Notorious: How Copy.ai is Combating GTM Bloat (and Growing 3.5x+ ytd)

Notorious: the best founders, startups, strategies, metrics and community. Every week.

Current subscribers: 10,596, +71 since last week

Share the love: please forward to colleagues and friends! 🙏

Notorious Startup of the Week: Copy.ai

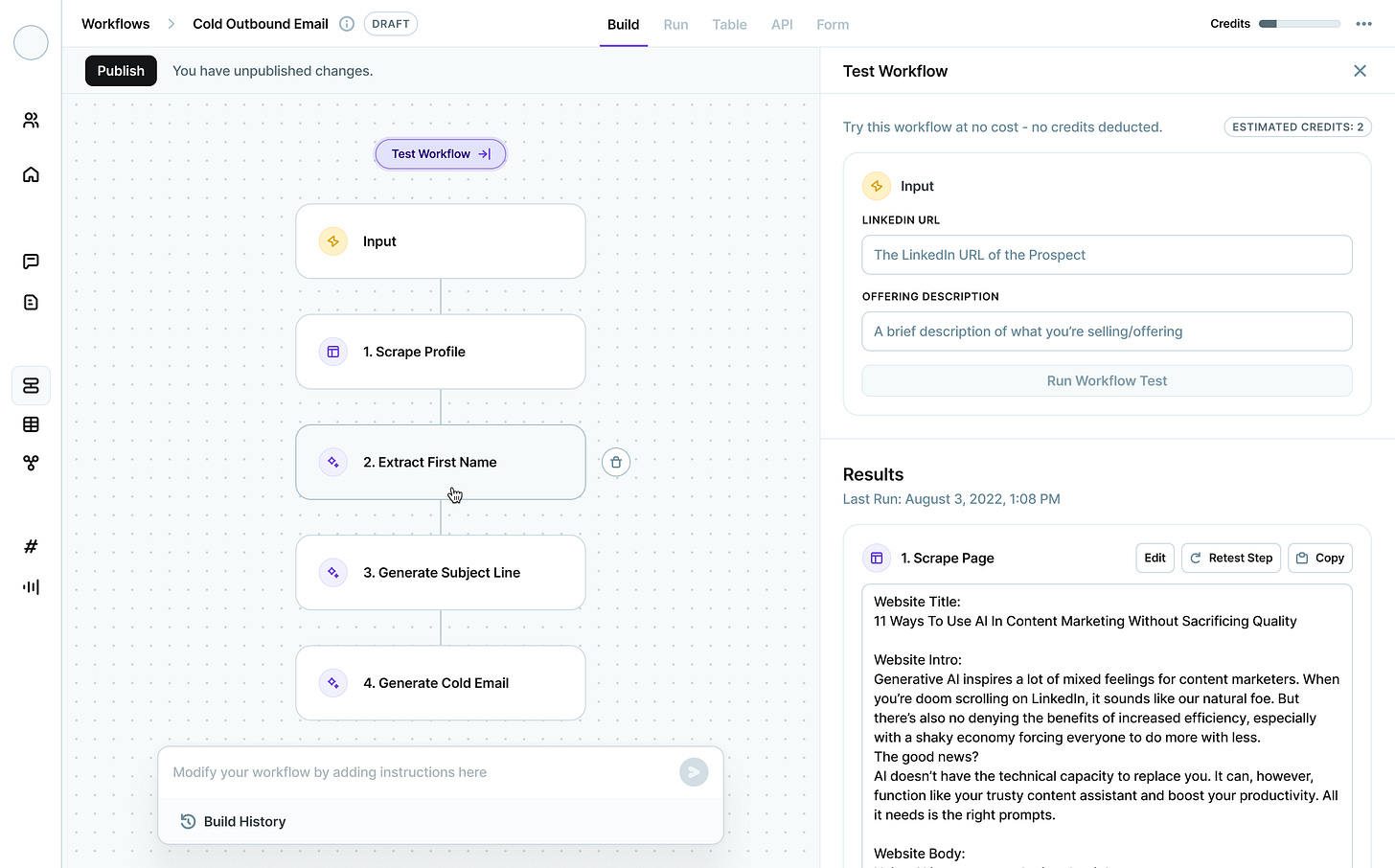

Go-to-market (“GTM”) is the lifeblood of every company. As companies scale, it becomes increasingly complex and difficult to reach the right customers with on-brand marketing when they are ready to buy. Companies create playbooks to optimize their sales and marketing processes, but these workflows are often manual and tedious. Enter Copy.ai. Copy.ai is building an AI-powered GTM platform that ingests unstructured data and orchestrates coordinated workflows. For this edition of Notorious, Copy.ai CMO Kyle Coleman shares Copy’s formula growing 3.5x in 8 months:

“Over the last eight months, Copy.ai has increased revenue by 260%, with October marking our fourth straight month of 20%+ ARR growth. During that same period, our ACVs have tripled and deal cycle times have been cut in half. This acceleration isn’t a fluke—it’s the result of a calculated master plan. A plan focused on building something bigger than just another piece of software. We’re creating the autonomous Go-to-Market AI platform—an evolving, intelligent system that gets stronger and smarter as more use cases are adopted.

