9.7.23 AI's Retention Problem

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 8,093, +71 since last week, +0.9%

Share the PLG love: please forward to colleagues and friends! 🙏

AI’s Retention Problem

In February, I wrote a NPLG post about how LLMs + PLG are a match made in heaven (see here). The basic premise is that since LLMs help PLG apps offer immediate product value to new users through AI-powered content generations, this creates a powerful flywheel: PLG onboarding experience brings in more users, more users provide more data to the app which then can use this data to fine-tune the AI models which makes the product experience better which brings in more users which brings in more data… the flywheel is spinning.

However, it’s becoming clear that most LLM-powered application startups are struggling with retention. Why is this? A few thoughts:

Today’s AI budgets are exploratory. If companies aren’t exploring AI right now, they are doing something wrong. Thus, many AI-app startups are seeing explosive growth in “land” deals, but the onus is on the apps to then prove they can deliver enough value to retain early, exploratory users. When I evaluate new investment opportunities, the first metric I look at is retention.

Copycats are everywhere. The building blocks of AI are more accessible and easier to build on top of than ever. We are seeing many competitors in popular categories for generative AI startups. As an example, from the W23 YC batch, there were multiple startups doing customer support with LLMs. Thus, customers are trying out many alternatives before choosing the winner. Don’t be fooled by spikes in early usage. Retention will be the key metric that differentiates the leaders from the pack.

AI Apps haven’t offered enduring use cases. I play around with 5+ new AI apps every week. Many of the use cases are horizontal, creative, and fun. However, I often struggle to identify an enduring use case to stick with the product. For example, I played with a few AI apps that track my activity on my laptop and I can go back and search for anything across my apps, but I haven’t found a sticky use case yet that keeps me using the service.

If you are an AI + PLG app founder dealing with retention issues, you are not alone! Don’t lose focus that retention is your most important metric.

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track (zach@wing.vc).

Organic Traffic (as % of all website traffic):

Great: 70%

Good: 50%

Conversion rate (website → free user):

Great: 10%

Good: 5%

Activation rate (free user → activated user):

Great: 50%

Good: 30%

Paid conversion rate (free user → paid user):

Great: 10%

Good: 5%

Enterprise conversion rate (free user → enterprise plan):

Great: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Great: 30%

Good: 15%

Conversion from waitlist to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

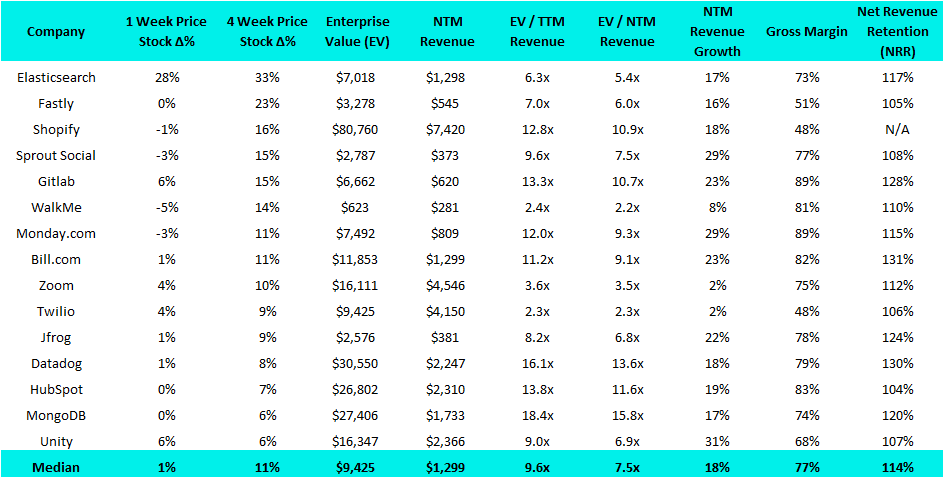

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

Browse AI, a developer of an automation software platform designed for extracting and monitoring data from websites at scale with no code, has raised $2.8M. The round was funded by Interface Capital, Alpine Venture Capital, AltaIR, Banana Capital, Creator Ventures, Trust Fund, Singularity Capital and Goodwater Capital.

