Notorious: 2025 is the Year of the Agentic Workforce

Notorious: the best founders, startups, strategies, metrics and community.

Current subscribers: 11,118, +101 since last post

Share the love: please forward to colleagues and friends! 🙏

2025: Year of the Agentic Workforce

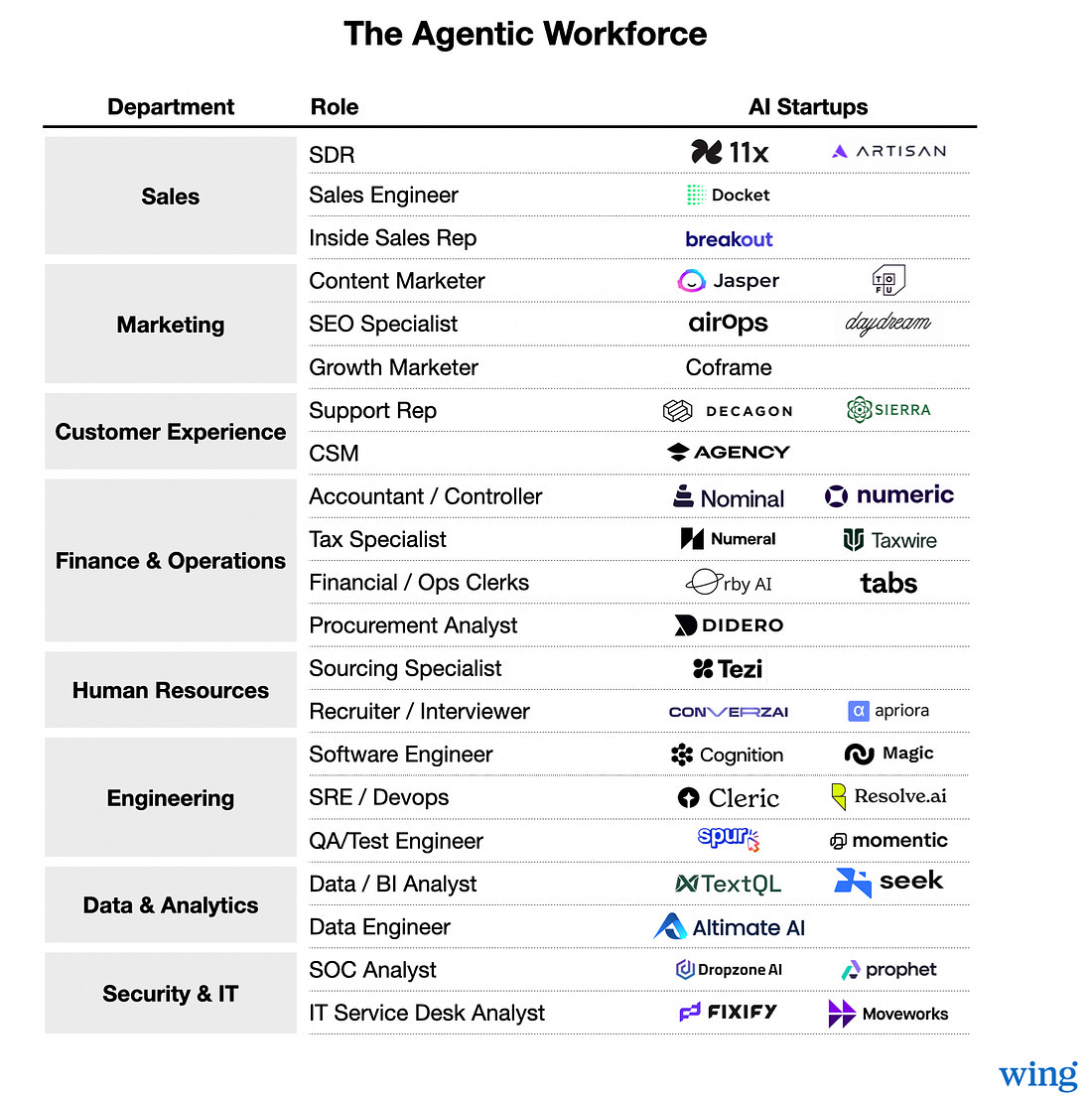

The way we work is about to change forever. 2025 marks the beginning of the AI agent era—a shift where digital colleagues take on tasks, make decisions, and collaborate with humans to drive business productivity at an unprecedented scale.

