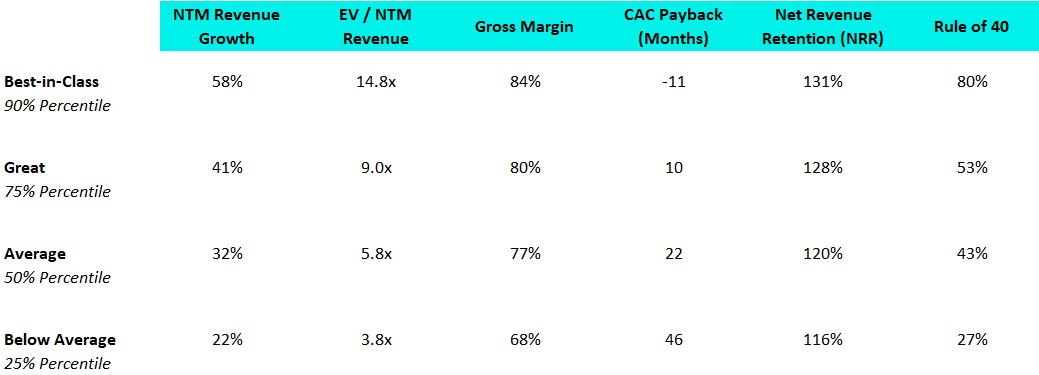

Best-in-Class PLG Benchmarking:

15 Highest EV / NTM Multiples:

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.