Notorious: Overlooked Personas

The best founders, startups, strategies, metrics and community. Every week.

Current subscribers: 9,222, +30 since last week

Share the love: please forward to colleagues and friends! 🙏

Overlooked Personas

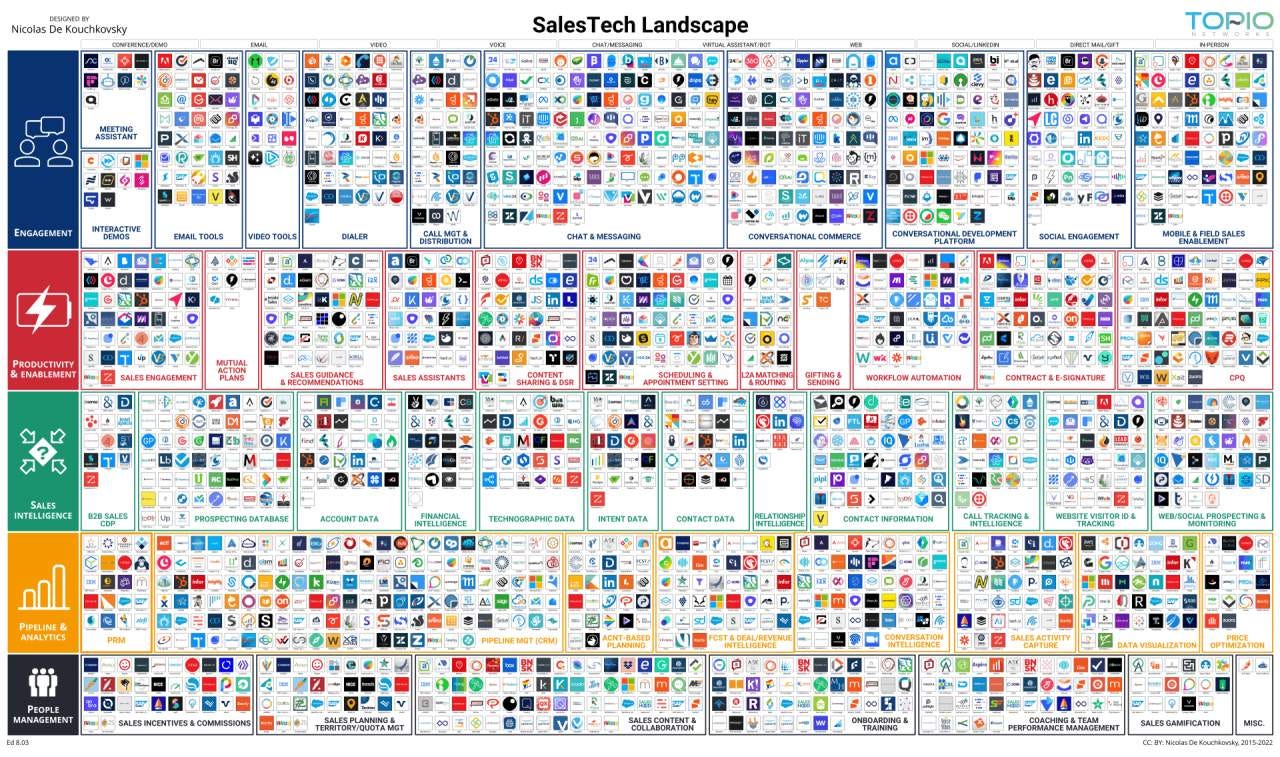

Many of the new startups I meet are determined to build products to serve either Sales/Marketing or Engineering teams. It makes sense as these are both big teams with large budgets. There is always room for innovation in these areas, especially with AI changing the tooling landscape, but these functional areas are crowded. The market maps are almost comical. Here is a market map for SalesTech tools - every logo is a different startup:

Founders should explore overlooked personas as potential product targets, as entering a company through a less crowded path opens opportunities to expand into adjacent functional groups. Here are some roles worth considering:

GTM Ops (Go-To-Market Operations): Serving customer-facing functions like Sales, Marketing, and Customer Support, GTM Ops streamline workflows and data management. Startups targeting GTM Ops present an intriguing entry point, potentially expanding to serve broader sales teams in the long run. According to LinkedIn, Sales Operation Managers are one of the 25 fastest-growing jobs in the US.

Business Development (BD) Teams: Ubiquitous in larger companies, BD teams lack modern tools compared to other functional groups. Startups can address this gap by developing dedicated research, prospecting, networking, and relationship management tools tailored for BD professionals.

Procurement Specialists: Though not traditionally considered a "sexy" target for startups, procurement represents an overlooked persona gaining attention. Specialists seek modern solutions to simplify vendor management, automate workflows, and optimize processes for efficiency and cost savings. A recent success is Zip, which is building modern procurement tools and was recently valued at $1.5B.

