Notorious PLG 1.25.22

Weekly update email on the most important product-led growth ("PLG") companies and strategies

Current subscribers: 1,495

Notorious PLG Startup of the Week: Arcade

Two of the foundational tenants of product-led growth are focus on the end user and immediate product value. These are both easier said than done. How do you help a prospective customer experience product value when they land on your website? Pictures and animated visuals certainly help, but there is often a gap between a user’s understanding of product value and the website experience. Enter Arcade.

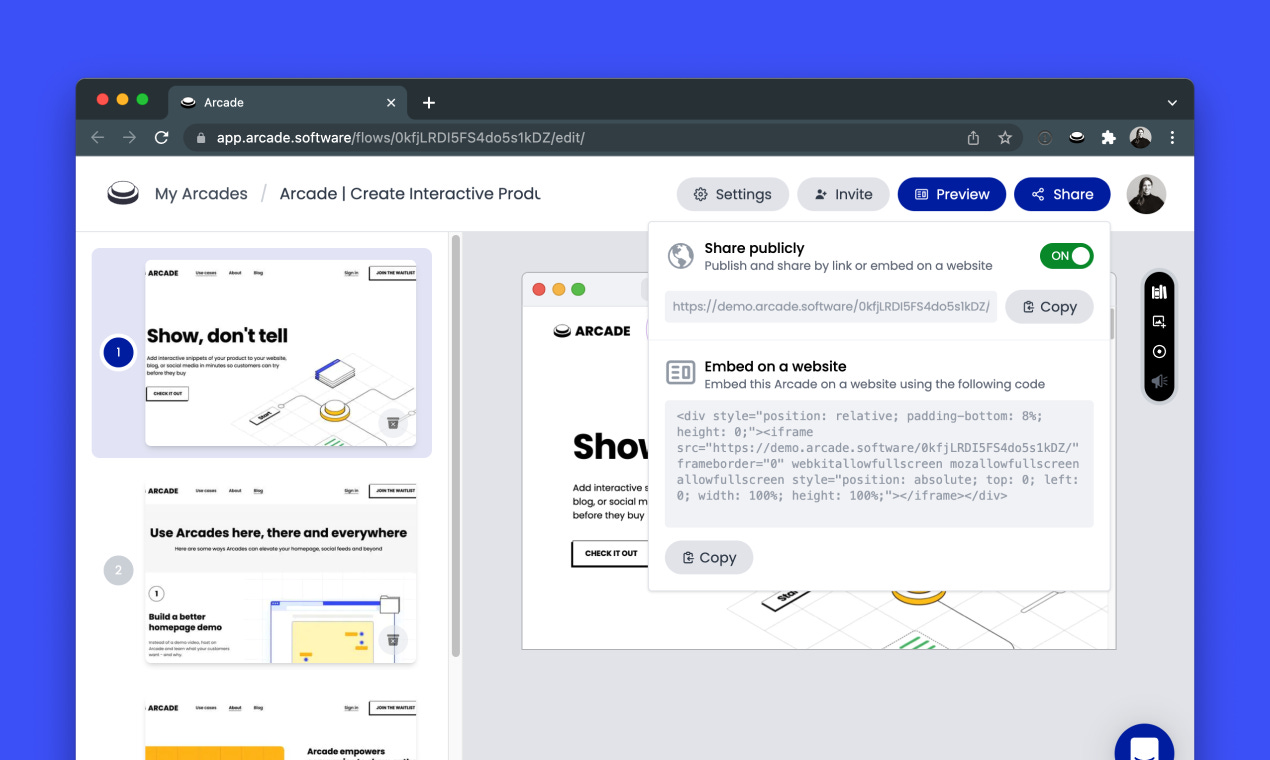

Arcade elevates the homepage, social feeds and blogs by allowing teams to integrate interactive experiences in minutes. The key word here is interactive. In my view, Arcade is a next-generation demo experience for users to actually interact with the product on the website without having to download anything. This is a powerful concept. Arcade provides an analytics suite for teams to understand and A/B test their interactive experiences. I love startups that will enable the next generation of PLG businesses and Arcade is doing that and more.

For this edition of Notorious PLG, CEO and Co-founder Caroline Clark shared her thoughts with me on Arcade’s transition from waitlist to self-service:

“My cofounder (Rich Manalang) and I joined Atlassian during its growth stage. Back then, Atlassian had around 500 employees and a few million in ARR. Since then, it’s grown to 8,000 employees and $2B in revenue.

Atlassian was one of the pioneers of product-led growth. The secret was simple: offer a great product at a relatively low price in an efficient way (through self-service). Customers who wanted extensive onboarding and customization were outsourced to consultants (who were called Atlassian experts).

Beyond the mechanics of GTM, there’s been a bigger cultural shift happening in the past few years — users want to be empowered to know what they are buying, and on fair terms without negotiation. Products need to be great. Today, there’s an incredible opportunity to build software companies (more capital, more talent, more infrastructure such as Firebase/Vercel to spin up new products), but also less margin for error (more competition).

