Notorious: How an AI Coding Tool Scaled at Warp Speed to a $10B Valuation (Cursor)

Notorious: the best founders, startups, strategies, metrics and community.

Current subscribers: 11,340, +41 since last post

Share the love: please forward to colleagues and friends! 🙏

Cursor’s $10B Rocketship: How an AI Coding Tool Scaled at Warp Speed

Every now and then, a startup bursts onto the scene with such explosive growth that it feels like the whole tech world just got whiplash. Right now, that startup is Cursor – an AI-powered code editor that’s shot from obscurity to a $10B valuation in just a couple of years. It’s not just hype: Cursor’s revenue growth has been off the charts. We’re talking essentially zero to $100M+ ARR in about a year, with developers flocking to this “AI IDE” in droves. How did a tiny MIT-founded team pull this off, and what makes their execution so special? Let’s dive into Cursor’s rapid rise – the sharp revenue trajectory, the tactics fueling its scale, and why its playbook has VCs and founders buzzing with excitement.

Blistering Growth & a Stratospheric Valuation

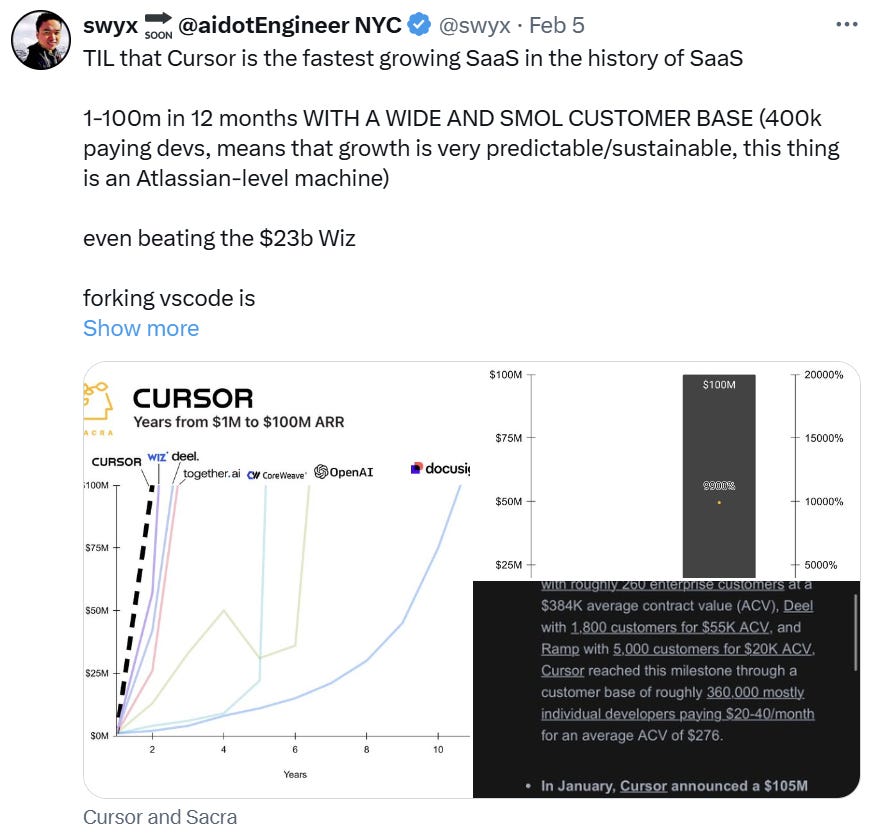

Cursor’s growth metrics read like startup fantasy. By spring 2024, the company was doing around $4M in ARR, which then exploded 12× to about $48M ARR by October 2024. And it didn’t stop there. Sources say Cursor barreled past $100M in ARR within its first 12 months on the market – reportedly making it the fastest SaaS product ever to hit that milestone (yes, even faster than ChatGPT’s meteoric climb). As of early 2025, Cursor’s ARR has already climbed to ~$200M, achieved with only a handful of team members.

Such blazing growth translated into equally impressive valuations. In mid-2024, Cursor raised a $60M Series A at a ~$400M valuation, then just four months later landed $100M at a $2.6B post-money. Now, barely another quarter later, the company is reportedly closing a new round at nearly $10B – a valuation jump that implies ~66× its current ARR. Investors are effectively pricing Cursor like a once-in-a-generation rocketship, and so far the numbers back it up. When VC firms are falling over themselves to get a piece (more on that frenzy later), you know you’ve hit a nerve.