Here’s how we did it: product vision, market positioning, and transformative pricing & packaging.

Initially, Copy.ai was known as a powerful tool to generate fast, high-quality copy, amassing over 17 million users. When GPT 4.0 dropped last year, we moved to the next phase of our master plan. Generative AI isn’t just about copy; it’s capable of automating entire workflows for go-to-market (GTM) teams. We had the product architecture—simple, scalable, deeply integrated. It was time to evolve. We pivoted from a chat app for copywriters to an end-to-end workflow automation platform purpose-built for GTM teams.

We quickly won some impressive enterprise customers—ServiceNow, Siemens—but “workflow automation” alone wasn’t moving the needle at the C-Suite level. We needed to strike a nerve with CMOs and CROs, addressing their most urgent and existential problems. In March, we sharpened our positioning and started evangelizing a new reality: Go-to-Market Bloat. This is the root cause of skyrocketing CACs and declining valuations. Our message was simple: if you don’t solve GTM Bloat, your company’s future is at risk. And the only weapon against it is an autonomous GTM platform powered by AI.

With this bold positioning, we were now speaking the C-Suite’s language, unlocking executive access earlier in the sales cycle. The problem was clear, but the solution needed a starting point. The prospect of a full-blown platform can seem daunting. So we engineered a targeted entry point—a wedge to get in and deliver immediate value.

We identified the highest-value use cases with the strongest market pull and designed seven targeted "wedge" packages—our Land SKUs in a classic Land & Expand strategy. Each package serves a specific executive-level problem, providing immediate ROI. And as companies adopt more SKUs, the real magic happens. Value compounds. The platform begins to operate as a true autonomous GTM flywheel—handling everything from prospecting to personalization, with intelligence that scales across the organization.

Our Solutions team ensured these wedges weren’t just packaged ideas but production-grade, hardened workflows. The pricing model is consumption-based, removing risk and fear of shelfware, while our value journey provides a clear path to expanding cross-functionally within the enterprise.

This isn’t just another SaaS product—our GTM AI platform is designed to autonomously and continuously learn and evolve as you unlock more use cases. For large, sophisticated enterprises, it’s not a matter of if you need this, it’s when. To stay competitive in a market where efficiency and intelligence are paramount, the ability to automate and scale your go-to-market strategy will determine whether you lead or follow.

The future is clear, and we’re excited to be at the forefront. The best days for Copy.ai are ahead, and we’re ready to power the GTM engine that will drive sustainable, enduring enterprise value for our customers. So excited, in fact, that we wrote the book on it. Notorious PLG readers get early access to the ebook and a free hardcover copy here: copy.ai/book

Thanks for reading. By way of background, I am an early-stage investor at Wing and a former founder. Please reach out to me on X @zacharydewitt or at zach@wing.vc. Some of the early-stage PLG + AI companies that I have the privilege to work with and learn from are: AirOps, Copy.ai, Deepgram, Hireguide, Slang.ai, Tango, Tome and Workmate.

Operating Benchmarks (from PLG Startups):

I will continue to update these metrics and add new metrics. Let me know what metrics you want me to add (zach@wing.vc)

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior Notorious episode.

Financial Benchmarks (from PLG Public Companies):

Financial data as of previous business day market close.

Best-in-Class Benchmarking:

15 Highest EV/ NTM Revenue Multiples:

15 Biggest Stock Gainers (1 month):

Complete Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG + AI Financings:

Seed:

ApertureData, a specialized database for multimodal data, has raised $8.25M. The round was led by TQ Ventures, with participation from WestWave Capital and Interwoven Ventures.

Artisan AI, a startup aiming to replace traditional sales software with AI-powered virtual employees, has raised $11.5M. The round was led by Oliver Jung, with participation from HubSpot Ventures, Day One Ventures, Fellows Fund, Soma Capital, Mento VC, CoreNest, Y Combinator and Sequoia Scout.

