Notorious: How Apollo.io Went From Nearly Out of Cash to $100M in ARR in 24 Months

Notorious: the best founders, startups, strategies, metrics and community.

Current subscribers: 10,989, +70 since last week

Share the love: please forward to colleagues and friends! 🙏

Notorious Startup of the Week: Apollo

This week, we have one of the most amazing GTM pivot stories in startups for you. Tim Zheng is Apollo's Co-founder and CEO. An engineer by trade, he founded the company in 2015 and today is leading the product's evolution to an end-to-end AI-powered sales platform. We are very grateful as Tim wrote this post exclusively for Notorious.

Apollo’s path to $100M ARR almost didn’t happen.

After a relatively smooth journey from $0 to $5M, Apollo’s growth hit a wall. By 2020, we were out of cash. Our sales-led motion wasn’t just slow—it was killing us. Our unit economics were upside down, spending $1 to acquire only $0.80 in revenue. We had six months of runway left. Morale was tanking, and our best talent was leaving. We had two options: pivot or die.

So we pivoted—hard.

We switched from a high-touch, sales-led motion to a freemium, product-led growth (PLG) model, with a self-serve product priced for SMBs. It worked. In 24 months, we tripled in size, surpassed $100M ARR, raised three more rounds, and today, Apollo’s valuation sits at $1.6B.

How We Did It: The Four Pillars of Apollo’s PLG Strategy

1. Find Your Uncontested Market

If they zig, we zag.

Before 2020, we were fighting for mid-market and enterprise deals, competing with sales tech giants. Meanwhile, we saw massive, unmet demand from SMBs and startups—they wanted an easy-to-use, all-in-one GTM platform but lacked the budget and ops teams to manage complex enterprise tools.

So we stopped chasing the mid-market and pivoted to serve SMBs with:

● $99/month pricing (vs. $10K+ annual contracts)

● Freemium, self-serve onboarding (so users could activate without talking to sales)

● A platform built for immediate value (usable from day 1 with minimal setup)

Lesson: Don't compete head-on with incumbents. Find an underserved segment and build exactly what they need.

2. Growth = NPS x Virality

In PLG, your product is the growth engine. Our key insight? Net Promoter Score (NPS) is not just a retention metric—it’s a growth metric.

Instead of forcing referrals through gimmicks (like “invite friends for credits”), we focused 100% on making the product better. As our NPS skyrocketed, word-of-mouth took off. Today:

● More than 90% of new users come from organic channels.

● Most inbound traffic is from branded search (proof of demand).

● Our viral factor compounds as happy customers fuel signups.

Lesson: The best virality play isn’t a referral program—it’s a product that people can’t stop talking about.

3. Turn Internal Data into an SEO Growth Engine

We had zero budget for paid ads or traditional content marketing, so we asked: What are our users already searching for?

Sales reps and founders were constantly looking for contact and company information—and they were already searching for it inside Apollo. We flipped this inside-out by indexing our data on Google in a growth hack we called “Discovery SEO.”

● We created millions of landing pages featuring useful contact and company data.

● These pages ranked on Google for highly relevant search queries.

● Hundreds of thousands of users found us organically—without ads.

This one growth hack generated orders of magnitude more traffic than paid ads—at zero cost.

Lesson: Your product likely has hidden SEO potential. Ask: What high-intent searches does our product already solve? Then, turn that into organic acquisition.

4. Experiment Relentlessly to Move Key Metrics

We didn’t just guess our way to growth—we applied the scientific method to increase retention by 6x—without adding features.

We focused on understanding user behavior rather than adding more features. Instead of guessing, we ran rigorous correlation analyses on what actions led to long-term retention. The key was identifying what behaviors distinguished high-retention users from those who churned, and then designing product experiences to drive those behaviors.

Mapped the funnel: Identified where users were dropping off.

Correlated behaviors with retention: Users who completed 3+ key actions (e.g., sending an email) had higher long-term retention.

Designed interventions: We nudged users toward those key actions via in-app guidance and onboarding tweaks.

Iterated weekly: We ran constant A/B tests to refine the experience.

Lesson: PLG isn’t about “big bets”—it’s about small, data-driven improvements that compound over time.

Takeaways (& How Apollo Continues to Scale)

Two years ago, we were on the brink of collapse. Today, we’re cash-flow positive and growing faster than ever. But the pivoting never really stops. The market evolves, competition shifts, and expectations rise. Staying ahead means constantly reevaluating and adjusting course.