Product-Led Growth Fueling a Developer Frenzy

So what’s behind Cursor’s breakneck scale? In a nutshell: a few savvy tactics and a product that basically sells itself:

Bottom-up adoption fueled by a frictionless freemium model: Cursor’s go-to-market strategy is a masterclass in PLG, driven by bottom-up adoption and a frictionless freemium model. Instead of a top-down sales approach, Cursor went straight to developers, offering a tool engineers genuinely love, which turned the product itself into the marketing engine. Word spread quickly, and by August 2024, Cursor had over 40,000 customers, including “cool kid customers” like OpenAI, Midjourney, Shopify, and Instacart. By early 2025, that number had skyrocketed to over 360,000 paying users, thanks to the ease of adoption: developers can start with a free trial and quickly see the value, with affordable plans priced at $20/month for pro and $40 for business. This low-friction, self-serve model means trial users seamlessly convert to paying customers, fueling rapid, sustainable growth.

A superior AI-native product experience: Cursor isn’t just an IDE with an AI bolted on; it’s an AI-first code editor built to make coding feel almost like chatting. This “vibe coding” approach – where writing code becomes a mellow back-and-forth with the AI – truly set Cursor apart. The product integrates seamlessly with developers’ existing workflow, so devs get a familiar environment supercharged with AI. It offers live autocomplete that can handle multiple files and big codebases, answer questions about your code, and refactor in seconds. In short, it delivers real “10x” developer productivity gains – enough to make even GitHub’s Copilot look over its shoulder.

Community-driven product iteration: Cursor didn’t just build in isolation – they built with their users. From day one, the team leaned into community feedback, rapidly iterating based on real-world developer needs. They actively engaged with users on platforms like Discord, GitHub, and even Twitter, fostering a loyal base that felt invested in the product’s success. This transparent, feedback-driven approach didn’t just help build a better product; it turned early adopters into vocal advocates, amplifying Cursor’s reach and reputation organically.

Riding the “Vibe” to a Category-Defining Company

Perhaps the most remarkable part of Cursor’s story is how it changed the developer experience zeitgeist. The product has made coding feel cool again – even fun. Users started talking about “vibe coding” with Cursor, describing how banging out code became more like chatting with a fellow engineer who never sleeps and knows basically everything. By eliminating a lot of the tedium, Cursor lets developers stay in a creative flow. That feel-good factor has been a huge asset; it’s not just a productivity tool, it’s a bit of a status symbol and community meme in engineering circles.

All this culminated in Cursor moving from a new kid on the block to the white-hot center of the tech zeitgeist. That’s a bold claim, but the buzz checks out – especially when you see a $9B valuation for a ~3-year-old startup and the fact that major dev tool incumbents are scrambling to catch up. Cursor’s execution so far has been nearly flawless: nailing product-market fit out of the gate, harnessing prodigious growth with a PLG strategy, and keeping the feature flywheel spinning fast enough to maintain a lead. It has turned the humble code editor into the latest arena of the AI revolution – and seized the crown in the process.

Thanks for reading. By way of background, I am an early-stage investor at Wing and a former founder. Please reach out to me on X @zacharydewitt or at zach@wing.vc. Some of the early-stage PLG + AI companies that I have the privilege to work with and learn from are: AirOps, Copy.ai, Deepgram, Hireguide, Slang.ai, Tango and Workmate.

Operating Benchmarks (from PLG Startups):

I will continue to update these metrics and add new metrics. Let me know what metrics you want me to add (zach@wing.vc)

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior Notorious episode.

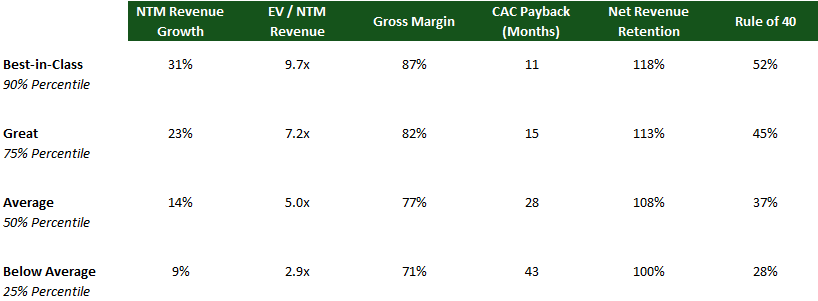

Financial Benchmarks (from PLG Public Companies):

Financial data as of previous business day market close.

Best-in-Class Benchmarking:

15 Highest EV/ NTM Revenue Multiples:

Complete Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG + AI Financings:

Seed:

Arlo Health, an AI-powered health insurance underwriter for small businesses, has raised $4M. The round was led by Upfront Ventures, with participation from 8VC and General Catalyst.

Charm Security, an AI-powered customer security platform that protects organizations and their customers from scams, social engineering, and human-centric fraud, has raised $8M. The round was led by Team8.