Aspect Build, a multi-language build and workflow management platform designed to code, review, test and build developer loops while navigating Bazel, has raised $3M. The round was led by FirstMark Capital.

Avarra, an AI-avatar-based enterprise platform intended to train human salespeople, has raised $8M. The round was led by Lightspeed Management Company, with participation from GTMFund and FirstHand Alliance.

BackOps AI, an AI-driven supply chain logistics and operations automation platform, has raised $2M. The round was led by Gradient Ventures, with participation from GV and 10vc.

Billables, an AI-powered time tracking platform designed for lawyers, consultants and professional services, has raised $3.9M. The round was led by Wing VC, with participation from F7 Ventures, SignalFire, DarkMode Ventures and Alumni Ventures.

Clerk Chat, an AI-powered conversational messaging platform for businesses, has raised $7M. The round was led by Race Capital, with participation from Soma Capital, Transpose Platform Management, Mento VC, AltaIR Capital and Hacker Fellowship Zero.

Cove, a Palo Alto-based AI collaborative visual workspace, has raised $6M. The round was led by Sequoia Capital, with participation from Homebrew and Adverb Ventures.

E2B, an open-source runtime for executing AI-generated code in secure cloud sandboxes, has raised $11.5M. The round was led by Decibel Partners, with participation from Kaya VC and Sunflower Capital.

Early, a software testing platform designed to automate coding quality checking, has raised $5M. The round was led by Zeev Ventures, with participation from Dynamic Loop Capital.

FullyRamped, an AI-powered sales simulation platform for organizations to onboard, train, and up-skill sales representatives, has raised $2.3M. The round was led by MaC Venture Capital, BoxGroup and NOMO Ventures, with participation from Greylock and Sequoia Capital.

Infactory, a generative AI-based fact-checking search engine, has raised $4M at a $25M valuation. The round was led by Bee Partners, with participation from A16zScoutFund, Alumni Ventures and FJ Labs.

Kapa.ai, a platform for creating LLM based chatbots that can answer developer questions about their product, has raised $3.2M. The round was led by Initialized Capital Management, with participation from Y Combinator.

Keep, a startup that leverages AI to help ops teams manage and prioritize their alerts, has raised $2.5M. The round was led by Runa Capital, with participation from Firestreak Ventures.

Kiva AI, an AI support company intended to develop specialized applications by employing human experts to label large datasets, has raised $7M. The round was led by CoinFund, with participation from Hashkey Group, PEER Venture Partners Protagonist.

Reducto, a retrieval augmented generation platform designed for users to convert documents into chunks for LLMs, has raised $8.4M. The round was led by First Round Capital, with participation from Liquid 2 Ventures, BoxGroup, Y Combinator and SV Angel.

Resolve AI, an AI software operations automation developer, has raised $35M. The round was led by Greylock, with participation from Unusual Ventures.

Strella, a startup using AI to automate and accelerate customer research, has raised $4M. The round was led by Decibel Partners, with participation from Unusual Ventures.

Tako, an AI search engine for data visualization, has raised $5.75M. The round was led by A* Capital and Abstract Ventures.

Thread AI, a composable AI infrastructure platform intended to design, implement, and manage an organization's mission-critical workflows, has raised $6M. The round was led by Index Ventures, with participation from Greycroft.

Vectorize, a platform that helps companies prepare and maintain their data for use in vector databases and large language models, has raised $3.55M at a $16.55M valuation. The round was led by True Ventures.

Vieu, an AI-powered business network for enterprise sales, has raised $11M. The round was led by Trilogy Equity Partners, with participation from Incubate Fund US and Vela Partners.

Zerve, a data science and AI development platform, has raised $7.74M. The round was led by Paladin Capital Group, with participation from Elkstone.

Series A:

Autone, an AI-powered retail inventory management platform, has raised $17M. The round was led by General Catalyst, with participation from YCombinator, Speedinvest, Seedcamp, Motier, Financière Saint James and 2100 VC.

Distributional, a startup building a platform to automate AI app and model testing, has raised $19M at a $90M valuation. The round was led by Two Sigma Ventures, with participation from NextEra Energy, Andreessen Horowitz, Operator Collective, Oregon Venture Fund, Essence Venture Capital and Alumni Ventures.

DocJuris, an AI-powered contract negotiation software, has raised $8M at a $27M valuation. The round was led by Silverton Partners, with participation from Watertower Ventures, Surface Ventures and Seed Round Capital.

