Notorious: Clay is Growing 10x y/y; Here's How!

Notorious: the best founders, startups, strategies, metrics and community. Every week.

Current subscribers: 10,105, +61 since last week

Share the love: please forward to colleagues and friends! 🙏

Notorious Startup of the Week: Clay

If you’ve experienced working with manual outbound campaigns, you know the struggle of creating prospect lists and drafting outreach from scratch. But Clay has a better way: they’ve combined over 75 data providers in a single tool to fully automate data enrichment and personalized outreach, which can save weeks or even months of work for busy Go-To-Market (GTM) teams.

Clay is experiencing one of those rare moments that startup teams dream of: They've grown 10x Year-over-Year (YoY) and now have tens of thousands of users as well as thousands of paying customers like Verkada, Anthropic, and Intercom. When Bruno Estrella joined Clay’s Growth Marketing team this year, his mission was clear: devise a strategy to propel Clay into exponential growth. Before joining Clay, Estrella was the Director of Growth Marketing at Webflow. During his nearly five years there, the company grew 20x and raised over $300M in funding.

“I learned firsthand that for a company to achieve flywheel growth, you need a growth strategy rooted in understanding your business, product, and audience,” Estrella explains.

In this post, we’ll walk through Estrella’s process for assessing his initial strategic bets at Clay.

Reflect on growth in the context of your business

As Clay set off to determine their core growth bets, they started with a framework often referred to as “The Four Fits,” or the “Market/Product/Channel/Model Fit Framework,” which was designed by Brian Balfour, the founder of Reforge.

This framework encourages businesses to think beyond product-market fit by ensuring that your product, market, channels, and monetization models are all in alignment during every phase of your business’ growth.

Let’s take a closer look at the four pillars of this framework:

Model-channel fit: The context of your business model will inform which acquisition channels you choose. For example, if your business model involves selling a high-priced direct-to-consumer product, Google Ads may not be the most effective channel.

Product-channel fit: Your product needs to fit the characteristics of your ideal acquisition channels. For instance, would your product benefit from organic channels, like social media and SEO, or from paid channels like paid social and search ads?

Model-market fit: The number of customers in your market will influence your business model. If you aim to build a centi-million dollar business and your market only has a thousand customers, your business model must rely on large enterprise deals.

Product-market fit: Pinpoint a thriving market, and position your product in a way that effectively addresses real pain points.

Consider these four pillars as we move through the rest of the post, using Clay as an example. These pillars will also serve as a baseline for you as you work your way through your own growth strategies.

Ask these 5 questions to assess your growth bets

Clay’s goal for the foreseeable future is to increase self-serve user acquisition. To determine how they could reach this goal, Clay’s team turned to four key questions inspired by the framework above.

1. What’s your business model?

Clay leverages a self-serve, product-led growth (PLG) strategy: They offer users a two-week free trial with access to all of Clay’s advanced features, CRM integrations, and high-usage thresholds. This reverse trial strategy exposes users to Clay’s full capabilities without even needing to input a credit card number, thereby simplifying the joining process and increasing the likelihood of conversion.

After the trial, Clay converts users to one of four features-based credit tiers. Clay’s pricing ranges from $0-800/month, with the first paid tier at $149/month. These tiers are designed to fit comfortably within the budgets of small and mid-sized businesses. Clay’s unique pricing model speaks directly to one of their value propositions: pay only for what you need.

This model places Clay in stark contrast with large data providers, which often face barriers to conversion due to lack of self-serve motions, opaque pricing, and high friction during onboarding and adoption.

2. What are your ideal user acquisition channels?

Since Clay’s model relies on low-friction, self-serve trials, it was crucial to leverage acquisition channels with a high volume of users who would be interested in trying Clay. The best free channels for that? Social media and SEO. The best paid channels? Search and social ads.