For decades, businesses have relied on Software-as-a-Service (SaaS) tools to operate. Employees navigated countless apps, manually entering data, updating records, and coordinating workflows. That model is now collapsing. The next generation of work won’t be about using software; it will be about managing intelligent agents that do the work for us.

From SaaS to AI Agents: A Tectonic Shift

Microsoft CEO Satya Nadella put it best: “SaaS is CRUD databases with business logic. As AI takes over that logic, SaaS will collapse.” In 2025, we’ll see the first real wave of this transformation. AI agents won’t just be assistants; they’ll be autonomous digital colleagues capable of executing complex workflows, learning from data, and optimizing operations across industries.

Businesses won’t be paying for software licenses; they’ll be hiring AI agents to get work done. Need customer support? Deploy an AI agent to handle inbound requests 24/7. Need financial analysis? Assign an agent to analyze transactions and flag anomalies. The future of software isn’t a static dashboard—it’s a network of intelligent agents operating seamlessly across systems.

The Startup Gold Rush: Building the Agent Economy

The shift from SaaS to AI agents presents one of the biggest startup opportunities of the decade. Just as the SaaS boom created billion-dollar companies, the rise of AI agents will fuel a new wave of disruptors.

Agent Development Platforms: Startups building low-code/no-code tools for creating AI agents will be in high demand. Businesses will want customizable agents that can integrate into their unique workflows without requiring AI expertise.

Vertical-Specific Agents: Industry-focused AI agents that solve niche problems—like AI-driven legal research, automated medical billing, or AI compliance officers—will carve out highly lucrative markets.

Agent Marketplaces & Infrastructure: Just like the rise of the app store, there will be marketplaces for AI agents where businesses can buy, deploy, and manage different agents from a single hub. Security, compliance, and governance solutions tailored for AI agents will also become essential.

Outcome-Based AI Services: Instead of traditional SaaS subscriptions, new pricing models will emerge where businesses pay per task completed or per successful outcome, aligning cost with value.

Considerations for Founders Building AI Agents

For founders looking to capitalize on this trend, here are some key considerations:

Data Access & Integration: Agents need reliable access to enterprise data to be effective. Partnerships with existing SaaS vendors or integrations with legacy systems will be crucial.

Trust & Explainability: Businesses will only adopt agents they fully trust. Founders should prioritize building transparent, explainable AI models with clear decision-making logic.

Autonomy vs. Control: Balancing agent independence with human oversight is critical. Many companies will want human-in-the-loop workflows before they fully hand off processes to AI.

Security & Compliance: Handling sensitive business data comes with strict compliance requirements. AI agents must meet GDPR, SOC2, and other regulatory standards to be enterprise-ready.

Differentiation: With major players like OpenAI, Anthropic, Meta and Google investing heavily in AI, startups need to find unique angles—whether through proprietary datasets, domain expertise, or deeper workflow integrations.

The Agentic Workforce Is Already Here

We’re already seeing glimpses of the agent-driven future. Startups like Sierra and Decagon are building autonomous agents for complex workflows. Salesforce (rebranding as Agentforce) and HubSpot are integrating AI deeply into their platforms to keep up with the agent revolution. Workday is creating an “Agent System of Record” to manage AI workers just like human employees.

This is just the beginning. The companies that embrace AI agents now will dominate the next decade of business. 2025 is the tipping point—the year where AI agents move from experimental to essential.

Are You Ready?

The future of work isn’t about more software. It’s about more intelligence, more automation, and more outcomes with less manual effort. The companies that figure out how to harness AI agents effectively will win big. The rest? They’ll be stuck in the SaaS past.

Welcome to the age of the Agentic Workforce. 2025 is just the beginning.

Thanks for reading. By way of background, I am an early-stage investor at Wing and a former founder. Please reach out to me on X @zacharydewitt or at zach@wing.vc. Some of the early-stage PLG + AI companies that I have the privilege to work with and learn from are: AirOps, Copy.ai, Deepgram, Hireguide, Slang.ai, Tango, Tome and Workmate.

