Notorious: OpenAI’s Revenue Breakdown (A Closer Look)

The best founders, startups, strategies, metrics and community. Every week.

Current subscribers: 9,916, +49 since last week

Share the love: please forward to colleagues and friends! 🙏

OpenAI’s Revenue Breakdown (A Closer Look)

Recently, it was reported that OpenAI’s annualized revenue is approaching $3.4 billion, doubling from just six months ago. This remarkable growth trajectory highlights the increasing demand for OpenAI's innovative products. Based on recent estimates, here is a breakdown of OpenAI's revenue streams:

55% from Consumer-facing ChatGPT Subscriptions: Priced at $20 per month, these subscriptions form the largest revenue bucket.

8% from ChatGPT Teams: At $25 per month, this tier caters to collaborative use cases in smaller teams.

21% from ChatGPT Enterprise: This premium offering, costing $50 per month, serves larger organizations with advanced needs.

15% from API Sales: Businesses and developers utilize OpenAI’s API to build applications on top of its models.

Approximately 85% of OpenAI’s revenue is derived from its ChatGPT product. This significant reliance on a single product line is both a strength and a potential risk. The API business, while currently a smaller portion of the overall revenue, is arguably the most promising. It offers a stickier revenue stream with significant expansion potential as developers and businesses continue to build and scale their applications using OpenAI’s models. This contrasts with the consumer-facing chat product, which may experience higher churn rates. For comparison, Netflix and Spotify have annual churn rates of around 20-25% and 30%, respectively.

Analyzing Google Trends for chatgpt.com, there has been a noticeable increase in interest over the past few months. SimilarWeb’s traffic analysis corroborates this, showing a robust 14% month-over-month growth in web traffic to chatgpt.com. This suggests a sustained and growing user interest in ChatGPT.

Despite its current success, maintaining the $20/month price point in the face of increasing competition might be challenging. Competitors could undercut prices to attract users, potentially affecting OpenAI’s subscription base. It will be fascinating to observe how OpenAI navigates this competitive landscape and whether it can sustain its pricing strategy.

Overall, while ChatGPT subscriptions currently dominate OpenAI's revenue, the API business holds substantial promise for future growth and stability. The evolving market dynamics and user trends will be critical factors in shaping OpenAI’s continued success.

Thanks for reading. By way of background, I am an early-stage investor at Wing and a former founder. Please reach out to me on X @zacharydewitt or at zach@wing.vc. Some of the early-stage PLG + AI companies that I have the privilege to work with and learn from are: AirOps, Copy.ai, Deepgram, Hireguide, Slang.ai, Tango and Tome.

Operating Benchmarks (from PLG Startups):

I will continue to update these metrics and add new metrics. Let me know what metrics you want me to add (zach@wing.vc)

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Freemium (Self Serve):

Great: 7%

Good: 4%

Freemium (Sales Assist):

Great: 12%

Good: 6%

Free Trial:

Great: 15%

Good: 8%

Reverse Trial:

Great: 15%

Good: 8%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior Notorious episode.

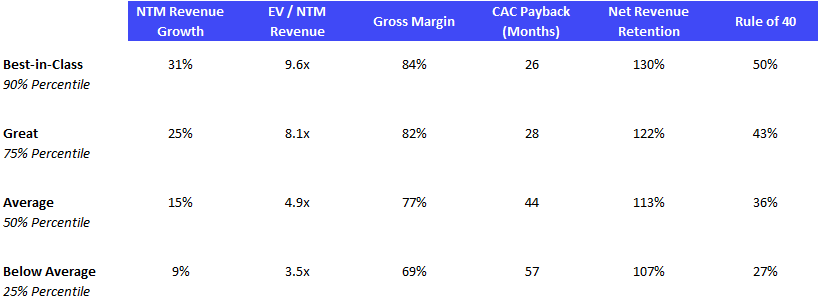

Financial Benchmarks (from PLG Public Companies):

Financial data as of previous business day market close.

Best-in-Class Benchmarking:

15 Highest EV/ NTM Revenue Multiples:

15 Biggest Stock Gainers (1 month):

Complete Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG + AI Financings:

Seed:

Ario, an AI-powered assistant for parents, has raised $16M. The round was led by Floodgate, with participation from Wing VC, Bain Capital Ventures and Moxxie Ventures.