Paid, a business engine that helps AI agent companies accelerate growth and profitability, has raised $10.73M. The round was funded by EQT Ventures and Sequoia Capital.

ScribeHealth.AI, an AI-powered medical scribe platform designed to automate SOAP notes and medical coding, has raised $1.2M. The round was led by Better Financial, with participation from Soma Capital, Global Founders Capital and Y Combinator.

Sohar Health, an AI-driven eligibility determination and verification of benefits provider, has raised $3.8M. The round was led by Kindred Capital, with participation from General Catalyst, Character, Y Combinator, Rebel Fund and Concept Ventures.

Taxo, a data extraction and reasoning engine dedicated to healthcare administration, has raised $5M. The round was led by Character, with participation from General Catalyst and Y Combinator.

Voiceops, an AI platform intended to help call centers achieve sales efficiency, has raised $5M. The round was led by Bonfire Ventures and Twelve Below, with participation from Precursor Ventures, Not Boring, Village Global, Kearny Jackson, Mana Ventures and Four Acres Capital.

Yutori, a startup building personal AI assistants that automate everyday digital tasks, has raised $15M. The round was led by Radical Ventures, with participation from Felicis.

Ethos, an automated expert network that matches users with relevant experts using AI, has raised $3.25M. The round was led by General Catalyst, with participation from McKinsey & Company, Jane Street, Bain & Company, Conviction Partners, 8VC, Common Magic, Interface Capital, Sequoia Capital, Andreessen Horowitz, Atomico, Elliott Investment Management, The Goldman Sachs Group and SoftBank Group.

Early Stage:

Nexthop.ai, an AI infrastructure company providing networking solutions for cloud companies, has raised $110M. The round was led by Lightspeed Venture Partners, with participation from Battery Ventures, Emergent Ventures, WestBridge Capital and Kleiner Perkins.

Series A:

Arcade, a generative AI marketplace for designing physical products, has raised $25M at a $202M valuation. The round was led by Canaan Partners, with participation from Inspired Capital, Torch Capital, Factorial Funds, Forerunner Ventures, Offline Ventures, Adverb Ventures and Sound Ventures.

Automaise, a no-code AI platform built to create, deploy, and manage AI agents for customer experience automation, has raised $5.36M. The round was led by Oxy Capital, with participation from Bright Pixel Capital, HCapital and Armilar Venture Partners.

Brisk Teaching, an AI teaching and learning agent for K-12 schools, has raised $15M. The round was led by Bessemer Venture Partners, with participation from South Park Commons, Owl Ventures and Springbank Collective.

DeepIP, an AI assistant for drafting patents, has raised $15M. The round was led by Resonance VC, with participation from Headline, Serena and Balderton Capital.

Distributed Spectrum, a defense tech company developing AI-powered sensors to help the U.S. military locate enemy troops and drones by their radio emissions, has raised $25M. The round was led by Shield Capital, Conviction Partners and Nat Friedman, with participation from Xfund and Felicis.

Layer Health, a healthcare AI company leveraging LLMs to enhance chart reviews, has raised $21M at a $100M valuation. The round was led by Define Ventures, with participation from GV, MultiCare Health System, East Post Road Ventures, MultiCare Capital Partners and Flare Capital Partners.

Silna Health, a healthcare revenue cycle management platform that uses AI to manage prior authorization, benefit checks and eligibility verification, has raised $27M. The round was led by Accel and Bain Capital Ventures.

Straiker, a startup offering real-time protection for AI applications and agents with an AI-native security solution, has raised $21M. The round was funded by Lightspeed Venture Partners, Bain Capital Ventures and Rain Capital.

Series B:

n8n, an AI-powered workflow automation platform, has raised $60M at $270M valuation. The round was led by Highland Europe, with participation from Sequoia Capital, Felicis, Harpoon VC and HV Capital.

Tomorro, a legal contract management platform that leverages AI to streamline contract processes for businesses, has raised $26.9M. The round was led by XAnge, Acton Capital and Adelie, with participation from HenQ, Resonance VC, Founders Future, Motier Ventures and Financière Saint James.

Series C:

Navina, an AI copilot that provides clinical intelligence to clinicians and care teams, has raised $55M. The round was led by Goldman Sachs Asset Management, with participation from Grove Ventures, Vertex Ventures Israel and ALIVE Israel Healthtech Fund.

Later Stage:

Mercury, a fintech company that provides a banking stack for startups, has raised $300M at a $3.5B valuation. The round was led by Sequoia Capital, with participation from Marathon, Coatue Management, Andreessen Horowitz, CRV and Spark Capital.

Fantastic post Zach! 👏