Apollo isn’t just scaling—it’s redefining how companies grow. With AI-driven sales automation, deeper data enrichment, and an expanding ecosystem of integrations, we’re eliminating friction in the GTM process and shaping the next phase of PLG.

The game isn’t just about getting bigger; it’s about getting better. Find your market. Optimize ruthlessly. Build a product people can’t shut up about. That’s how you win.

Thanks for reading. By way of background, I am an early-stage investor at Wing and a former founder. Please reach out to me on X @zacharydewitt or at zach@wing.vc. Some of the early-stage PLG + AI companies that I have the privilege to work with and learn from are: AirOps, Copy.ai, Deepgram, Hireguide, Slang.ai, Tango, Tome and Workmate.

Operating Benchmarks (from PLG Startups):

I will continue to update these metrics and add new metrics. Let me know what metrics you want me to add (zach@wing.vc)

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior Notorious episode.

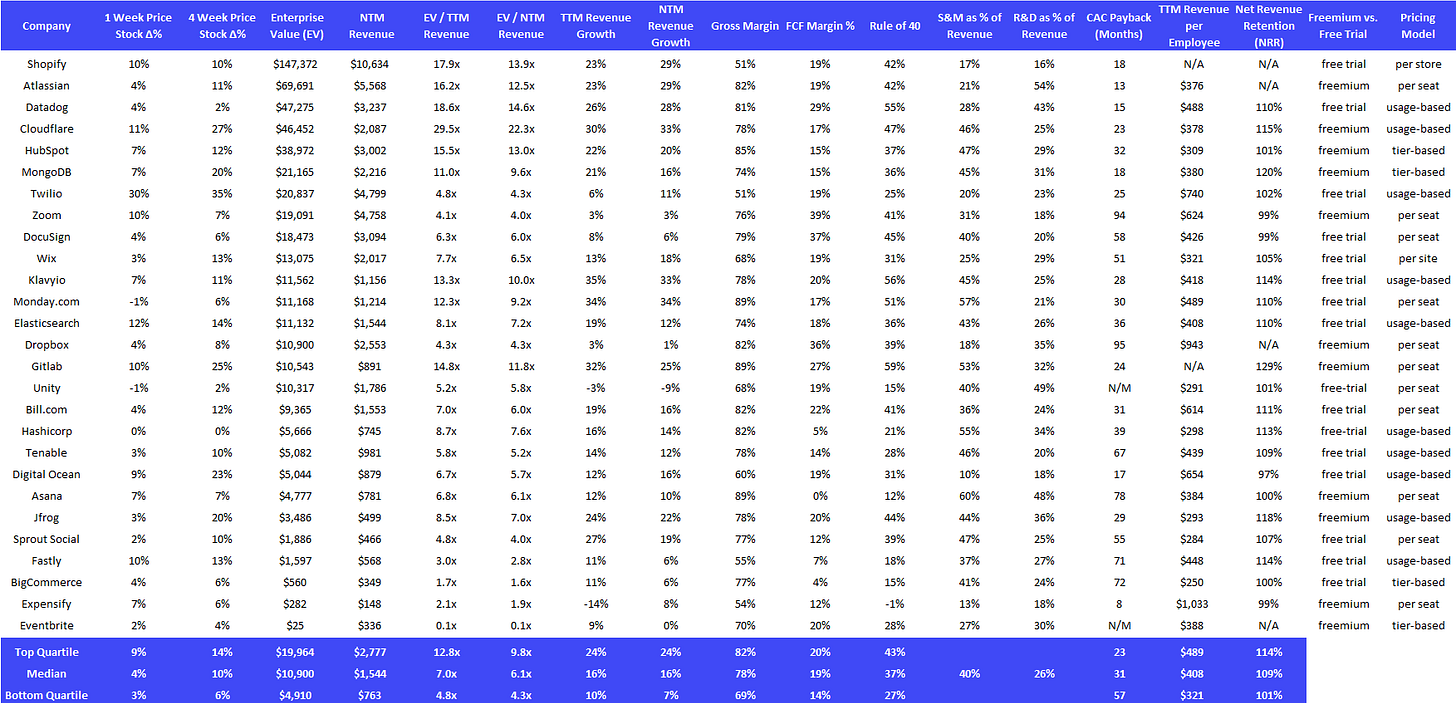

Financial Benchmarks (from PLG Public Companies):

Financial data as of previous business day market close.