Inventive, a startup building embedded AI for SaaS products, has raised $6.5M. The round was led by Wing VC, with participation from Tokyo Black.

Browserbase, a browser automation platform designed to run, manage, and monitor browser automation scripts, has raised $6.5M. The round was led by Kleiner Perkins, with participation from Base Case Capital and AI Grant.

CuspAI, a startup that is building an AI-driven search engine for new materials, has raised $30M. The round was led by Hoxton Ventures, with participation from Basis Set Ventures and Lightspeed Venture Partners.

Day.ai, an AI-powered conversation intelligence platform designed to offer customer relationship management, has raised $4M. The round was led by Sequoia Capital.

Emergence, a company that claims to be building an “agent-based” system that can perform many of the tasks typically handled by knowledge workers, has emerged from stealth with $97M. Learn Capital provided the funding.

EvolutionaryScale, a startup building AI models that can generate novel proteins for scientific research, has raised $142M. The round was led by Nat Friedman, Daniel Gross and Lux Capital, with participation from Amazon and Nventures.

Greptile, a startup that allows engineers to use natural language to index and search large codebases, has raised $4.1M. The round was led by Initialized Capital Management, with participation from Y Combinator.

Guide Labs, a coding interpretable foundation model intended to ease the alignment process, has raised $9.3M at a $35M valuation. The round was funded by Lombardstreet Ventures, Initialized Capital Management, Pioneer Fund and Y Combinator.

Hoop, a NYC-based provider of an AI-powered task management platform, has raised $5M. The round was led by Index Ventures, with participation from Origin Ventures, Divergent Capital, and Chingona Ventures.

Liminal AI, a data security solution designed to enable enterprises to safely interact with generative artificial intelligence, has raised $5M at a $20M valuation. The round was led by Fin Capital, with participation from Matchstick Ventures, High Alpha and Craft Ventures.

Maxim, an enterprise-grade stack for building AI applications, has raised $3M at a $13M valuation. The round was led by Elevation Capital.

OmniAI, a data transformation platform designed to convert unstructured data into useful insights, has raised $3.2M at a $30M valuation. The round was led by FundersClub, with participation from Imagination Capital.

Openledger, an AI platform designed for decentralized and verifiable data infrastructure, has raised $8M. The round was co-led by Polychain Capital and Borderless Capital, with participation from Mask Network, STIX Global, TRGC, Finality Capital Partners, Hash3, Hashkey Capital, MH Ventures and WAGMI Ventures.

Restate, a lightweight workflows-as-code platform, has raised $7M. The round was led by Redpoint Ventures, with participation from Essence VC and firstminute.capital.

Seven AI, a Boston-based startup that uses AI to help enterprises boost their defenses against cyberattacks, has raised $36M at a $100M valuation. Greylock led the round, with participation from CRV and Spark Capital.

Substrate, an AI infrastructure designed to make multi-step programs that run fast, has raised $8M. The round was led by Lightspeed Venture Partners, with participation from South Park Commons and Craft Ventures.

Synthflow, an AI voice assistant platform designed to offer cold call, answer inbound calls, and schedule appointments, has raised $7.4M. The round was led by Singular, with participation from Atlantic Labs.

Tektonic AI, a Seattle, WA-based company developing GenAI agents for enterprise processes, has raised $10M. The round was led by Point72 Ventures and Madrona Venture Group.

Thoughtly, a company building AI voice agents for contact centers, has raised $3M. The round was funded by Afore Capital, Expansion Venture Capital and Greycroft.

Tomato.ai, an artificial intelligence-based voice clarity software designed to offer more efficient agent calls, has raised $12.09M at a $25M valuation. The round was led by Recursive Ventures and Cardumen Capital, with participation from Point72 Ventures, Tribe Capital, JAZZ Venture Partners, Octave and Gaingels.

Zeta Labs, a developer of an AI assistant designed to automate routine web-centric tasks, has raised $2.9M. The round was led by Daniel Gross and Nat Friedman, with participation from Kaya VC, AI Grant and Earlybird Venture Capital.

Series A:

Aim Security, a generative AI security platform designed to offer a guide to secure GenAI adoption, has raised $18M. The round was led by Canaan Partners, with participation from YL Ventures, Operator Partners and Cyber Club London.

Decagon, a generative AI company empowering enterprise customer support, has raised $30M. The round was led by Accel, with participation from A* Capital, Neo and Andreessen Horowitz.

