Notorious PLG 4.6.22: The Seed SaaS Org Chart

Weekly update email on the most important product-led growth ("PLG") companies and strategies

Current subscribers: 1,700

The Seed SaaS Org Chart

One of the most frequent questions I get from early-stage founders is “what should my org chart look like?” David Sacks wrote a nice blog post on this where he outlined what the org chart should look like for Series A, B and C SaaS companies. I largely agree with David’s post, but I wanted to augment it with what I believe the opitmal org chart is for a SaaS company at the seed stage. I have seen a few hundred org charts at the seed stage and am constantly updating my framework so please let me know your thoughts:

Seed Target — 20 Employee Org

CEO (20)

CTO (9)

Front End (3)

Back End (2)

Client Applications (1)

Core Services / Platform (1)

Dev Ops/Infra (1)

Product (2)

PM (1)

Designer (1)

Sales (2)

Sales Manager (1)

AE (1)

Marketing (3)

Product Marketing Manager (1)

Growth Marketer (1)

Demand Gen (1)

Customer Success (2)

Customer Sucess Manager (1)

Support Rep (1)

Ops (1)

This seed org chart is right before the Series A and assumes ~$5M of capital raised. My partner Peter Wagner just published an extensive blog post on early-stage financing trends for B2B companies raising from the top 21 venture firms. His analysis found that although the median seed round in 2021 was ~$4.5M, the average company raising Series A’s had raised $5.0M in 2021. With $5M of capital, it is possible to get to 20 employees assuming an average salary of ~$175K and 1.5-2 years of runway with some ramp time for hiring.

I would love to hear your feedback. Please email me at zach@wing.vc

PLG Tweet(s) of the Week:

If you were forwarded this email and are interested in getting a weekly update on the best PLG companies (private + public), please click this subscriber button below:

Recent PLG Financings (Private Companies):

Series A:

Antimatter, a startup that provides SaaS companies with the cryptographic infrastructure that can provably guarantee that a service meets their residency, governance and tenancy requirements, has raised $12M. The round was led by NEA, with participation from General Catalyst and UNION Labs.

Dagger, a program delivery platform designed to provide programmable backend service, has raised $20M. The round was led by Redpoint Ventures, with participation from Y Combinator.

Skiff, an end-to-end encrypted document collaboration platform designed to create a private and decentralized workspace, has raised $10.5M. The round was led by Sequoia Capital. Formerly featured on Notorious PLG (read more here).

Series B:

Shoreline, an automation solutions company, has raised $35M at a $135M valuation. The round was led by Insight Partners, with participation from Dawn Capital.

Series C:

Builder.ai, a low-code/no-code app development platform, has raised $100M. Insight Partners led the round, and was joined by WndrCo.

Celona, a developer of AI-powered business-critical solutions designed to meet the connectivity needs of AI and edge-compute powered apps in the enterprise, has raised $60M at a $360M valuation. The round was led by DigitalBridge Ventures, with participation from existing investors including NTTVC, Lightspeed Venture Partners, Norwest Venture Partners, Qualcomm Ventures and Cervin Ventures.

Docker, an open source containerization company, has raised $105M at a $2.1B valuation. The round was led by Bain Capital Ventures, with participation from Atlassian Ventures, Citi Ventures, Vertex Ventures, and Four Rivers.

LamdaTest, a platform that allows users to test their websites and apps on over 3,000 different combinations of browsers, operating systems and devices, has raised $45.7M at a $373.7M valuation. Premji Invest led the round, with participation from Sequoia Capital India, Telstra Ventures, Blume Ventures, Leo Capital and Sandeep Johri.

Modern Treasury, a developer of payment operations software designed to simplify and modernize business payments, has raised $50M at a $2B valuation. The round included backers SVB Capital and Salesforce Ventures, as well as new investors Artisanal Ventures and NewView Capital.

Series D:

HackerRank, a platform for recruiters to test coders, has raised $60M at a $500M valuation. Susquehanna Growth Equity led the round with JMI, Khosla Ventures, Randstad Innovation Fund and Recruit Holdings also participating.

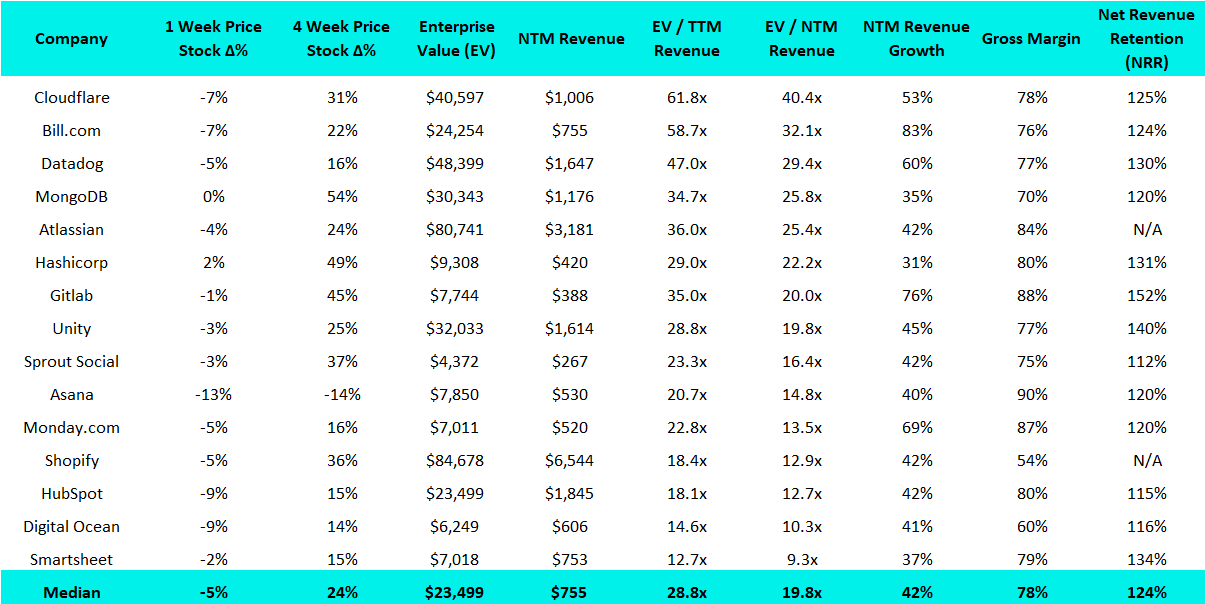

Recent PLG Performance (Public Companies):

Financial data as of previous business day market close.

15 Biggest Stock Gainers (1 month):

Best-in-Class PLG Benchmarking:

15 Highest EV / NTM Multiples:

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.