3. Based on your product’s characteristics, what are your ideal user channels?

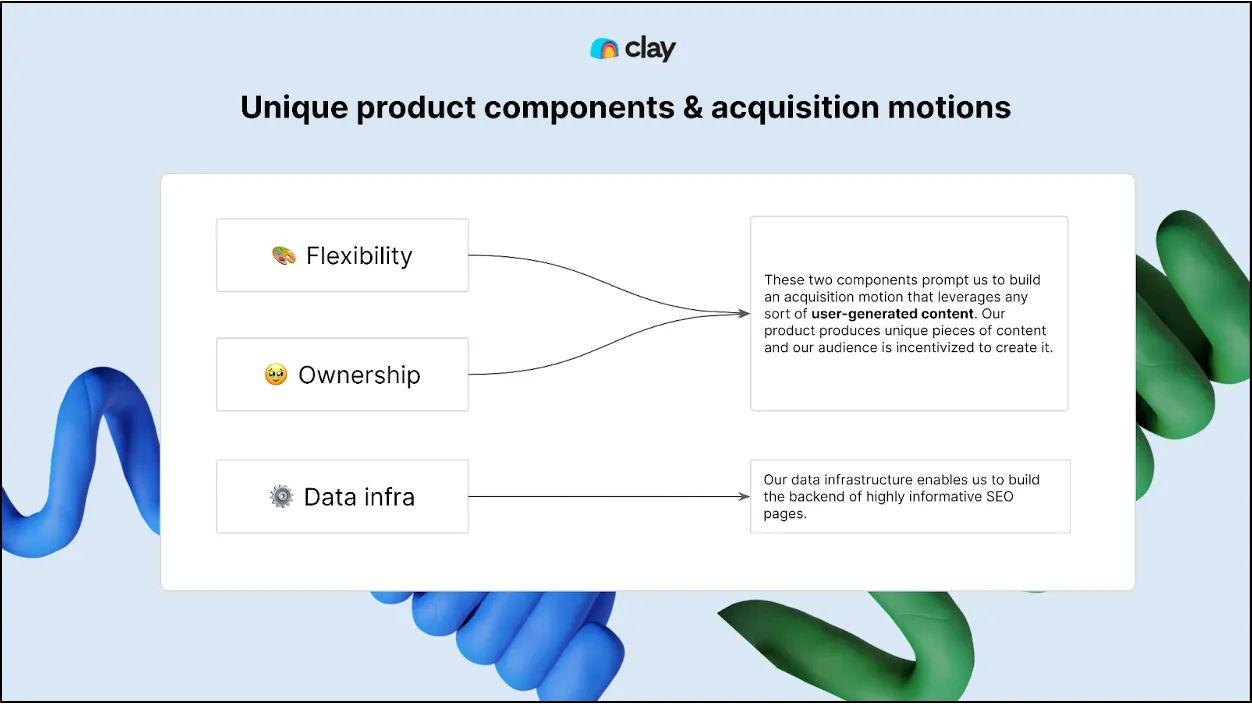

Clay’s product is highly flexible; users can use Clay to build workflows that were previously only accessible to extremely sophisticated GTM teams. For instance, Clay’s product makes waterfall data enrichment, data normalization, and CRM syncing available to everyone. Building these workflows can spark a sense of pride and ownership among users, similar to creating a beautiful site in Webflow or an impressive app in Airtable. This pride makes Clay a good fit for social channels like LinkedIn, where people want to position themselves as experts in order to amplify their brands.

Furthermore, for companies who are looking to level up their SEO, Clay offers several valuable data points that they can use to optimize their strategies.

4. What’s your current market, and does it fit your business model?

Clay targets two key market segments: Freelancers and marketing agencies, who use Clay to build outbound campaigns faster, and in-house Growth teams, who use Clay to power their data enrichment and GTM motions.

These targets fit Clay’s self-serve PLG business model nicely, as freelancers and marketing agencies can quickly onboard and find value, while in-house growth teams can evangelize the value of Clay.

Determine the best ways to tap into your target market

By tackling the questions above, Clay aligned on social media and SEO as core channels for their business model, product, and market. To understand how they could most effectively leverage these channels, they looked at their current growth drivers, including word-of-mouth marketing, user-generated content (UGC), and referrals from agencies and service providers.

Word-of-mouth marketing

Word-of-mouth marketing is Clay’s primary growth driver. Most word-of-mouth marketing follows a simple process that can be depicted in just four steps:

1. Sign up: Users sign up for a free account.

2. Experience product value: Users can appreciate the product’s value.

3. Socialize to others: Users become relative experts and tell their friends about the product.

4. Gain recognition: Users gain recognition for successfully using the product.

As users complete the final steps of this word-of-mouth growth loop, the cycle starts all over again.