Grit, a developer of machine learning software designed to automatically fix the technical debt, has raised $7M. The round was led by Founders Fund and Abstract Ventures, with participation from 8VC, Operator Partners, AME Cloud Ventures, CoFound Partners, Uncorrelated Ventures, A* Capital, Quiet Capital and SV Angel.

Ideogram, a developer of artificial intelligence tools designed to amplify human creativity, has raised $16.5M. The round was led by Index Ventures and Andreessen Horowitz.

Lex, a developer of an online writing platform designed to unlock the best in writing, has raised $2.7M. The round was led by True Ventures.

Modyfi, a developer of an image editing tool designed to empower creativity and collaboration in the photo-editing process, has raised $7M. The round was led by New Enterprise Associates, with participation from Habitat Partners, General Catalyst, Craft Ventures, Cursor Capital, WndrCo, Form Capital and Gaingels.

Panobi, a developer of an organizational growth platform for product and marketing teams, has raised $5M. The round was led by Index Ventures.

Poolside, a developer of an artificial intelligence platform intended to offer cutting-edge foundation concepts and infrastructure that will reinvent connection, has raised $126M. The round was led by Felicis and Redpoint Ventures.

Portkey, a developer of a business application intended for launching production-ready applications for monitoring and model management, has raised $3M. The round was led by Accel and Lightspeed India Partners.

Superframe, a developer of AI-powered software designed to optimize market technology stacks, has raised $5M. The round was led by Designer Fund, with participation from Essence Venture Capital.

SureIn, a developer of an insurance management application designed to make business insurance easy, transparent and hassle-free, has raised $4.42M. The round was led by PactVC, with participation from Sequoia Capital and Xdeck Ventures.

Series A:

Ikigai Labs, a SF-based provider of generative AI solutions for tabular data, has raised $25M at a $125M valuation. Premji Invest led the round and was joined by Foundation Capital and Emirates Telecommunications Group.

Modular, a startup creating a platform for developing and optimizing AI systems, has raised $100M at a $600M valuation. The round was led by General Catalyst, with participation from GV, SV Angel, Greylock and Factory.

Qase, an operator of a test management platform intended for manual, automated quality assurance testing, tracking, and reporting, has raised $6.7M at a $51.7M valuation. The round was led by Chrome Capital, with participation from FinSight Ventures, AAL Management and S16VC.

Series B:

Ghost, a startup that is providing a B2B marketplace for surplus inventory, has raised $30M at a $155M valuation. Cathay Innovation led the round, and was joined by existing investors Union Square Ventures, Equal Ventures and Eniac Ventures.

Series C:

AI21 Labs, a Tel Aviv-based startup developing a range of text-generating AI tools, has raised $155M at a $1.4B valuation. The round was led by Walden Catalyst, Pitango, SCB10X, b2venture, Samsung Next, with participation from Google and Nvidia.

Series D:

Apollo.io, a full-stack sales tech platform, has raised $100M at a $1.6B valuation. The round was led by Bain Capital Ventures, with participation from Sequoia Capital, Tribe Capital, and Nexus Venture Partners.

Hugging Face, a provider of open-source tools for developing AI, has raised $235M at a $4.5B valuation. The round was led by Salesforce Ventures, with participation from Google, Amazon, Nvidia, Intel, AMD, Qualcomm and IBM.

Ramp, a financial operations platform designed to help users spend less, has raised $300M at a $5.8B valuation. The round was led by Sands Capital and Thrive Capital, with participation from Founders Fund and General Catalyst.

Later Stage:

Anthropic, an AI startup co-founded by former OpenAI leaders, has raised $100M. SK Telecom provided the funding.

Rockset, a company building tools to drive real-time search and data analytics, has raised $44M. The round was led by ICON Ventures, with participation from Glynn Capital, Four River Partners, K5 Global, Sequoia and Greylock.

Great read.