Notorious PLG 11.9.21

Weekly update email on the most important product-led growth ("PLG") companies

Current subscribers: 1,294

Notorious PLG Startup of the Week: Coda

We have all experienced the explosion of SaaS application adoption in the workplace. Although productivity apps are designed to make us faster and more efficient, when we use too many of them, they can slow us down by requiring us to context switch too frequently. It becomes dizzying to go back and forth between documents, sheets, wikis, messaging apps etc. Enter Coda. Coda is a powerful, all-in-one platform that bundles together documents, spreadsheets, and niche workflow apps to get things done. Coda powers companies like Figma, Uber, Square and Robinhood to run meetings, decide on product roadmaps and coordinate product sprints. I often refer PLG founders to Coda for inspiration as I think their Starter Kits and Galleries are a masterclass in delivering immediate value. For document applications, there is typically a cold start problem. Not with Coda. With Coda, a team can quickly adopt a template from a top company like YouTube or Uber. These out-of-the-box frameworks and best-practice templates reduce setup cost and friction for new users.

For this edition of Notorious PLG, Shishir Mehrotra (CEO + Co-founder) shared his thoughts on PLG with me:

“Some of our biggest learnings around product-led growth centered on user observations we made a few years ago, which have had long-lasting effects. At a high level, our product decisions are designed to align our own values with our user’s values and what’s important to them. One of the best examples of this is the way we encourage makers—those who use and create docs—to share docs outside of their team by publishing docs in the doc gallery. In turn, people come to Coda’s gallery to find ideas and adapt solutions to their own needs, or to get inspired by someone else’s perspective. But it took us a while to get there.

Doc gallery as a teaching tool

Back in 2016 and 2017, we attempted to teach people Coda by showing them every building block in the product. But that strategy was not effective for all types of learners. Early adopters were willing to learn the product end-to-end, but others just wanted to solve a problem. At the same time, we noticed that our early adopters took tons of pride in what docs that built for their teams, and were willing to share with wider audiences.

So we built our first template gallery in 2017 to see if others would be enthusiastic about sharing ideas, best practices and docs. The response was solid, but there were too many friction points and problems with the gallery that we still needed to address. Despite the shortcomings, research showed we had developed a valuable way for makers to teach others via docs.

Doc gallery as a flywheel

About a year later, we started worrying about expanding our user base beyond just early adopters, and we were also concerned about our top-of-funnel growth. As a company, we had very ambitious targets and we needed to create a flywheel of growth at the top of the funnel.

Around this time, we noticed that makers who were using the product to transform a company process were critical anchors for our go-to-market efforts. As an example, a team at Uber used Coda to run a significant redesign of the driver app. It helped anchor our building blocks in solving real world problems.

Based on these insights and informed by some observations from my time at YouTube, we formed a plan for a new flywheel. The concept was that makers publishing their ideas, along with how they actually implemented those ideas, could form a critical new flywheel for the business. With Coda, you could go from philosophy to implementation, and with the gallery, any user could copy the doc and try it out for themselves.

The new flywheel would enable us to sustain aggressive top-of-funnel lead goals by organically getting people interested in solutions that other people had built using Coda. At the same time, it would demonstrate the true breadth and depth of what people can create with Coda, making it a true destination to explore ideas.

This plan led us to relaunch our gallery. In addition to lots of product changes, we re-oriented our go-to-market team to support makers who were building interesting and useful docs. In about less than a year, this new flywheel was driving more than half of our sessions. Today, it remains an incredibly important driver of our business, and we just announced plans to create an entire ecosystem from this gallery, where makers can sell what they create and publish. This is just the beginning of a new set of use cases for the gallery and our product, where no solution will be too unique or bespoke.”

Please email any Notorious PLG of the Week suggestions to me at zach@wing.vc

PLG Tweet(s) of the Week:

If you were forwarded this email and are interested in getting a weekly update on the best PLG companies (private + public), please click this subscriber button below:

Recent PLG Financings (Private Companies):

Series A

Lumigo, a SaaS platform that helps companies monitor and troubleshoot serverless applications, raised $29M led by Redline Capital Management. Meron Capital, Grove Ventures, Pitango Venture Capital, Vertex Ventures US and Wing Venture Capital also participated.

Merge, a company providing one API to integrate with all HR, payroll, recruiting, and accounting platforms, raised $15M led by Addition. NEA, Jean-Denis Greze, Alex Solomon, Harry Stebbings, Packy McCormick, Cristina Cordova, Eric Glyman, Joshua Browder, Oliver Jay, Daniel Marashlian and Michael Martocci also participated in the round.

Velocity, a platform to increase R&D velocity by allowing developers to create on-demand, fully isolated production-like environments, raised $17M at $59M post through a combination of debt and Series A funding. The round was led by Insight Partners. Greycroft, Hetz Ventures, Danny Grander, Nadir Izrael, Yevgeny Dibrov, Abhinav Asthana, Ben Bernstein, Dan Fougere, Prashanth Chandrasekar and Elik Eizenberg also participated.