User-generated content (UGC)

UGC is Clay’s second major growth driver. It follows a similar process as word-of-mouth marketing, with only one key difference: content creation.

1. Sign up: Users sign up for a free account.

2. Experience product value: Users can appreciate the product’s value.

3. Create content: Users share outputs they’ve created using the product.

4. Gain recognition: Users gain recognition as innovators.

As more and more content is generated about Clay, more new users will join in the loop, generate their own content, and be recognized in their own right.

Referrals

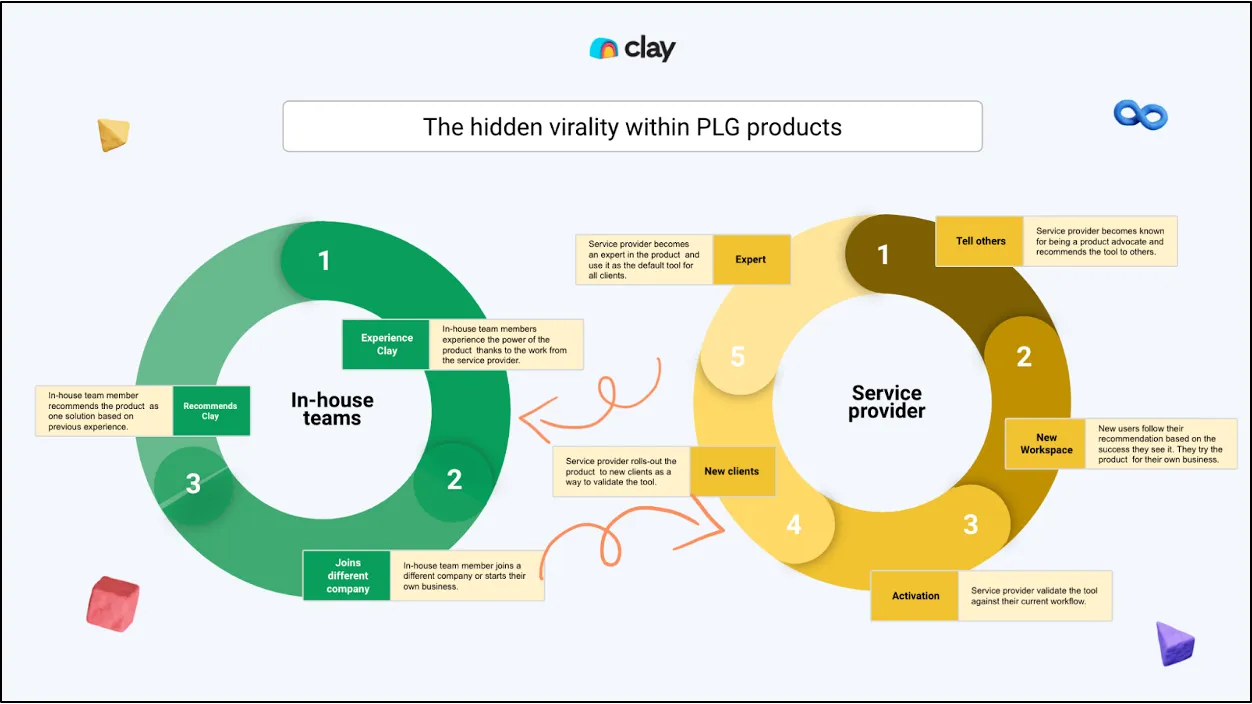

Clay’s third most effective growth driver is referrals from agencies and service providers to in-house marketing teams.

When service providers demonstrate Clay’s capabilities to in-house teams, those in-house teams give the product a try, and eventually start using it at their own companies. Think of it as a double growth loop: Agencies and service providers introduce in-house teams to the tool, sparking a new cycle of users who show the product to even more new users.

Combine your business model, product, and market to create the ultimate growth strategy

When Clay shaped their growth bets, they wanted to optimize the ways in which they were already growing. They did this by amplifying word-of-mouth marketing, UGC, and referrals across their social media channels. They also aimed to scale their SEO strategy to increase their top-of-funnel (TOFU) user acquisition for their free trials.