Operating Benchmarks (from PLG Startups):

I will continue to update these metrics and add new metrics. Let me know what metrics you want me to add (zach@wing.vc)

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior Notorious episode.

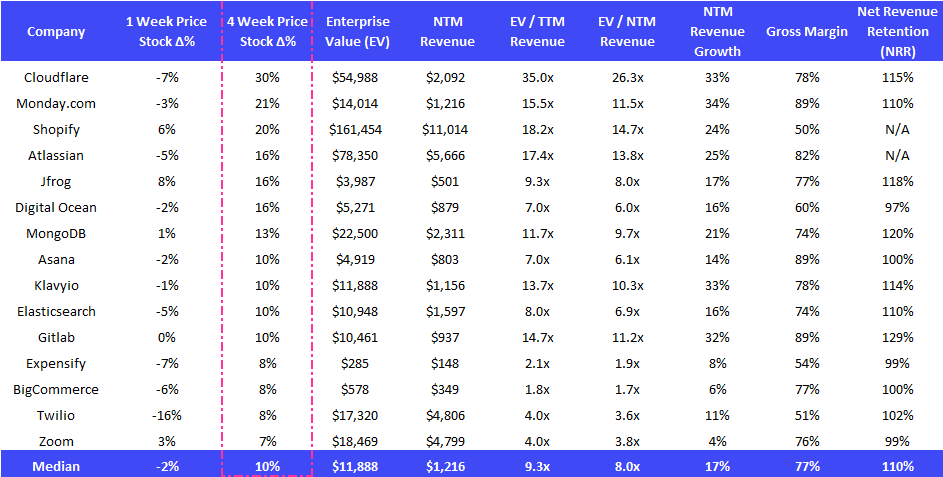

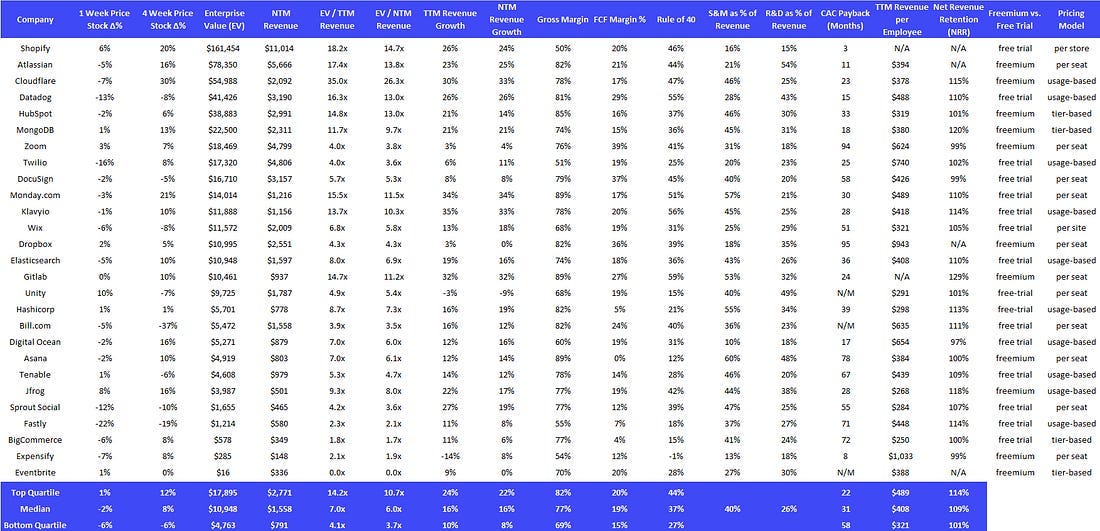

Financial Benchmarks (from PLG Public Companies):

Financial data as of previous business day market close.

Best-in-Class Benchmarking:

15 Highest EV/ NTM Revenue Multiples:

15 Biggest Stock Gainers (1 month):

Complete Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG + AI Financings:

Seed:

Aracor AI, an automated contract review tool designed for attorneys to analyze documents to deliver professional insights, has raised $4.5M. The round was led by Fuel Venture Capital.