Factory, a company using AI to help businesses streamline coding tasks, has raised $15M at a $100M valuation. Sequoia led the round, with participation from Lux Capital and Mantis VC.

GPTZero, an AI detector software platform designed to identify text generated by AI and certify human writing, has raised $10M at a $40M valuation. The round was led by Nikhil Basu Trivedi, with participation from Uncork Capital, Reach Capital, Alt Capital and Neo.

HeyGen, an AI startup that lets users quickly create realistic-looking avatars, has raised $60M. The round was led by Benchmark, with participation from Conviction Partners, Thrive Capital, SV Angel and Bond Capital.

LegalFly, an AI copilot platform designed to amplify and refine the myriad facets of a legal professional's workflow, has raised $16.1M. The round was led by Notion Capital, with participation from Fortino Capital Partners and Redalpine.

LiveKit, a platform for building and scaling voice applications, has raised $22.7M at a $115.7M valuation. The round was led by Altimeter Capital, with participation from Redpoint Ventures.

SurrealDB, a platform that allows developers to model data using multiple different data models at once, has raised $20M. The round was led by FirstMark and Georgian, with participation from Crew Capital and Alumni Ventures.

Tembo, a scalable and secure platform designed for building, deploying, and managing a range of data services and applications on Postgres databases, has raised $14M. The round was led by GreatPoint Ventures, with participation from Venrock, Defined Capital, Cintrifuse Capital, Bearcat Ventures, Wireframe Ventures and Grand Ventures.

Twelve Labs, a company that bills itself as a multimodal AI that understands videos like humans, has raised $50M. The round was led by Nvidia, with participation from New Enterprise Associates, Radical Ventures, Index Ventures SA and Korea Investment Partners.

Series B:

Clay, an AI startup focused on sales and marketing for businesses, has raised $46M at a $500M valuation. The investment was led by Meritech Capital Partners, with participation from BoxGroup, Boldstart Ventures, First Round Capital and Sequoia Capital.

Coder, a startup that provides preconfigured, geared-toward-the-enterprise cloud environments for developer use cases, has raised $35M at a $205M valuation. The round was led by Georgian, with participation from Uncork Capital, Notable Capital and Redpoint Ventures.

Fireworks AI, a platform that lets companies access multiple AI models, has raised $52M at a $552M valuation. The round was led by Sequoia Capital, with participation from Databricks Ventures, Advanced Micro Devices, MongoDB Ventures, Benchmark Capital Holdings and Nvidia.

Hebbia, a New York-based document search AI startup, has raised $130M at a $710M valuation. The round was led by Andreessen Horowitz, with participation from GV and Index Ventures.

HerculesAI, an AI-powered automation software designed to automate time-consuming administrative tasks, has raised $26M. The round was led by Streamlined Ventures, with participation from Thomson Reuters Ventures, PROOF, Davidovs Venture Collective, Decart Ventures, Network VC, Evolution VC, Streamlined Ventures, Vision Capital Group and Hybridge Capital Management.

Mistral AI, a company that has made proprietary models designed to be repackaged as API-first products, has raised $640M at a $6B valuation. The round was led by General Catalyst and DST Global, with participation from Cisco Systems, Samsung Electronics, International Business Machines, Belfius Investment Partners, Bertelsmann Investments, Salesforce, Eurazeo, Korelya Capital, Lightspeed Venture Partners, Headline, Andreessen Horowitz, Millennium Technology Value Partners, Nvidia, Bpifrance and BNP Paribas.

Onehouse, a Sunnyvale, CA-based data lakehouse company, has raised $35M. Craft Ventures led the round, and was joined by Addition and Greylock.

Pika, a Palo Alto, CA-based text-to-video AI platform, has raised $80M at a $470M valuation. The round was led by Spark Capital, with participation from Conviction Capital, Lightspeed Venture Partners, NYX Ventures Partners, Greycroft, Makers Fund, Neo and SV Angel.

Rocketlane, an automation platform that helps enterprises better understand customer feedback, has raised $24M. The round was co-led by 8VC, Matrix Partners India and Nexus Venture Partners.

Series C:

Captions, an AI-powered video creation platform, has raised $60M at a $560M valuation. The round was led by Index Ventures, with participation from Kleiner Perkins, Andreessen Horowitz, Sequoia Capital, Adobe Ventures and HubSpot Ventures.