Other Overlooked Personas: Exploring roles such as User Research, Growth, Chief of Staff, and Compliance can also uncover untapped opportunities for innovation. By venturing into these less crowded paths, startups can carve out unique niches and pave the way for expansion into adjacent functional groups, fostering sustainable growth and differentiation in the market.

Thanks for reading. By way of background, I am an early-stage investor at Wing and a former founder. Please reach out to me on X @zacharydewitt or at zach@wing.vc. Some of the early-stage PLG + AI companies that I have the privilege to work with and learn from are: AirOps, Copy.ai, Deepgram, Hireguide, Slang.ai, Tango and Tome.

Operating Benchmarks (from PLG Startups):

I will continue to update these metrics and add new metrics. Let me know what metrics you want me to add (zach@wing.vc)

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

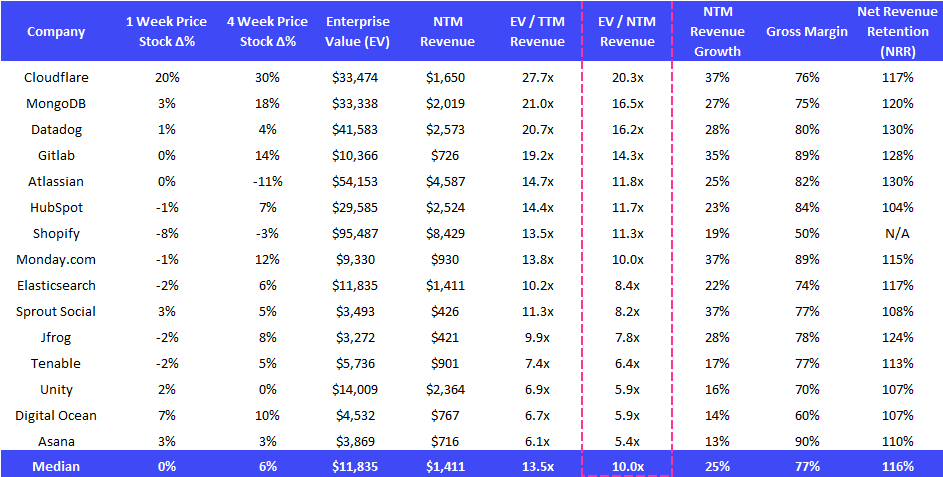

Financial Benchmarks (from PLG Public Companies):

Financial data as of previous business day market close.

Best-in-Class Benchmarking:

15 Highest EV/ NTM Revenue Multiples:

15 Biggest Stock Gainers (1 month):

Complete Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG + AI Financings:

Seed:

Mesh, a B2B professional information verification platform intended to help streamline the credibility validation process, has raised $5.7M. The round was led by Greycroft.

Vocode, an open source library for building voice-based LLM applications, has raised $3.25M. The round was funded by Gradient Ventures, Accel and Liquid2Ventures.

Series A:

Brix, an AI project management software designed to revolutionize the hiring process and optimize team's work productivity, has raised $20M. The round was led by Frees Fund, with participation from Plug and Play Tech Center.

Colossyan, a company that uses AI to generate workplace learning videos, has raised $22M. Lakestar led the round, with participation from Launchub, Day One Capital and Emerge Education.

LimaCharlie, a security infrastructure platform designed to manage cloud security, has raised $10.2M at a $45.2M valuation. The round was led by Sands Capital, with participation from Lytical Ventures, Long Journey Ventures, StoneMill Ventures, CoFound Partners, Myriad Venture Partners, IronGate Capital Advisors, and Strategic Cyber Ventures.

Mechanical Orchid, an SF-based workload modernization startup, has raised $24M at a $95M valuation. Emergence Capital Partners led the round, and was joined by Industry Ventures, Spider Capital, Bloomberg Beta, Cendana Capital and Webb Investment Network.

Upstash, a serverless data platform designed for durable storage, has raised $10M. The round was led by Andreessen Horowitz.

Series B:

Ambience, a company that has developed what it describes as an “AI operating system” for healthcare organizations to help clinicians complete the substantial administrative work required of them, has raised $70M at a $300M valuation. Kleiner Perkins and OpenAI’s Startup Fund led the round, with Andreessen Horowitz and Optum Ventures joining.

Synthetaic, a startup developing tools designed to automate the analysis of large datasets, namely satellite imagery and video, has raised $15.9M at a $100M valuation. The round was led by Lupa Systems and TitletownTech, with participation from IBM Ventures and Booz Allen Hamilton.

Series C:

Zededa, a startup that makes enterprise computing tools, has raised $72M at around a $400M valuation. Smith Point Capital led the round, with participation from Lux Capital, Almaz Capital, Coast Range Capital and Juniper Networks.