Bluebook, a startup building AI agents for accounting firms, has raised $3M. The round was led by EQT Ventures, with participation from Y Combinator.

Genia, an AI-powered generative design software intended to produce optimized structural engineering drawings, has raised $3M. The round was led by Pi Labs, with participation from Amplify, Boost VC, Dorm Room Fund, Suffolk Technologies and The Y Startup Index Fund.

Hatz AI, a white-labeled AI platform designed to build applications and agents, vector storage, and custom large language models, has raised $2.5M at a $34.5M valuation. The round was led by Vestigo Ventures.

Indigo, an AI-powered home buying and selling platform for real estate agents, has raised $8M. The round was led by NFX, Era Ventures and GTM Fund, with participation from 1Sharpe Ventures.

Iris, an AI platform designed to streamline the RFP process, has raised $4.07M. The round was funded by Florida Funders and Naples Technology Ventures.

Minerva, an AI platform designed to model consumer behavior and provide companies with insights into their customers, has raised $8.1M at a $30M valuation. The round was led by The General Partnership, with participation from Soma Capital, KBW Ventures and Sequoia Capital.

Pinkfish AI, a startup helping enterprise customers build AI agents and other AI-driven workflows through natural language prompts, has raised $7.6M. The round was led by Norwest Venture Partners, with participation from Storm Ventures.

Series A:

ConverzAI, an AI-powered virtual recruiting platform designed to autonomously hire candidates, has raised $16M at an $81M valuation. The round was led by Menlo Ventures, with participation from Afore Capital, Recall Capital, Left Lane Capital and Foundation Capital.

Eudia, an augmented intelligence platform designed for corporate legal teams, has raised $105M. The round was led by General Catalyst, with participation from Sierra Ventures, Everywhere Ventures, Floodgate, Hakluyt Capital, Defy Partners Management, B3 Capital and Backbone Capital.

Latent Labs, a startup developing foundation AI models to support the development of new medicines, has raised $50M. The round was led by Radical Ventures and Sofinnova Partners, with participation from 8VC, Kindred Capital, Pillar VC, SBXi, Flying Fish Partners and AWS Startups.

Plain, a B2B support platform for modern companies, has raised $15M. The round was led by Battery Ventures, with participation from Index Ventures and Connect Ventures.

Tofu, an omnichannel marketing platform that helps B2B marketing teams scale their campaigns, has raised $12M at a $66M valuation. The round was led by SignalFire, with participation from HubSpot Ventures, Tau Ventures, Correlation Ventures, Alumni Ventures, SH Fund, Riverside Ventures, Eudemian Ventures and Han Bridge Capital.

Unwrap, a customer intelligence platform that uses AI natural language processing to analyze large amounts of customer data, has raised $12M. The round was led by Scale Venture Partners, with participation from Atlassian Ventures, Cercano, ScOp VC and the Allen Institute for Artificial Intelligence.

Series B:

Comulate, a startup developing automated billing and revenue operations technology for insurance companies, has raised $20M at a $240M valuation. The round was led by Workday and BOND Capital, with participation from Spark Capital and Neo.

fal, a generative media platform designed for developers, offering AI model inference and training capabilities, has raised $49M. The round was led by Notable Capital, with participation from Andreessen Horowitz, Kindred Ventures, First Round Capital and Bessemer Venture Partners.

Moderne, an automated code refactoring and analysis company, has raised $30M. The round was led by Acrew Capital, with participation from Intel Capital, Allstate, AMEX Ventures, TIAA Ventures, True Ventures, Mango Capital and Morgan Stanley.

SpotDraft, an AI-driven contract management platform designed to draft and execute legal contracts, has raised $54M. The round was led by Trident Growth and Vertex Growth, with participation from Premji Invest, Arkam Ventures, Xeed Ventures and Prosus.

Series D:

Harvey, an AI startup focused on the legal industry, has raised $300M at a $3B valuation. The round was led by Sequoia Capital, with participation from OpenAI Startup Fund, GV, REV Venture Partners, Coatue Management, Conviction Partners and Kleiner Perkins.