Notorious PLG 3.30.22: Who Should v1 Be Built For?

Weekly update email on the most important product-led growth ("PLG") companies and strategies

Current subscribers: 1,691

PLG Startup of the Week: Tome

Last year, I spent time researching productivity in the corporate world. The findings were scary. I wrote more about my findings here. To summarize, the corproate world has way too many meetings. According to Bain, time spent in meetings has grown 8-10% annually since 2000 and there are now 25M+ meetings per day in the US. One survey found that 46% of employed Americans would rather do anything unpleasant like stand in line at the DMV or watch paint dry than sit through another meeting of status updates. If there are ~25M meetings in the US per day and if we make a simplifying assumption that there are ~5-10 slides created for each of these meetings, then there are ~125-250M slides created per day! No surprise that there are 1B+ ative users for Google Slides.

Armed with this insight, I on the hunt for productivity tools that streamline communication. I was blown away when I met the Tome team. The founders had lived the pain point at Instagram and Facebook and were on a mission to modernize presentations and communications at work by building a storytelling tool. Tomes are magical: they require less design time, are built to be shared (both desktop + mobile), support live integrations with our favorite apps and have embedded video. Tome just launched on Product Hunt and you can sign up to the waitlist here. I put together a Tome explaning why we invested in Tome alongside Greylock and Coatue.

For this edition of Notorious PLG, Keith Peiris (CEO and co-founder) shared with me his thoughts on who to build for. I get this question a lot - what personas should we build v1 for? How do we know what these users want? Check out the Tome Keith created with his thoughts! Otherwise, I copied his thoughts below:

“When we started Tome, we placed a lot of intentionality in who we build for.

We wanted to build Tome for people like ourselves - engineers, product managers, product designers, creatives, and data scientists who need to tell great stories at work; however, don’t have time to construct a deck to tell their story well. From a founder-market-fit perspective, this felt reasonable because it’s very intuitive to build for yourself if you can practice honesty and self-awareness.

Separately, this made a lot of sense from a bottoms-up motion for the company because it’s very common for great products to get adopted by product teams (eg. Slack with engineers) and flow into the rest of the organization. Finally, we liked the idea of a product team pitching an idea in Tome, winning approval, and then sending their Tome out to everyone in the organization afterwards to expand. Once we formulated this thesis (and battle tested it), we started to design and build.

We’ve always designed Tome in a way where it could be a ubiquitous storytelling tool for everyone; but, it’s important to have focus early on. You need someone to love your product before you think about everyone needing to like it.

🤔 1 - Build something that we want to use

“Cooking is not difficult. Everyone has taste, even if they don't realize it. Even if you're not a great chef, there's nothing to stop you understanding the difference between what tastes good and what doesn't” - Gerard Depardieu

We’re our first customers and we should make sure we're willing to pay for our product.

We asked the company to use Tome for everything from product specs, design reviews, to bug bashes. When the team chose to use another tool, we asked them to explain why, in detail. We kept iterating and changing things until we consistently reached for Tome instead of other tools.

🧫 2 - Find a few more teams like us

“We are more alike, my friends, than we are unalike.” - Maya Angelou

We started reaching out to product teams and founders through friends and friends-of-friends of the company. We were able to gather a substantial amount of folks this way.

When trying out a new productivity tool - there are reasons outside of our control that can lead to churn. For example, it could be a tough time at their company and the CEO doesn’t want to see new tools, they could be under a lot of stress, or IT might clamp down on them trying something new.

With this in mind, we weren’t looking at any efficiency metrics (eg. what % of the user base did we retain) because it’s hard to separate the signal from the noise. Instead, we looked for:

Teams where Tome was thriving - understand why

Feedback from people who wanted to use it but couldn’t - prioritize features accordingly

Be really honest with ourselves about apathy - if someone didn’t use the product or want to give us feedback; is that because the tool wasn't useful enough to them?

For group 1, we empirically learned what use cases to lead with and what to replicate. For group 2, we prioritized those features because we had a belief that solving the gap would lead to more trials (and it did).

💭 Group 3 was the hardest to untangle - was the product not compelling enough to even warrant trial/feedback or were these people just too busy with their lives?

It was more art than science in understanding this group. For the ones who just couldn’t see Tome as a part of their work lives - we formed a hypothesis that the old version of Tome was too narrow to be used in enough weekly use cases. Consequently, you didn’t care enough to give us feedback on it.

We validated this by looking at the use cases that worked for group 1 - they were quite narrow.

Henri and our incredible design team started thinking about how to keep the simplicity of Tome but make it work for a much wider variety of use cases and artifacts.

We built a disposable prototype of the new idea and showed it to people. They rattled off a lot more use cases for Tome v2 than Tome v1. It was worth a shot. Also, internally, many of us couldn’t wait to use the new thing. The old thing felt too restrictive and limiting.

