8.24.21 Notorious PLG

Weekly update on the most important PLG companies

Thank you for being a part of the Notorious PLG community! If you enjoy this weekly newsletter, please forward along to a friend.

Notorious PLG Startup of the Week:

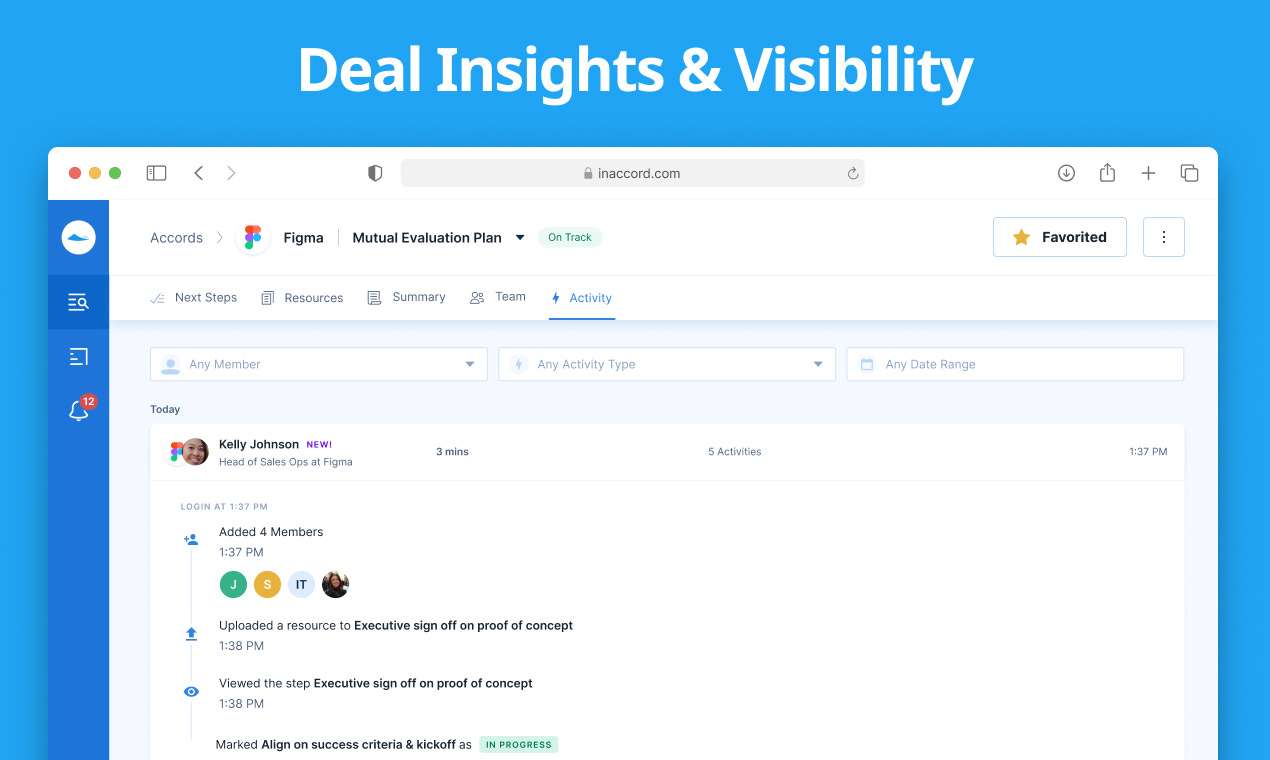

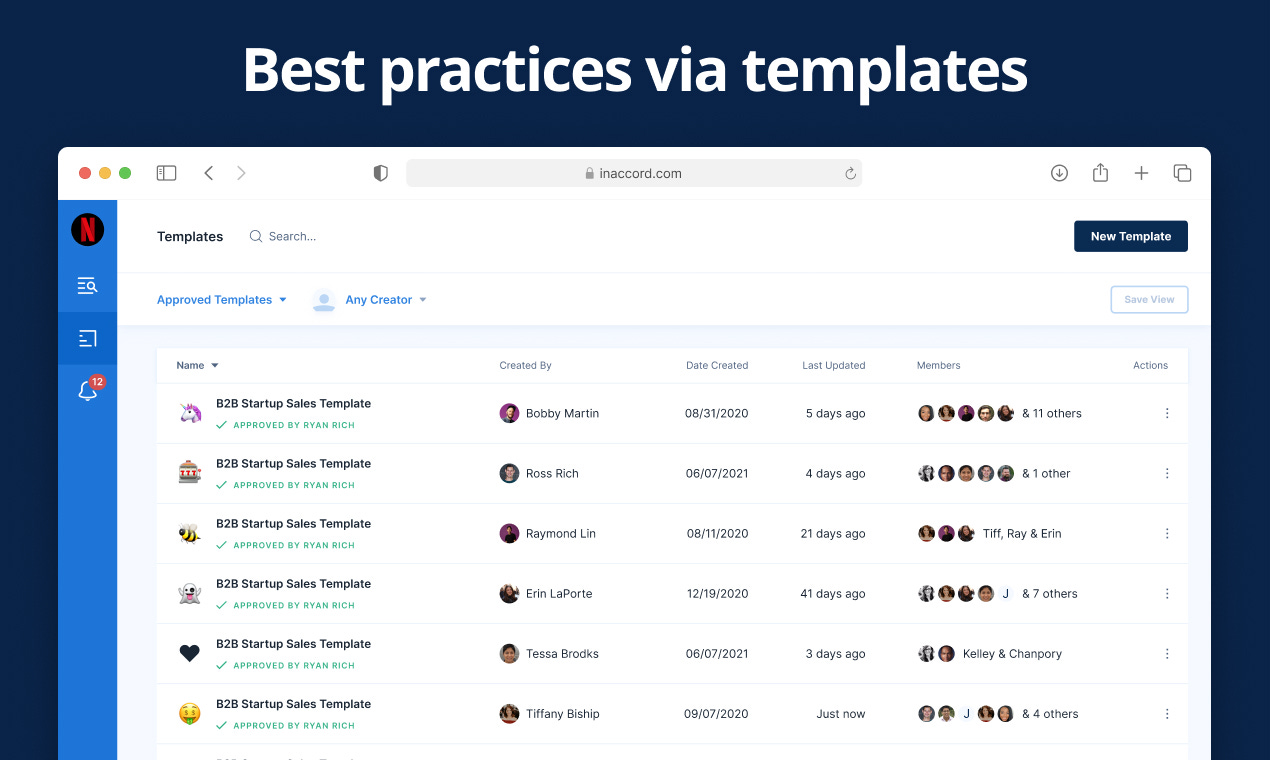

Accord is a customer collaboration platform founded by former Stripe & Google Cloud sales leaders. The company has raised ~$7M from former employer Stripe, YC and many prominent angels including CEOs and sales leaders. The most important thing for high-growth startups is to find and maintain a repeatable GTM process. Even though customers may agree to purchase your software, too often deals stall or get lost as onboarding and activation plans lack clarity and ownership (the avg. sales deal can involve 14 people). Accord offers a workspace where vendors and customers come together to build “mutual action plans” that clearly articulate and define the necessary steps to evaluate, onboard and close. There is an explosion of software being built to make the end-to-end customer experience more magical and Accord plays at very important moments in the customer journey: decision-making, activation and onboarding. I imagine Accord will be a very sticky product as once a company gets their templates and best practices setup in Accord, the software becomes foundational to a repeatable GTM motion.

For this edition of Notorious PLG, CEO and Co-founder Ross Rich shared some thoughts about his PLG approach:

“Although I was very familiar with the concept of PLG from my days at Stripe, actually executing on a PLG motion at Accord was completely foreign at first… apparently it’s not just launching a free trial or/or an ungated product experience! However, now a quarter into taking a more PLG approach, I feel like we’re starting to understand the massive impact that getting the product in the hands of potential users can do for the velocity of deals & our inbound funnel.