Best-in-Class Benchmarking:

15 Highest EV/ NTM Revenue Multiples:

15 Biggest Stock Gainers (1 month):

Complete Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG + AI Financings:

Seed:

Arva AI, an AI-powered business verification platform designed to streamline and expedite verification for banks and fintech companies, has raised $3M. The round was led by Gradient Ventures, with participation from Olive Tree Capital, Amino Capital, 468 Capital and Y Combinator.

Atomicwork, an agentic service management solution that empowers IT teams to automate employee support and IT service management, has raised $40.07M. The round was led by Blume Ventures and Z47, with participation from Alphatron Capital, Foster Ventures, Neon Fund, Matrix and Storm Ventures.

BeHeard, an AI-based platform designed to enhance customer feedback through AI agents, has raised $5M. The round was funded by Anthropic, Ridge Ventures, Sterling Road, True Ventures and Menlo Ventures.

Boardy, an AI-driven professional networking startup, has raised $8M. The round was led by Creandum, with participation from 8VC, Precursor Ventures, Afore Capital, FJ Labs, NextView Ventures, Soma Capital and Hacker Fellowship Zero.

Borderless AI, a startup building AI agents for HR departments, has raised $32M. The round was led by SIG and Aglaé Ventures, with participation from PeopleTech Partners and Trac.

Collate, an AI-based life sciences platform intended to automate the documentation processes that slow down drug and medical device development, has raised $30M at a $100M valuation. The round was led by Redpoint Ventures, with participation from First Round Capital, Conviction Partners and Y Combinator.

Confido Health, a startup building AI-powered digital workers for the healthcare industry, has raised $3M. The round was led by Together Fund, with participation from MedMountain Ventures, Rebellion Ventures and DeVC.

Coplay, an AI copilot for game developers, has raised $1.2M. The round was led by Failup Ventures, with participation from Tower Research Ventures, Founders, Inc and Sequoia Capital.

Fazeshift, an AI-powered accounts receivable software designed to eliminate manual tasks, has raised $4M. The round was led by Gradient Ventures, with participation from Pioneer Fund, Wayfinder Ventures, Phoenix Investment Club and Y Combinator.

Grove AI, an AI clinical research agent designed to accelerate participant recruitment and engagement at scale, has raised $4.9M. The round was led by A* Capital, with participation from Afore Capital, LifeX Ventures, Pear and Upfront Ventures.

Jentic, an AI integration software intended to connect agents with application programming interfaces securely, has raised $4.19M. The round was led by Elkstone, with participation from Sure Valley Ventures, TechOperators and Shuttle.

Keye, an AI-native due diligence platform offering data analysis tailored for PE investors, has raised $3.5M at a $35M valuation. The round was funded by Syntax Ventures, DG Daiwa Ventures and Y Combinator.

Lanai, an enterprise operating system designed to assist organizations in adopting AI, has raised $10M. The round was led by Juxtapose, with participation from Lux Capital, F7 Ventures and BAG Ventures.

Orchid Security, a security platform that leverages LLMs to unify and secure complex identity environments across enterprises, has raised $36M. The round was led by Intel Capital and Team8, with participation from Capital One.

Riley AI, an AI-powered product insights assistant, has raised $3M. The round was led by Vertex Ventures US, with participation from NextView Ventures and Hyphen Capital.

Salt AI, an AI workflow orchestration firm for enterprises, has raised $3M. The round was led by Morpheus Ventures, with participation from Irregular Expressions, Calm Ventures and Struck Capital.

Tenex.AI, an AI-enabled cybersecurity platform providing managed detection and response services for Google Cloud environments, has raised an undisclosed amount of funding from Andreessen Horowitz and Shield Capital.

Early Stage:

1Up, an AI-powered knowledge automation platform for sales teams, has raised $5.25M. The round was funded by Upfront Ventures and Lightbank.

Bioptimus, a startup that is developing a foundational AI model for biology, has raised $41M. The round was led by Cathay Innovation, with participation from Hitachi Ventures, Sunrise Capital, Andera Partners, Pomifer Capital, Boom Capital Ventures, Sofinnova Partners and Bpifrance.

Dub, an open-source link management infrastructure platform designed for modern marketing teams, has raised $2M. The round was funded by OSS Capital.

nexos.ai, an infrastructure company providing a centralized platform for enterprises to integrate and manage multiple AI models, has raised $8M. The round was led by Index Ventures, with participation from Creandum and Dig Ventures.