We started Arcade in 2021 to help power this new product-led growth economy. Today, we have an interactive demo product. We launched a week ago after six months of development, and already have hundreds of published demos with >100 customers, including Carta and Productboard. We have seen significant improvements in user engagement, feedback and conversion for these companies.

What I thought I would dive into today for this newsletter is one of the bigger decisions that I face as a founder: when do we go self-service? Recently I’ve been asked this question by a few other founders, so I imagine this is a common question.

First, I want to establish that going self-service for us is a matter of when, not if. We believe in Atlassian’s GTM motion. Our product is very user friendly, and we purposely went this route so that anyone can adopt it without us needing to be in the room (or...Zoom).

The bigger question for us is when. When we first started with our MVP, we needed to learn directly from the customer about what they wanted and needed. It wasn’t appropriate for us to share a self-service version of the product at that point because it simply wasn’t ready. We learned a ton from these early adopters through multiple Zoom calls and Slack conversations.

Around ~100 leads into our waitlist, we started broadening the pool. I went from cherry picking to reaching out to every user to have an onboarding call. That increased our data set some more.

Then, a few months in, we noticed that the calls were getting really short and the only reason people were jumping on them was so that we could give them the product. Concurrently, we noticed that questions over Slack were getting fewer. The waitlist at this point also meant that we were not able to onboard everyone through Zoom. I decided then to beta test self-service. For certain users who didn’t represent large companies, I emailed them an Arcade account and learned through their product usage and feedback what parts of the self-service product experience were intuitive, and what we needed to invest in.

There was a pivotal moment in December 2021. We were preparing for our launch in January 2022, and we debated as a team whether to keep the waitlist or go self-service. We had a long list of pros and cons, but at the end we decided to bite the bullet and try out, at volume, this self-service thing.

This accelerated some changes in parts of our onboarding experience that we hadn’t paid attention to historically. Product-wise, this meant that we added some specific tips in the product for an ideal viewer experience. We added Intercom so that users can easily ask us questions. We invested a lot in content, including a rebranded website, a demo video, and new example Arcades. The example Arcades were also added to our documentation and the initial email we send to new users.

Finally, we decided to cap the self-service signups at a fixed number. This was primarily driven by the fact that we are still a tiny team of three (we are hiring though!).

Going forward, our plan is to add a batch of users from our waitlist (~100 per batch) after each major product change to see if it makes an improvement to our north star product KPI goal.

This is still an experiment, and we will continue to learn as we go. I’d love to return to this post in a year with a full report on how batch processing went.

Feel free to check out Arcade, and if you mention you are a Notorious PLG user, you can jump the waitlist ;)”

Please email any Notorious PLG of the Week suggestions to me at zach@wing.vc

PLG Tweet(s) of the Week:

If you were forwarded this email and are interested in getting a weekly update on the best PLG companies (private + public), please click this subscriber button below:

Recent PLG Financings (Private Companies):

Seed:

CodeSee, a startup that is building a set of tools to help developers understand how all the parts of a code base fit together, has raised $7M at a $18.2M valuation. The round was led by Wellington Access Ventures, Plexo Capital and Menlo Ventures.

Series A:

Softr, a no-code web-app building platform, raised $13.5M at a $57.9M post-money valuation led by FirstMark Capital.

Prophecy, a low-code data engineering platform for enterprise data teams, has raised $25M. Insight Partners led the round, with participation from SignalFire, Dig Ventures and Berkeley Skydeck.

Dovetail, a researcher-focused software company, has raised $63M at a $700M valuation led by Accel.

Series B:

Appcues, a startup building technology to identify onboarding issues and then provide low-code, non-technical solutions to fix them quickly, has raised $32.1M at a $147.1M valuation. The round was led by NewSpring, with participation from Columbia Partners, Sierra Ventures and Accomplice.

Juro, a legaltech startup developing a browser-based contract automation platform, has raised $23M. Eight Roads led the round, and was joined by Union Square Ventures, Point Nine Capital, Seedcamp and Taavet Hinrikus.

SaaS Labs, a startup that has an automation platform for sales and support staffs at small to midsize companies, has raised $42M. Sequoia Capital India led the round, with participation from Base 10 Partners, Eight Roads Ventures, Anand Chandrasekaran and Allison Pickens.

Walnut, a business platform intended to improve sales experiences, has raised $35M. The round was led by Felicis Ventures with participation from NFX, Eight Roads Ventures and A Capital.

Series C:

1Password, a provider of password management software, has raised $620M at a $6.8B valuation. Iconiq led the round, and was joined by Tiger Global, Lightspeed Venture Partners, Backbone Angels and Accel.

Clockwise, a time management and smart calendar tool, has raised $45M at a $300M valuation. The round was led by Coatue, with participation from Atlassian Ventures, Accel, Greylock Partners and Bain Capital Ventures.

Spendesk, an all-in-one expense management solution designed to streamline the tedious admin associated with spending and managing money at work, has raised $114M at a $1.29B valuation. The round was led by Tiger Global.

Recent PLG Performance (Public Companies):

Financial data as of Friday market close.

15 Biggest Stock Gainers (1 month):

Best-in-Class PLG Benchmarking:

15 Highest EV / NTM Multiples:

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.