For context, I was one of the first hires brought on to create the sales-led side of Stripe’s go-to-market. Beyond SMBs and early stage startups self-serving on the platform, pretty much all of our mid-market, enterprise, and partnership deals were driven by sales. It was incredibly rare for any non-early stage company to play around with something so impactful as how they collect their revenue vs what you see with many PLG companies.

Not surprisingly, we began with what we knew and were comfortable with – closing growth & later stage companies through a sales-led framework. That worked well in the beginning while we were co-creating the platform with a handful of Innovators, but fell apart once we started to see serious inbound traffic & buying intent from earlier stage startup Founders and Sales Leaders. These particular users were excited about what we were building and seeing value from Accord faster than previous customers, but wanted a completely different buying experience. This earlier stage market & persona we started to lean into wanted: to play around with the product immediately, fully transparent pricing, to make a decision within a few days, and do their evaluating & validating via G2 review, case studies, resources, trials, etc, rather than spend time with us on sales calls.

In short, it was clear that we were getting in our own way. We needed to adjust to the market that was pulling Accord from our hands, and expose more information and more of the product through a PLG motion. The first iteration was a big undertaking, and took us about 8 weeks, and the leverage / positive feedback we saw from the adjustment was wildly positive.

I’m excited to further explore the PLG strategies & tactics, and double-down on investing in the buying experience our customers are looking for. It’s also been cool to see traditional PLG companies (eg Figma’s case study with Accord) leverage Accord to facilitate mid-market and enterprise sales & onboarding in a similar way that I would have loved to do at Stripe.

I should also note that I love that this approach aligns perfectly with our broader mission at Accord: to build better relationships through transparency & collaboration.”

P.S. Accord is hiring

Please email any Notorious PLG of the Week suggestions to me at zach@wing.vc

PLG Tweet of the Week:

Good thread on all of our favorite acronyms: PLG, PLS, SLG etc

If you were forwarded this email and are interested in getting a weekly update on the best PLG companies (private + public), please click this subscriber button below:

Recent PLG Financings (Private Companies):

Uizard: Denmark-based, design app for non-designers to build mockups of mobile apps, websites and desktop software raised $15M Series A led by Insight. Uizard, like many of the best PLG companies today are helping users get going quickly with robust template libraries.

Stacker: UK-based, no-code platform to build custom business apps raised $20M Series A led by A16Z. Using data from Google Sheets, Excel or Airtable, users can build customer portals, internal tools, partner apps and custom CRMs.

Teleport: service that allows engineers and security professionals to unify access for SSH servers, Kubernetes clusters, web applications, and databases raised $30M Series B led by Kleiner Perkins.

Preset: cloud-based data exploration and visualization platform raised $40M Series B led by Redpoint. On Preset’s homepage, they market “Zero to dashboard in minutes” which is one of the core principals of PLG: deliver value immediately.

Postman: developer-focused, collaboration platform for API development raised $225M Series D @ $5.6B valuation led by Insight Partners. Postman now has 15M+ developers using their platform. Rumor has it this was a very competitive deal.

Recent PLG Performance (Public Companies):

Financial data as of Friday market close.

Biggest Stock Gainers (1 week):

Monday.com: 30%

Wix: 5%

Smartsheet: 4%

Biggest Stock Gainers (1 month):

Monday.com: 70%

Atlassian: 23%

Datadog: 19%

Enterprise Value / TTM Revenue:

Top quartile: 35.2x

Median: 18.1x

Lower quartile: 9.8x

Enterprise Value / NTM Revenue:

Top quartile: 26.2x

Median: 13.4x

Lower quartile: 7.6x

Rule of 40 (TTM Revenue Growth % + FCF Margin %):

Top quartile: 50%

Median: 36%

Lower quartile: 26%

Median % of Sales:

S&M: 45%

R&D: 31%

G&A: 19%

Net Revenue Retention:

Top quartile: 130%

Median: 123%

Lower quartile: 115%

GM-Adjusted CAC Payback Period (Months):

Top quartile: 16

Median: 21

Lower quartile: 28

15 Highest EV / NTM Multiples:

Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12.

Current subscribers: 895