Social media

Clay wanted to tap into service providers who were interested in showcasing their wins to attract new clients. By creating content about their capabilities with Clay, these service providers could gain recognition while also evangelizing about Clay. This method is central to Clay’s growth, as it aligns with how service providers behave on social channels.

SEO

Clay’s unique product and business model allow them to leverage data for SEO acquisition motions. They’re currently working on ways to deepen and scale this strategy.

TL;DR: How can you assess your growth bets?

Throughout this blog, we used Clay as an example to help you understand your existing growth model, and where you can place your big bets.

You can start by asking the following fundamental questions:

What’s your business model?

Based on your business model, what are your ideal user acquisition channels?

Based on your product, what are your ideal user channels?

What’s your current market, and does it fit your business model?

Whether you’re scaling up your growth strategy or considering expansion into new markets, this framework will serve as a set of guardrails for every step of your journey.

Thanks for reading. By way of background, I am an early-stage investor at Wing and a former founder. Please reach out to me on X @zacharydewitt or at zach@wing.vc. Some of the early-stage PLG + AI companies that I have the privilege to work with and learn from are: AirOps, Copy.ai, Deepgram, Hireguide, Slang.ai, Tango and Tome.

Operating Benchmarks (from PLG Startups):

I will continue to update these metrics and add new metrics. Let me know what metrics you want me to add (zach@wing.vc)

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior Notorious episode.

Financial Benchmarks (from PLG Public Companies):

Financial data as of previous business day market close.

Best-in-Class Benchmarking:

15 Highest EV/ NTM Revenue Multiples:

15 Biggest Stock Gainers (1 month):

Complete Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG + AI Financings:

Seed:

Black Forest Labs, a developer of an open-source AI image generation model, has raised $31M. The round was led by Andreessen Horowitz.

Hedra., an AI video creation platform, has raised $10M. The round was led by Index Ventures, Abstract Ventures and Andreessen Horowitz, with participation from Outset Capital.

Not Diamond, a developer of network infrastructures designed to help developers dynamically route queries from their application to the AI models, has raised $2.3M. The round was led by Defy Partners Management, with participation from Karman Ventures, VitalStage Ventures, 640 Oxford and Inovia Capital.

Tezi, a startup building an AI agent for hiring managers to automate the recruiting workflow, has raised $9M. The round was led by 8VC, with participation from Audacious Ventures, Liquid 2 Ventures, Afore Capital, South Park Commons and Prime Set.

vals.ai, a third-party review system designed for vetting the performance of AI in areas like accounting, law and finance, has raised $5M. The round was led by Bloomberg Beta, Sequoia, and 8VC, with participation from Pear.

Series A:

Credo AI, an AI governance platform designed to automate artificial intelligence oversight and risk management, has raised $21M at a $103M valuation. The round was led by Mozilla Ventures, FPV Ventures and CrimsoNox Capital, with participation from Booz Allen Ventures, Sands Capital, Decibel Partners and AI Fund.

Ema, a generative AI company creating the universal employee of the future, has raised $36M. The round was led by Accel Partners and Section 32 , with participation from Prosus Ventures, Hitachi Ventures, Sozo Ventures, Wipro Ventures, SCB10X, Frontier Capital and Colle Capital.

Series B:

Checkly, a Germany-based provider of synthetic monitoring powered by Monitoring as Code (MaC) and Playwright, has raised $20M. The round was led by Balderton Capiital, with participation from existing Accel and CRV.

Protect AI, a security and artificial intelligence startup, has raised $60M at a $400M valuation. The round was led by Evolution Equity Partners, with participation from Salesforce Ventures, Samsung Electronics, 01 Advisors, Acrew Capital, Boldstart Ventures, Knollwood Capital, Pelion Venture Partners and StepStone Group.

Series C:

Gradient AI, a provider of artificial intelligence solutions for the insurance industry, has raised $56.1M. The round was led by Centana Growth Partners, with participation from MassMutual Ventures, Sandbox Industries, Forté Ventures, Wavemaker Three-Sixty Health and Plug and Play Tech Center.

Later Stage:

DeepScribe, an AI-based medical scribe technology designed to automate medical documentation, has raised $60M. The round was funded by undisclosed investors.

Zach, seems like you leveraging a lot of concepts from Reforge. Can you provide proper attribution and link to Reforge? Thanks.