Nilus, an AI-driven treasury management platform, has raised $10M. The round was led by Vesey Ventures and Felicis, with participation from Better Tomorrow Ventures, Bessemer Venture Partners and Cerca Partners.

Series A:

Backflip, an AI-driven design platform that turns text descriptions and photos into 3D-printable models, has raised $30M. The round was led by Andreessen Horowitz and New Enterprise Associates.

Basis, a startup developing AI agents for accounting tasks, has raised $34M. The round was led by Khosla Ventures, with participation from Better Tomorrow Ventures, BoxGroup, Avid Ventures and NFDG.

Bland AI, an AI based phone-calling platform designed for enterprise communication, has raised $59.43M. The round was led by Scale Venture Partners, with participation from ElevenLabs, Cameron Ventures, Horizon Venture Capital and Y Combinator.

Decart, a startup that helps businesses train AI models at scale, has raised $32M at a $500M valuation. The round was led by Benchmark, with participation from Sequoia Capital and Zeev Ventures.

Eve, an AI-powered platform designed to assist plaintiff law firms throughout every phase of a legal case, has raised $47M. The round was led by Andreessen Horowitz, with participation from Menlo Ventures and Lightspeed Venture Partners.

Gumloop, a no-code platform designed for automating workflows with AI, has raised $17M. The round was led by Nexus Venture Partners, with participation from First Round Capital and Y Combinator.

Raspberry AI, a generative AI platform for fashion designers, has raised $24M. The round was led by Andreessen Horowitz, with participation from MVP Ventures, Correlation Ventures and Greycroft.

Series B:

Air, a provider of creative workflow automation solutions for brands and marketers, has raised $35M. The round was led by Avenir Growth Capital, with participation from Salesforce Ventures, Good Friends and Xfund.

Anysphere, an applied research lab working on automating coding, has raised $100M at a $2.6B valuation. The round was led by Thrive Capital, with participation from Andreessen Horowitz.

Clay, a provider of AI technology designed to automate sales and marketing processes, has raised $40M at a $1.25B valuation. The round was led by Meritech Capital Partners.

Hippocratic AI, a startup building AI solutions that can handle non-diagnostic patient-facing tasks, has raised $141M at a $1.64B valuation. The round was led by Kleiner Perkins, with participation from Universal Health Services, WellSpan Health, Nvidia, Premji Invest, SV Angel, General Catalyst and Andreessen Horowitz.

StackBlitz, an instant fullstack web integrated development environment for the JavaScript ecosystem, has raised $105.5M. The round was led by Emergence and Ghosal Ventures, with participation from Madrona Venture Group, Conviction Partners and Mantis VC.

Series C:

ElevenLabs, a cloud-based AI platform that enables customers to generate synthetic speech for use in applications such as dubbing, has raised $250M. The round was led by ICONIQ Growth, with participation from Andreessen Horowitz.

Render, a cloud application platform that developers can use to deploy applications, services and websites on cloud infrastructure, has raised $80M. The round was led by Georgian, with participation from General Catalyst, South Park Commons, Addition, Bessemer Venture Partners, 01 Advisors and Avra.

Series D:

Instabase, a company that creates software for extracting and processing unstructured data from myriad document types, has raised $100M. The round was led by Qatar Investment Authority, with participation from Greylock, Andreessen Horowitz, Index Ventures and Nea.

Synthesia, an AI startup that lets businesses produce lifelike video avatars, has raised $180M. The round was led by New Enterprise Associates, with participation from GV, Atlassian Ventures, MMC Ventures, FirstMark Capital, WiL and PSP Partners.

Series J:

Databricks, an AI and data analytics firm, has raised $10B at a $62B valuation. The round was led by Insight Partners, GIC Private, WCM Investment Management, Thrive Capital, Andreessen Horowitz and DST Global, with participation from Sands Capital, Stripes, Lightspeed Venture Partners, ICONIQ Growth, MGX, Kleiner Perkins, Ontario Teachers' Pension Plan, Wellington Management, Macquarie Group and Olive Hill Group.

Later Stage:

Anthropic, a developer of a series of enterprise-focused large language models, has raised $1B. The round was funded by Alphabet.

Perplexity, the creator of an AI search engine, has raised $500M at a $9B valuation. The round was led by IVP, with participation from Nvidia, Builders + Backers, New Enterprise Associates, B Capital and T. Rowe Price Group.