Gladia, an audio intelligence API platform designed to extract, analyze, and understand data from sound, has raised $16M. The round was led by XAnge, with participation from XTX Ventures, Athletico Ventures, Roosh Ventures, Illuminate Financial Management, New Wave VC, Sequoia Capital, Cocoa Ventures, Soma Capital, Global Founders Capital, Gaingels, Mana Ventures and Motier Ventures.

Herald, a digital infrastructure provider for commercial insurance, has raised $12M at a $53.5M valuation. The round was led by Lightspeed Venture Partners and Brewer Lane Ventures, with participation from Underscore VC and Afore Capital.

Lightdash, an open-source business intelligence platform, has raised $11M at a $79M valuation. The round was led by Accel, with participation from Shopify Ventures, Operator Partners, Moonfire and Y Combinator.

Noetica, an AI-powered software platform for benchmarking deal terms, has raised $22M. The round was led by Lightspeed Venture Partners, with participation from Thomson Reuters Ventures, Bling Capital, Flybridge Capital Partners, Company Ventures and The Legal Tech Fund.

Numeric, an AI accounting automation platform, has raised $28M. The round was led by Menlo Ventures, with participation from Fifth Down Capital, Founders Fund, Access Industries, Long Journey Ventures, Friends & Family Capital, 8VC, Socii Capital and IVP.

Omnea, an AI-based procurement orchestration and supplier risk management platform, has raised $20M. The round was led by Accel, with participation from First Round Capital and Point Nine Capital.

Pydantic, an open-source data validation platform designed to validate data in Python using type hints, has raised $12.5M. The round was led by Sequoia Capital, with participation from Partech and Irregular Expressions.

Qodo (fka CodiumAI), an AI-powered coding companion designed to enhance the software development cycle, has raised $40M. The round was led by Susa Ventures and Square Peg, with participation from Firestreak Ventures, ICON Continuity Fund, TLV Partners and Vine Ventures.

Rogo, a secure enterprise AI platform for finance professionals, has raised $18.5M at an $80M valuation. The round was led by Khosla Ventures, with participation from AlleyCorp, ScOp Venture Capital, BoxGroup, Original Capital, Mantis VC and Alt Capital.

Voyage AI, a startup building RAG tools to reduce AI hallucination, has raised $20M. The round was led by CRV, with participation from Wing VC, Conviction, Snowflake, Databricks, Pear VC, Tectonic Capital, Mayfield Fund and Fusion Fund.

Series B:

11x, a startup developing autonomous digital workers that automate Go-to-Market workflows, has raised $50M. The round was led by Andreessen Horowitz.

Centaur Labs, a Boston-based health data annotation startup, has raised $16M. The round was led by SignalFire, with participation from Matrix, Accel, Susa, Omega, Y Combinator, Samsung Next and Alumni Ventures.

Decagon, an AI customer support agents developer, has raised $65M. The round was led by Bain Capital Ventures, with participation from A* Capital, Accel, BOND Capital and ACME Capital.

Galileo, a platform for enterprise GenAI evaluation and observability, has raised $45M. The round was led by Scale Venture Partners, with participation from Premji Invest.

Numa, a startup that brings AI and automation to car dealerships, has raised $32M. Touring Capital and Mitsui led the round, with Costanoa Ventures, Threshold Ventures, and Gradient also participating.

Poolside, a French developer of AI for software development, has raised $500M. Bain Capital Ventures led the round, and was joined by DST Global, StepStone Group, Schroders Capital, Premji Invest, BAM Elevate and B Capital.

Port, a platform designed to centralize multiple dev tools and workflows in a single dashboard, has raised $35M. The round was led by Accel, with participation from Bessemer Venture Partners, Team8 and TLV Partners.

Series C:

Crescendo, an augmented-AI customer experience (CX) platform, has raised $45M at a $500M valuation. The round was led by General Catalyst, with participation from Alorica and Celesta.

Series D:

Suki, a technology company that provides AI voice solutions for healthcare, has raised $70M at a $500M valuation. The round was led by Hedosophia, with participation from Venrock, Flare Capital Partners, Breyer Capital, InHealth Ventures and March Capital.

Later Stage:

OpenAI, creator of ChatGPT, has raised $6.6B in a funding round that values the company at $157B. The round was led by Thrive Capital, which invested around $1.3B; Microsoft, Nvidia, SoftBank, Khosla Ventures, Altimeter Capital, Fidelity and MGX also participated in the fundraising.

You have some of the best analysis available. The insights are sharp, actionable, and truly stand out. It’s clear that a lot of thought and expertise go into every piece, making it invaluable for anyone looking for top-tier strategic input.