Whimsical, a unified workspace for thinking and collaboration, raised $30M led by Accel. Basis Set Ventures and other undisclosed investors also participated in the round.

Series B

Apollo.io, a sales intelligence and engagement platform, raised $32M led by Tribe Capital, with participation from NewView Capital and existing investor Nexus Venture Partners.

Contra, a professional network for independent workers, $30M at $180M post led by NEA, with participation from Unusual Ventures and Cowboy Ventures.

Gather, a startup building a virtual universe which improves how people connect, communicate, and interact online, raised $50M from Sequoia Capital and Index Ventures. Other undisclosed investors also participated in the round.

Growth

OctoML, a startup that helps enterprises optimize and deploy their ML models, raised $85M Series C at $825M post led by Tiger Global Management. Previous investors Addition, Madrona Venture Group and Amplify Partners also participated.

HoneyBook, a client experience and financial management platform for independent business owners, raised $250M at $2.5B post led by Tiger Global Management. Citi Ventures, Durable Capital Partners, OurCrowd, and Norwest Venture Partners also participated in the round.

When I Work, a messaging platform that lets hourly workers employed by a business sign up for shifts, trade shifts with colleagues and let management and others know when they cannot make it to a shift, raised a $200M growth round from Bain Capital.

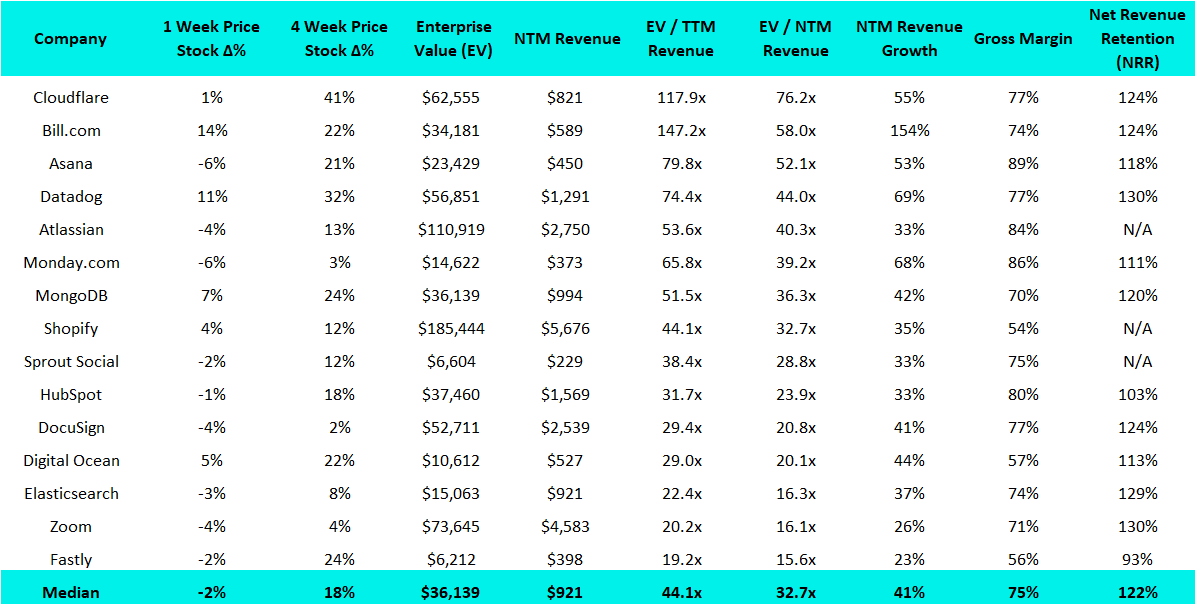

Recent PLG Performance (Public Companies):

Financial data as of Friday market close.

Biggest Stock Gainers (1 week):

BigCommerce: 27%

Jfrog: 19%

Bill.com: 14%

Biggest Stock Gainers (1 month):

Cloudflare: 41%

Datadog: 32%

Squarespace: 26%

Enterprise Value / TTM Revenue:

Top quartile: 44.1x

Median: 20.1x

Lower quartile: 10.2x

Enterprise Value / NTM Revenue:

Top quartile: 29.8x

Median: 15.2x

Lower quartile: 7.4x

Rule of 40 (TTM Revenue Growth % + FCF Margin %):

Top quartile: 50%

Median: 40%

Lower quartile: 26%

Median % of Sales:

S&M: 45%

R&D: 31%

G&A: 20%

Net Revenue Retention:

Top quartile: 128%

Median: 121%

Lower quartile: 113%

GM-Adjusted CAC Payback Period (Months):

Top quartile: 18

Median: 21

Lower quartile: 28

15 Highest EV / NTM Multiples:

Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12.