Notorious: Getting Fit

The best founders, startups, strategies, metrics and community. Every week.

Current subscribers: 9,735, +37 since last week

Share the love: please forward to colleagues and friends! 🙏

Getting Fit

This week, Karri Saarinen (CEO and Co-founder of Linear) shared Linear’s headcount numbers at each financing milestone. Linear has built a beloved product and is backed by some of the best VCs including Sequoia and Accel. Through the go-go years of ZIRP, Linear stayed lean and kept its headcount growth reasonable. In 2020 when Linear raised its Series A, it has 8 employees. In 2020, the norm was for Series A companies to have 40+ employees. For perspective, in 2021, David Sacks published a blog post about the SaaS Org Chart listing the optimal 50-person org for a company that raised its Series A.

Startups are getting fit. Some teams, like Linear, were smart to start lean and remain disciplined. There are many forces driving startups getting fit:

Venture capital funding has dried up, especially in the growth-stage rounds (Series B+)

AI is increasing productivity, so teams can do more with less.

The biggest tech companies are being rewarded in the public markets for getting fit and reducing headcount. This has a trickle-down effect on startups.

Leaner orgs execute highest priorities faster (see below for Zuck’s letter):

Thanks for reading. By way of background, I am an early-stage investor at Wing and a former founder. Please reach out to me on X @zacharydewitt or at zach@wing.vc. Some of the early-stage PLG + AI companies that I have the privilege to work with and learn from are: AirOps, Copy.ai, Deepgram, Hireguide, Slang.ai, Tango and Tome.

Operating Benchmarks (from PLG Startups):

I will continue to update these metrics and add new metrics. Let me know what metrics you want me to add (zach@wing.vc)

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Freemium (Self Serve):

Great: 7%

Good: 4%

Freemium (Sales Assist):

Great: 12%

Good: 6%

Free Trial:

Great: 15%

Good: 8%

Reverse Trial:

Great: 15%

Good: 8%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior Notorious episode.

Financial Benchmarks (from PLG Public Companies):

Financial data as of previous business day market close.

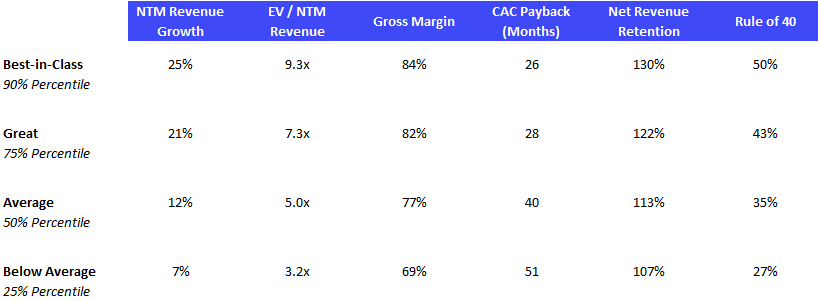

Best-in-Class Benchmarking:

15 Highest EV/ NTM Revenue Multiples:

15 Biggest Stock Gainers (1 month):

Complete Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG + AI Financings:

Seed:

Ducky, an AI-powered support platform, has raised $2.7M. The round was led by Penny Jar Capital, with participation from Bread & Butter Ventures, Wilson Sonsini Goodrich & Rosati and NOMO Ventures.

Zefi, a platform that allows companies to centralize and analyze all conversations with their end customers automatically using AI, has raised $1.73M. The round was led by 14Peaks Capital and 360 Capital, with participation from BIT, Secways Capital, Vento, B Heroes, Growth Engine, Exor, Halo Growth Ventures, and Aticco Ventures.

Zendata, a provider of AI governance and data privacy solutions, has raised $2M. The round was led by PayPal Ventures, with participation from Altari Ventures, Geek Ventures, FirstHand Alliance, Race Capital and Sputnik ATX.

Series A:

Maven AGI, an AI customer support startup, has raised $20M at a $90M valuation. The round was led by M13, with participation from E14 Fund and Lux Capital.

Series B:

xAI, Elon Musk’s AI company, has raised $6B at a $24B valuation. The round was led by Sequoia Capital, Andreessen Horowitz and Fidelity International Strategic Ventures, with participation from Valor Equity Partners, Kingdom Holding Company, Redstone VC, Flat Capital, HOF Capital, Vy Capital, Tribe Capital, Lightspeed Venture Partners, ARK Investment Management and Redefine Ventures.

There's many reasons to admire Linear, but their discipline to stay lean and avoid taking a round in 2021 (when I'm sure they could have raised oodles) stands out.