We’ve hired some of the best web and iOS engineers I’ve ever worked with - they worked in-tandem with our design team and built the flexible layout engine that you see today in record time.

As the current version of Tome was coming together, we started to onboard a few more teams and they instantly “got it”. The usage looked very real. Up until this point, we had ignored everything in Amplitude, we were winning over real people with real use cases and we just had to find more of those people.

📈3 - Get way more teams like us, but introduce variance

“The ability to create and use explanatory knowledge gives people a power to transform nature which is ultimately not limited by parochial factors, as all other adaptations are, but only by universal laws. This is the cosmic significance of explanatory knowledge – and hence of people” - David Deutsch

Now that we have behavior in Tome that we want to multiply AND well reasoned explanations, it seemed appropriate to get more scale. Numbers without explanation or deep understanding leads to throwing experiments against the wall and seeing what sticks.

We wanted a lot more core Tome users but needed to introduce some randomness into the system. If we surgically built just for product people, we might miss something obvious that prevents us from making a product that more people can use. I wanted ~20% of the teams we onboard to represent teachers, professors, economists, scientists, psychologists and other functions that have complex ideas to convey.

We decided to tackle this by investing in some channels that brought us our core demographic (eg. Product Hunt, investor blogs) and do some work into broader channels (eg. mainstream media, thought leaders with broad reach).

It worked! We blew through our sign up goals in quality, volume, and variance. The team is now building self-serve to catch up. The early usage looks really promising.

I’m glad we took the time to build personal conviction in the product before looking at numbers because it gave us the confidence and the hypotheses to see through them when needed. 🙏”

Please email any Notorious PLG of the Week suggestions to me at zach@wing.vc

PLG Tweet(s) of the Week:

If you were forwarded this email and are interested in getting a weekly update on the best PLG companies (private + public), please click this subscriber button below:

Recent PLG Financings (Private Companies):

Series A:

Casual, a financial platform designed to build models, visualize data, and communicate with numbers, has raised $20M. The round was led by Coatue and Accel.

Finally, an accounting and finance automation startup for small businesses, has raised $95M in equity and debt funding. PeakSpan Capital led the equity tranche, and was joined by Active Capital, 500 FinTech and GTMfund Clear Haven Capital. Clear Haven Capital provided the debt facility.

Weglot, a French startup building a translation tool for websites, has raised $50M. Partech funded the round.

Series B:

Hex, a startup that has created a data science collaboration platform, has raised $52M at a $352M valuation. Andreessen Horowitz, Snowflake, Databricks, Redpoint and Amplify Partners all participated in the round.

Series C:

Astronomer, a Cincinnati-based data orchestration platform, has raised $213M. Insight Ventures led the round, and was joined by Meritech Capital, Salesforce Ventures, Sutter Hill Ventures, Venrock and Sierra Ventures.

Digits, a startup that is building accounting software, has raised $65M. SoftBank’s Vision Fund led the round, with 20VC Growth, GV and Benchmark also participating.

Series D:

RapidAPI, an API management and connection provider, has raised $150M at a $1B valuation. SoftBank led the round, and was joined by Citi Ventures, Qumra Capital, Andreessen Horowitz, M12, Viola Growth, Green Bay and Grove Ventures.

Recent PLG Performance (Public Companies):

Financial data as of Friday market close.

15 Biggest Stock Gainers (1 month):

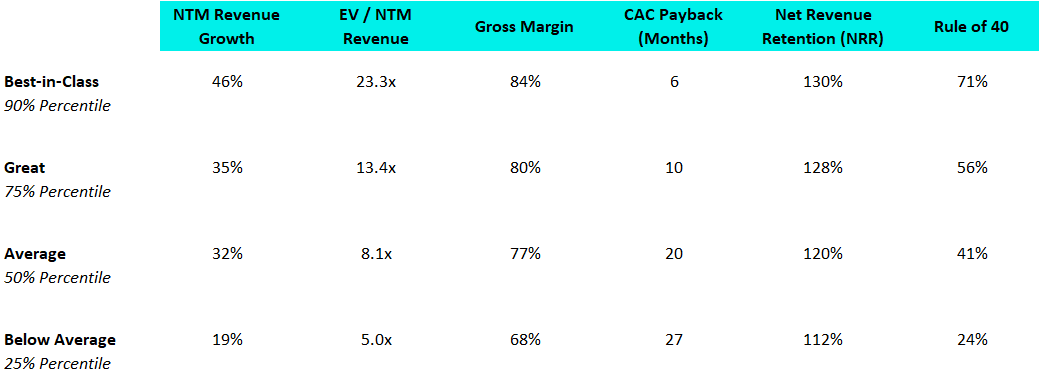

Best-in-Class PLG Benchmarking:

15 Highest EV / NTM Multiples:

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.